Consumer prices rose much more than expected, while retail sales fell when they were expected to rise. Consumers are buying less, but paying more. It's stagflation all the way. This is the worst possible macro economic environment for U.S. financial assets.

— Peter Schiff (@PeterSchiff) February 14, 2018

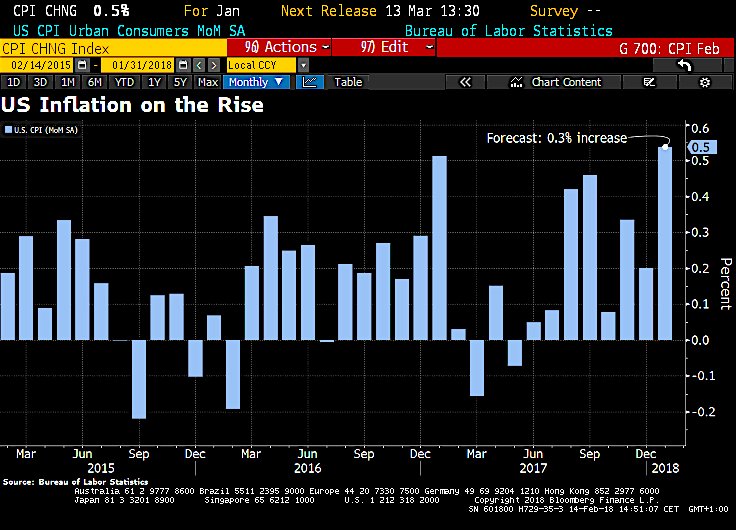

Inflation Tracker: Monthly Gain in Apparel Prices Hits 28-Year High

Another crack in the dam; nobody knows when it’s going to give way and the cumulative stresses brought on by a decade of Fed stock market nannying will demand their inevitable pound of financial flesh, but we’re getting closer, every single day.

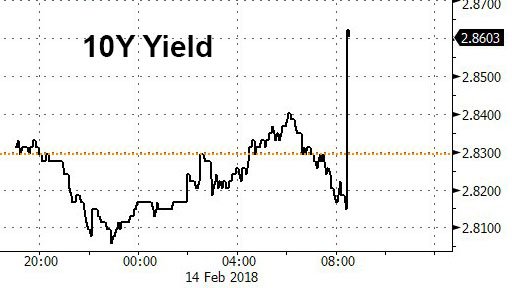

The consumer price index rose 0.5 percent from the previous month, above the median estimate of economists for a 0.3 percent increase, a Labor Department report showed Wednesday.

Excluding volatile food and energy costs, the so-called core gauge increased 0.3 percent, also above forecasts for 0.2 percent. It was up 1.8 percent from a year earlier, higher than the 1.7 percent estimate.