Feds Collect Record Taxes in First Month Under Tax Cut; Run Surplus in January

(CNSNews.com) – The federal government this January ran a surplus while collecting record total tax revenues for that month of the year, according to the Monthly Treasury Statement released today.

January was the first month under the new tax law that President Donald Trump signed in December.

During January, the Treasury collected approximately $361,038,000,000 in total tax revenues and spent a total of approximately $311,802,000,000 to run a surplus of approximately $49,236,000,000.

Despite the monthly surplus of $49,236,000,000, the federal government is still running a deficit of approximately $175,718,000,000 for fiscal year 2018. That is because the government entered the month with a deficit of approximately $224,955,000,000.

The $361,038,000,000 in total taxes the Treasury collected this January was $11,747,870,000 more than the $349,290,130,000 that the Treasury collected in January of last year (in December 2017 dollars, adjusted using the Bureau of Labor Statistics inflation calculator).

The Treasury not only collected record taxes in the month of January itself, but has now collected record tax revenues for the first four months of a fiscal year (October through January).

So far in fiscal 2018, the federal government has collected a record $1,130,550,000,000 in total taxes.

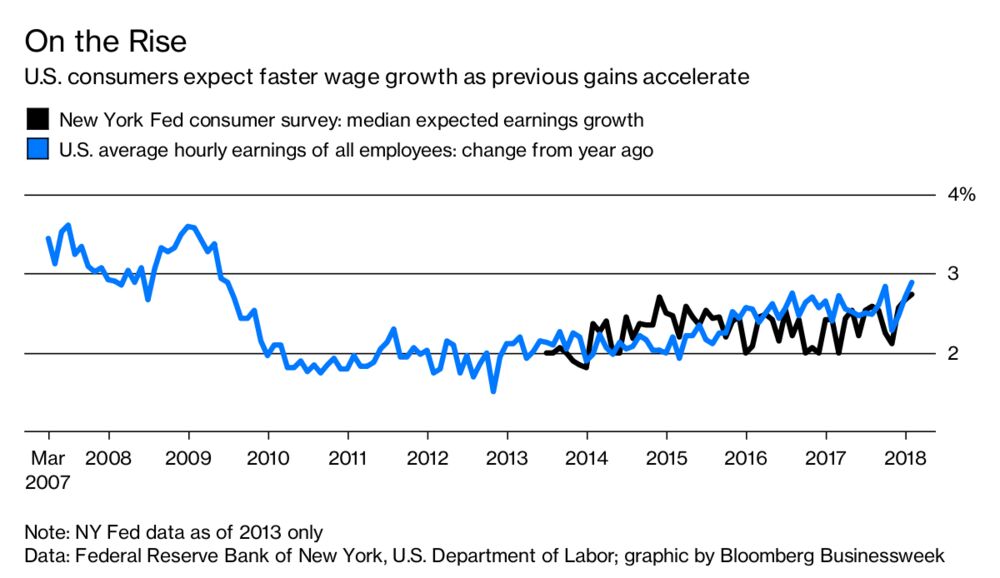

Americans Expect Biggest Pay Jump in Years

New York Fed survey results jibe with jobs report wage gauge

www.bloomberg.com/businessweek

What a bunch of tripe……..Lower Taxes and Increased Spending are going to INCREASE NATIONAL DEBT. Talk about a Pyrrhic Victory! Massive Program cuts & closures will be the result. Still think Trump is great? MAGA!