via Zerohedge

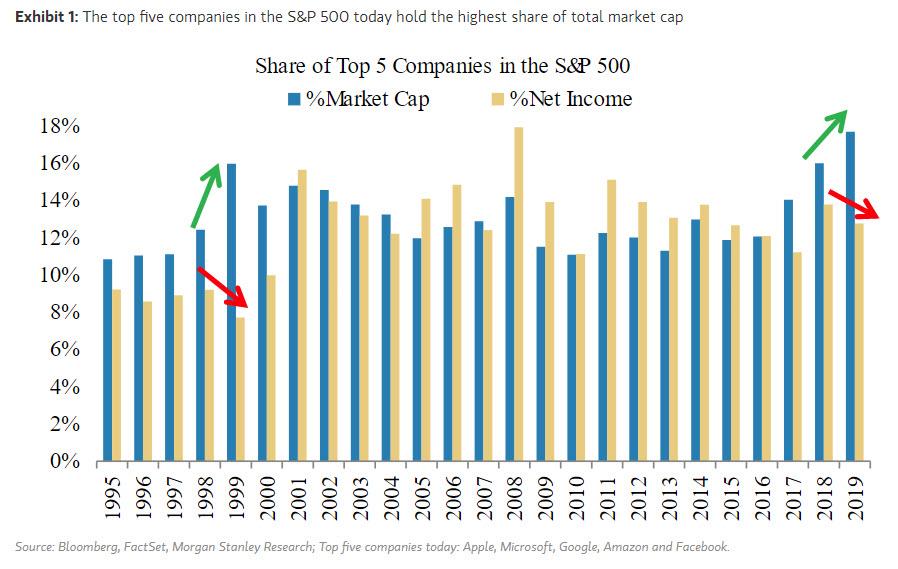

Yesterday, when looking at the composition of the ongoing market meltup, Morgan Stanley flagged just how uneven the leadership distribution has become highlighting the “other 1 percent”, namely the handful of tech names that have been responsible for the bulk of the S&P’s move higher in 2019, and noting “that in a world of low growth, limited pricing power and now rising costs, it’s clear that bigger is better and scale matters.” As a result, “currently, the top five companies in the S&P 500 (the other 1 percenters) make up 18% of the total market cap.”

As Morgan Stanley’s equity strategist, Michael Wilson, writes today “this is the most extreme this metric has ever been, including the tech bubble of the late 1990s. This doesn’t have to correct itself immediately but it is an unsustainable development in our view especially if net income concentration doesn’t keep pace.” We also know how this “unsustainable development” came to be: as he cautions, “this divergence is the result of the extraordinary liquidity being provided by the world’s central banks, which is flowing to the most liquid and largest names in the S&P 500. This also recalls 1999, when the Fed expanded its balance sheet at the end of the year and early in 2000 as a precaution against Y2K disruption.”

In other words, not only is it “not different this time“, but the entire market is stating to resemble the euphoria last seen just before the dot com bubble. And we all have the Fed to thank for it.

Again.

It gets better: with Michael Wilson clearly getting very angry client emails, especially following his downgrade of the “tech” sector last summer (take one look at the Nasdaq since last July to see why said clients may be mad), the MS strategist decided to take out his frustration at the Fed, pointing out what has been obvious to our readers ever since, oh… 2009, to wit: “we continue to view central bank activity as an important driver of asset prices in the near term given the lackluster improvement in earnings revisions.” Well, about time, Michael, about time. What next: you will admit to reading tinfoil fringe blogs that have blamed the Fed of doing just the for the past 11 years?

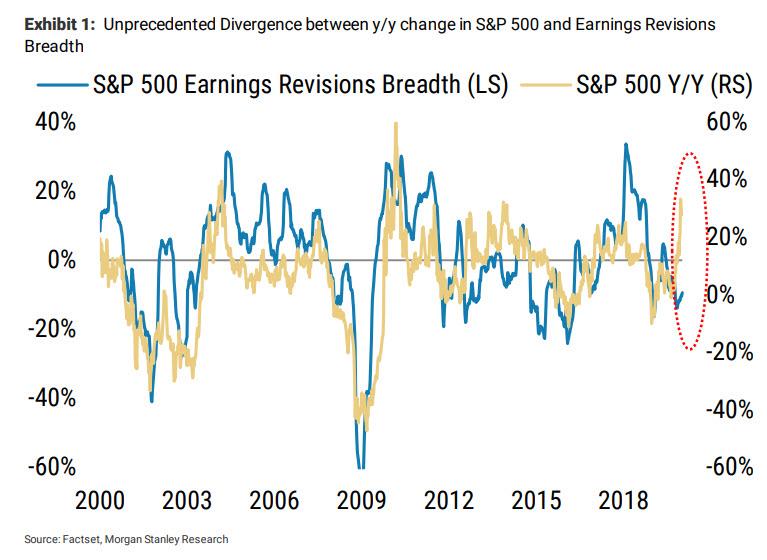

So what finally sparked Wilson’s Eureka moment? It appears, the answer is the chart below, which shows that “an unprecedented divergence has opened up between the y/y change in the S&P 500 and earnings revisions breadth.”

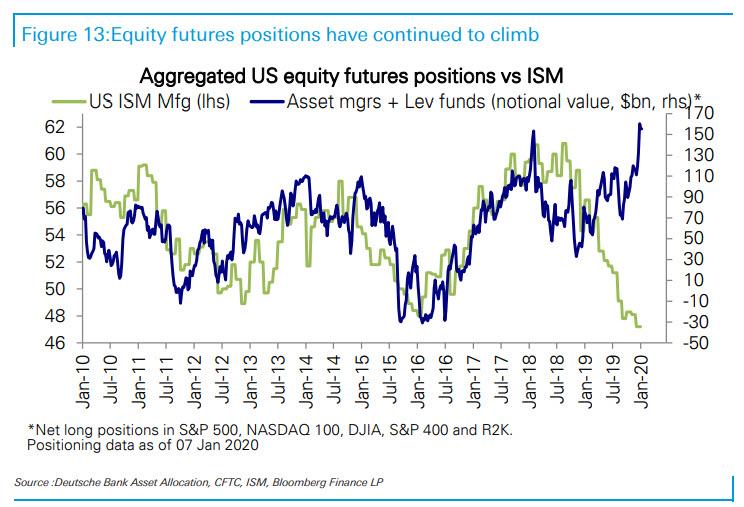

But what if it’s just sour grapes, and S&P earnings are indeed set to blast off? After all, as we showed yesterday, the market is already pricing in the biggest economic recovery (or at least ISM surge) since the financial crisis.

Indeed, Wilson gives some credence to this view, noting that “as for earnings, our work is also starting to show some signs of bottoming in the growth rate for the S&P 500 while small/mid caps are still struggling with deteriorating operating leverage. We will be looking this earnings season for signs of stabilization in margins and areas of pricing power and positive operating leverage. The equity market continues to pay up for quality and is fading cyclicals relative to defensives again as this ratio tests its 200 day moving average.” “In short”, Wilson summarizes, “as equity markets make new highs every week, there is still a defensive undertone that suggests the recovery will be much more modest than 2016-17 and in line with our economists’ forecast.”

Ok, fine: while economic data may have indeed bottomed, does that suggest a meteoric rise in S&P earnings to justify the unprecedented multiple expansion observed in the past year? The answer it appears, is probably not, and Wilson explains why below:

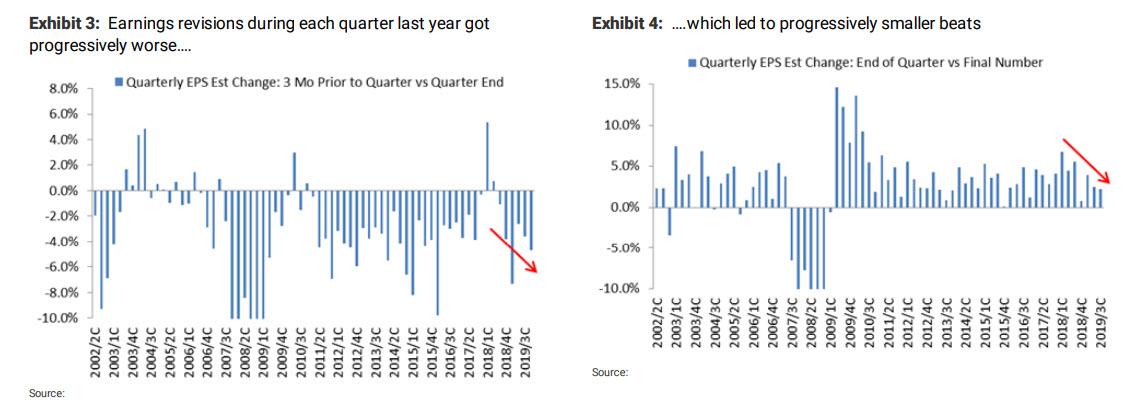

As we head into earnings season,negative revisions have abated which is natural at this time of the quarter. Exhibit 3 shows that revisions during each quarter last year got progressively worse which led to progressively smaller beats (Exhibit 4).

Based on the sharp decline of 4Q EPS estimates during last quarter, we expect a beat of approximately 2 percent when 4Q earnings season is finished. This would leave 4Q flat y/y based on the current -1.8% estimate. Hardly exciting, but that would be a slight uptick from 3Q when y/y EPS came in at -0.8% which supports the view that the earnings recession is behind us, at least for the large caps.”

So yes, some good news: after four quarters of declining earnings as the WSJ noted earlier today, earnings are finally bottoming out. Now if only that justified a 30% S&P surge in 2019. To that point, Wilson still thinks 2020 bottom up consensus EPS forecast for the S&P 500 of +9.5% growth is too high “and these numbers will come down.” The question is how much down, and just how much pain will there be as the “Unprecedented Divergence” shown above finally closes.