via Trinh Nguyen:

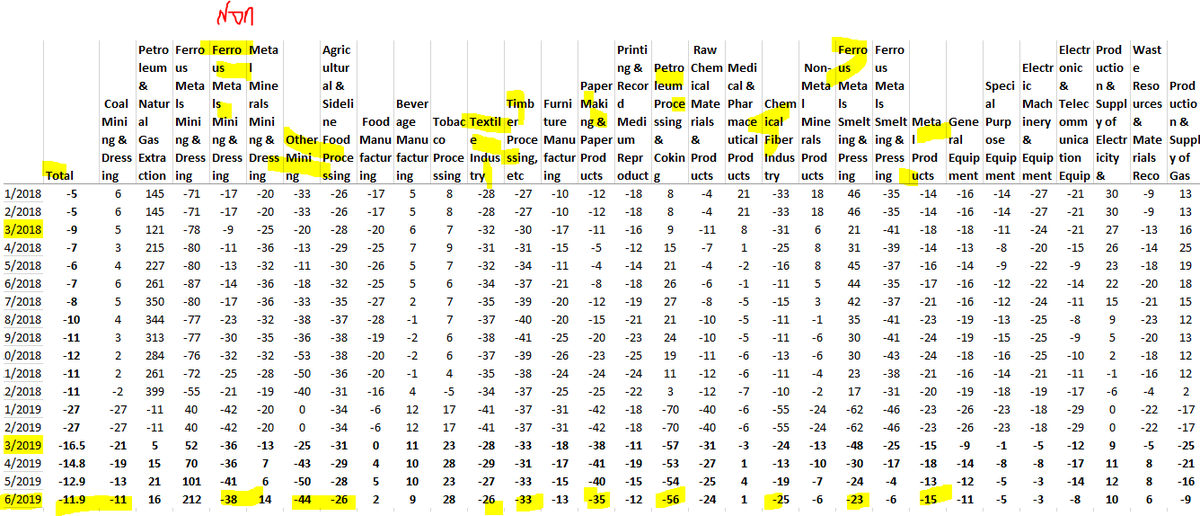

Worst sectors in H1:

a) Petroleum processing -56%(worsening)🥶

b)Other mining -44% (improving)

c) Non ferrous metals -38(improving)

d) Chemical fibers -25% (worsening)🥶

e) Metal products -15 ((worsening)🥶

f) Textile -26% (some stabilization) 🥶

Bottom line regarding industrial profits in H1:

a) Policy support is working to help stabilize some downstream sectors & that has both domestic & external implications (for example Australia doing well for exporting)

b) Headwinds strong for upstream & H2 not looking bright

Note that the strengths are SOFTENING (even essentials like food & medicine) & the only respite is that the SHARP CONTRACTION is STABILIZING so: China easing so far is putting is FLOOR on growth & not enough to engineer a V-shaped recovery & has implications REGIONALLY & GLOBALLY