![Édouard Riou [Public domain], via Wikimedia Commons](https://thegreatrecession.info/blog/wp-content/uploads/BalloonFall-500x696.jpg)

The bust is on! Not only is the stock market crashing like never seen before (Dow down 3,000 points today!), but there are now deeply distressing breaks in the bond market. These staggering responses to Fed actions run counter to what is expected; but people are so focused on stocks, the are missing the more worrisome action.

When the Dow crashed trough the sub-basement into the pit of hell today, 10-year bonds remained locked around the 0.75% rate they’ve hunkered in at for about a week. This represents a freeze on the flight to safety in bonds, which indicates how illiquid the bond market has become and how its patches are pulling at their stitches. Money fleeing stocks is now avoiding bonds and going to cash.

Last Monday 30-year yields posted the biggest intraday decline since at least October 1998, pushing bond prices up as stocks continued to sell off. That’s what you would expect when stocks are crashing and the Fed is rushing back to easing. Stocks sell and money flees into bonds as a safe haven, pushing yields down and prices up. The rest of the week they did the opposite. Bond yields rose and prices fell as stocks mostly fell.

By the the end of the week, a massive injection of cash from the Federal Reserve along with President Donald Trump’s declaration of a national emergency with promises of fiscal support gave stocks their best day in history, but bond prices continued to fall as yields rose. Throughout the Fed’s Great “Recovery,” bond yields fell whenever the Fed sucked up government bonds with its QE, but now concerns about the necessary issuance of even greater record amounts of government debt, pushed the yields that investors demand up and prices, therefore, down, even when the Fed practically promised to buy everything.

During the middle of last week’s reversal, I got our 401Ks entirely out of bonds and into cash (the only other safe alternative in our 401K plans) because the movements were becoming too unpredictable. I decided it was time to reap the gains that bonds had given during the stock market’s crash, so I came through all right, but most of the gains were already lost, so violently did bonds swing the other way.

How bad is the bond breakup?

I was, as it turned out, in good company. Analysts suddenly started to say the U.S. government-debt market is not functioning properly:

“We were just trying on Monday to trim a long position in the 30-year Treasury because it had moved so far in our favor, and were unable to get bids from several major dealers. We’ve never seen that before.… I’ve never seen … the inability to trade a U.S. Treasury….

Liquidity is not only cataclysmic but getting worse…. Traders also reported a shortage of prices on screens, while futures on U.S. ultra bonds hit circuit breakers repeatedly during Friday morning trading in Europe.

“We heard there were some issues in off-the-run Treasuries,” Treasury Secretary Steven Mnuchin said on CNBC Friday morning. “We are working on that ” … but apparently not enough, and the result was the biggest VaR shock of all time as risk parity funds launched a crushing deleveraging which has crippled conventional correlations, and left traders speechless at … offerless Treasury markets….

As risk parity funds were caught in a liquidation cascade, both the equity and Treasury markets became unstable to the point of being untradeable. After starting the week off below 1%, 30-year yields soared to 1.79% amid the margin call liquidation route….

Said Zoeb Sachee, head of European government-bond trading at Citigroup Inc. “There has been an abrupt deterioration in liquidity in the last week or so and it seems to get worse by the day.”

“We have seen such aggressive moves in the market that everyone is having to rebalance, address losses, or de-risk,” [said] Richard Kelly, head of global strategy at TD Bank…. “We are at the stage where central banks need to provide exceptional liquidity into the market to make sure that basic markets can function….”

‘The Treasury market is broken.”

The inability to find a price on older treasuries (“off-the-run” treasuries) is significant because in repo agreements, someone who wants to effectively get a loan offers an existing treasury to market at a price with a promise to purchase it back at a higher price on a set date. So, this indicates a new crack in the repo market. At the same time people “were unable to get bids,” meaning zero offers for the treasuries they wanted to sell. It appears the market froze up from both sides.

“I’ve never seen anything like it”, says veteran bond trader.

Amid frenzied trading over the past week, the $18 trillion U.S. Treasury market showed cracks that raised eyebrows across Wall Street, and finally led the Federal Reserve to announce a range of measures on Sunday night including purchases of hundreds of billions of U.S. government bonds over the coming months….

The cost to trade Treasurys with virtually identical terms but which differ in maturities by a few months has diverged sharply last week as traders struggled to buy and sell bonds in a hurry. This worrisome phenomenon underlines how volatility across Wall Street has seen trading volumes for older Treasurys slump even in the U.S. bond-market which is advertised as the deepest and most liquid safe-haven asset in the world.

“I have never seen moves like this in 35 years of trading…. At this point, the market will get absolutely exhausted,” said Tom di Galoma, managing director of Treasurys trading at Seaport Global Securities….

The more visible and most widely traded part of the market are newer “on-the-run” securities which are the bonds most recently issued by the U.S. government, but it’s the older “off-the-run” securities that represent the bulk of the $18 trillion market. Much of it is held by fund managers, insurance companies, pension funds, and other investors….

Though traders have been able to move in and out of on-the-run Treasurys with relative smoothness, it’s the less liquid and much bigger off-the-run portion of the market that has seen a sharp erosion of liquidity. This has led to a sharp widening of the price difference between the two buckets of bonds….

The surge in trading costs for older off-the-run Treasurys highlights the enormous pressure faced by broker-dealers, the middlemen of the bond-market, who are grappling with the biggest swings in government debt yields in sometimes decades.

“If we can’t price and clear Treasurys in a very efficient manner, the market is going to have broader issues,” said Gregory Faranello, head of AmeriVet Securities….

Mutual funds and other investors promise their clients that they will be able to pull money in and out of funds on a day-to-day basis….

“You couldn’t trade off-the-run Treasurys even if you begged people,” said Gang Hu, managing director of WinShore Capital Management, a fixed-income hedge fund….

Market participants say the recent blow-out of bid-ask spreads for older Treasurys is not so much a reflection of funding pressures, and more a reflection of how dealers were struggling to handle unprecedented daily volatility in the bond-market….

Priya Misra, global head of rates strategy at TD Securities, in an interview with Bloomberg Television said the Fed’s repo liquidity injections would not help smooth dislocations in the Treasury market….

The U.S. central bank offered up $1.5 trillion of funds through longer-term repurchasing operations this week…. The U.S. central bank said it would buy … $500 billion in Treasury securities and $200 billion in mortgage-backed securities over the coming months, beginning on Monday….

Investors say the lack of liquidity in the off-the-run Treasurys shines a light on the workings of financial markets, at a time when it could come under increased pressure in the coming months as the coronavirus epidemic impacts economies and markets.

Wow! What a sudden swing for the normally sanguine government bond market. Yields at first plunged as a result of the Fed’s actions on Monday and then began drifting back up to where they were. At the same time, older treasuries stagnated while new ones did not. What is causing older treasuries — the ones used for repos — to become so, well, dead, that they’re not moving?

The shift from stock troubles to new bond troubles is even more severe … or, at least, sudden … than I expected. While I saw a badly flawed economy slowly crumbling into recession, I didn’t know it would get a COVID-19 booster to put a heavy foot in its back and stomp it down.

And, now that has led us to this headline, which I’ll let you read on MarketWatch, after you are done with this article, so they get some benefit from my use of their extensive quotes above:

Wall Street fears ‘flashbacks to 2008’ with forced selling in $9 trillion U.S. corporate bond market

The bond market is troubled in the government basket and in the corporate basket. The long and short of it is, as the article just linked to says, that the decade-long bond bubble is imploding from one end to the other. On the corporate side, the global credit cycle is ending because defaults are about to begin. Corporate bonds are in a crisis situation with no liquidity in the market. (I recommend you read the article above.)

It’s easy to see why corporate bonds are moving toward default as revenues crash under the virus for corporations that loaded up on debt for stock buybacks when debt was cheap. Now the cost for refinancing corporate debt is rising as investor flee to safety. But that makes the freeze in government debt trading all the harder to understand.

As Bloomberg also writes,

Bond ETFs Face Toughest Liquidity Test Yet in Virus Turmoil

Bond-fund prices are dropping the furthest below their net-price value they have ever gone, creating “unprecedented dislocations in the ETFs that track them.”

The inherent rub is that fixed-income ETFs, which trade on exchanges and behave like stocks, are much more liquid than the securities they hold. That’s fueled fears that in the event of a sell-off, investors scrambling to redeem their holdings would overwhelm the managers…. Now, as credit spreads blow out and investors rush for the exit, fixed-income ETFs are being put to the test.

In other words, investors can move in and out of the ETFs (stock Exchange Traded Funds) much easier than the fund managers can move in and out of the bonds they hold in those funds, making it hard for the managers to sell bonds and cash out members who are fleeing.

How did this upset in the normally sanguine bond market happen and why? I think the bond market is riddled with problems but to try to understand why its breaking up in government bonds — the safest haven of all — we’re going to have to dig deeper. Let’s start with asking, “Why are ‘old’ treasuries stalling out in trade, while new treasuries are doing fine?” We’d ask that because it is such an anomaly, and an absolute anomaly might point us in the direction of some of the deepest trouble.

What went broke?

I suspect people started fleeing government bonds for the same two reasons I saw them as no longer being a safe haven. One reason was the obvious: all of Trump’s promises of government stimulus and corporate bailouts and assistance to job-stranded citizens mean a huge increase in the government deficit that has already seen a huge increase this year. That means huge issuances of new bonds. When you’re already running more than a one-trillion-dollar deficit, you’re not in good shape to pile on more.

The Fed, however, simultaneously promised to vacuum all of that up as quickly as the government issues it, monetizing the debt, but everyone is nervous the Fed is losing controls as well as the government. So, I needed to find a bigger, deeper, darker reason for the freeze in older bonds.

That led me to discovering (for myself) something much worse. It has a gnarly name — “rehypothecation” — that may need some explaining. The short of it is that older US government bonds have become unsafe because of how they are traded and used as collateral again and again, and everyone is losing track of the collateral pledges (or never had track). That’s why money fleeing from stocks is choosing even safer havens now. The older the bond, the more likely it stacked in more than one collateral basket. (But that, too, takes some explaining as to how that can happen.) This is what has banks scared, driving fear in the repo market and churning up a constant crisis state there. (In addition to the failing hedge funds the I pointed out in one of my Patron Posts. Yet, they may be connected, too.)

Rather than attempt to explain rehypothecation myself, I’m going to let two others explain it — one in words that I think lay it out about as simply as it can be stated and the other with his magic drawing board.

In an attempt to contain the damage [in bonds], the Federal Reserve on March 3 slashed the fed funds rate from 1.5% to 1.0%, in its first emergency rate move and biggest one-time cut since the 2008 financial crisis. But rather than reassuring investors, the move fueled another panic sell-off….

Exasperated commentators on CNBC wondered what the Fed was thinking….

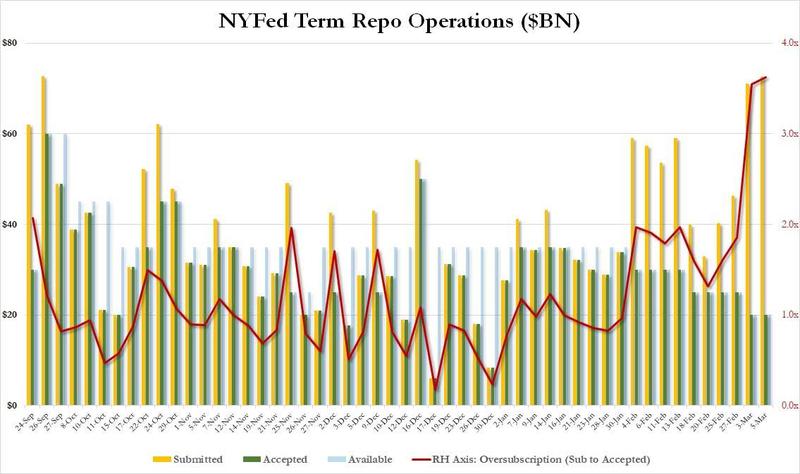

So what was the Fed’s reasoning for lowering the fed funds rate? According to some financial analysts, the fire it was trying to put out was actually in the repo market, where the Fed has lost control despite its emergency measures of the last six months. Repo market transactions come to $1 trillion to $2.2 trillion per day and keep our modern-day financial system afloat….

The risky element of these apparently secure trades is that the collateral itself [the bonds that are traded, including government bonds] may not be reliable, because it may be subject to more than one claim. For example, it may have been acquired [as pledged collateral, not as a physical possession] in a swap with another party for securitized auto loans or other shaky assets — a swap that will have to be reversed at maturity. As I explained in an earlier article, the private repo market has been invaded by hedge funds, which are highly leveraged and risky; so risk-averse money market funds and other institutional lenders have been withdrawing from that market. When the normally low repo interest rate shot up to 10% in September, the Fed therefore felt compelled to step in. The action it took was to restart its former practice of injecting money short-term through its own repo agreements with its primary dealers, which then lent to banks and other players. On March 3, however, even that central bank facility was oversubscribed, with far more demand for loans than the subscription limit….

The Fed’s emergency rate cut was in response to that crisis. Lowering the fed funds rate by half a percentage point was supposed to relieve the pressure on the central bank’s repo facility by encouraging banks to lend to each other. But the rate cut had virtually no effect, and the central bank’s repo facility continued to be oversubscribed the next day and the following….

The problem is in the collateral, which lenders no longer trust. Lowering the fed funds rate did not relieve the pressure on the Fed’s repo facility for obvious reasons: Banks that are not willing to take the risk of lending to each other unsecured at 1.5% in the fed funds market are going to be even less willing to lend at 1%….

But surely the Fed knew that. So why lower the fed funds rate? Perhaps because it had to do something to maintain the façade of being in control, and lowering the interest rate was the most acceptable tool it had. The alternative would be another round of quantitative easing….

In the face of a recession caused by massive supply-chain disruption, the U.S. central bank has shown itself to be impotent.

In other words, no one trust the bonds that are used as collateral in repo financing are clear — that they have not been expressly offered to others as collateral who might have first positions in the undisclosed collateral chain. This author explains this root cause in another article”

At $1 trillion daily, the repo market is much bigger and more global than the fed funds market that is the usual target of central bank policy. Repo trades are supposedly secured with “high-quality collateral” (usually U.S. Treasuries). But they are not risk-free, because of the practice of “re-hypothecation”: the short-term “owner” of the collateral can use it as collateral for another loan, creating leverage – loans upon loans. The IMF has estimated that the same collateral was reused 2.2 times in 2018, which means both the original owner and 2.2 subsequent re-users believed they owned the same collateral. This leveraging, which actually expands the money supply, is one of the reasons banks put their extra funds in the repo market rather than in the fed funds market. But it is also why the repo market and the U.S. Treasuries it uses as collateral are not risk-free….

As Wall Street veteran Caitlin Long warns:

“U.S. Treasuries are … the most rehypothecated asset in financial markets, and the big banks know this.… U.S. Treasuries are the core asset used by every financial institution to satisfy its capital and liquidity requirements – which means that no one really knows how big the hole is at a system-wide level….

“This is the real reason why the repo market periodically seizes up. It’s akin to musical chairs – no one knows how many players will be without a chair until the music stops….

Some hedge funds take the Treasury security they have just bought and use it to secure cash loans in the repo market. They then use this fresh cash to increase the size of the trade, repeating the process over and over and ratcheting up the potential returns.

Zero Hedge concludes:

“This … explains why the Fed panicked in response to the GC [General Collateral] repo rate blowing out to 10% on Sept 16, and instantly implemented repos as well as rushed to launch QE 4: not only was Fed Chair Powell facing an LTCM [Long Term Capital Management] like situation, but because the repo-funded [arbitrage] was (ab)used by most multi-strat funds, the Federal Reserve was suddenly facing a constellation of multiple LTCM blow-ups that could have started an avalanche that would have resulted in trillions of assets being forcefully liquidated as a tsunami of margin calls hit the hedge funds world….”

Does anyone want to trust that the Fed has that all sorted out, given how the repo crisis has raged on for half a year? In short, the most basic, supposedly most secure, lowest-interest market has become garbage, and it’s about to be incinerated due to spontaneous combustion. You can see the smoke rising from the junk pile now.

Here is the magic-drawing-board explanation for those who do better with a visual explanation of something complicated like rehypothecation :

And that is why we are now seeing moves the ones below after half a year of constant repo intervention by the Fed:

Does that look under control to you? Or does it look like a hockey stick?

Which is why I don’t even trust US government bonds anymore

Simply put, you don’t know how many times the old government bonds your bond fund owns (or thinks it owns) have been pledged as collateral now that hedge funds have entwined themselves so deeply into the repo market.

My move of our 401Ks into cash funds may ultimately not be safe now either if banks start to fail due to the rehypothecation problem, but it will be safest for the longest among the kinds of funds available in our 401Ks. One can hope that, by the time cash funds (made up of money market funds and CDs, etc.) look unsteady, most stocks will have bottomed out to where one might be able to re-enter the stock market safely at bargain prices.

![John Robert Charlton [CC BY 2.0 (https://creativecommons.org/licenses/by/2.0)]](https://thegreatrecession.info/blog/wp-content/uploads/Monster-of-the-Deep-747x1024.jpg)

I have doubts that government bonds will stabilize because of the rehypothecation problem and rapidly rising government debt and the seeming inability of the Fed to wrestle all of that back under control. The Repocalypse has returned with a vengeance, and the Fed is having a hard time feeding the monster with enough to keep it quiet.

As I’ve laid out in my recent Patron Posts, I anticipate some big changes in how the Fed does its work. It may start giving out non-recourse loans. It appears it is already accepting lower quality collateral for its new bald-faced QE, about which it now simply says, “We don’t care what you call it. We’re just doing it.” Is it becoming a garbage disposal again for all this junk?

It has reversed from trying to roll off all of its tired, dog-eared mortgage-backed securities (MBS) junk left over from its Great Recession salvation days to now stocking back up on that rubbish in order to clear the trash off the market and make banks safer.

It may be accepting that stuff in repos because they are what banks most want to get rid of or because they are now deemed just as safe as rehypothecated US treasuries. If that’s the case, the Fed has just moved over the past weekend to giving banks cash for toxic junk as well as rehypothecated US treasuries.

Sucking up this swill is likely one reason the Fed has opened up the repo taps to pouring out another $1.5 trillion in “call-it-what-you-want-now QE.” They may even engage in some “not-TARP” loans. (More on all of the Fed’s recent and massive failures in my next post, as I’ll keep this one to being just about the big bond bust.)

As one reader (who goes by the name “Aricool”) said on a comment to my FuBEAR article on another site, “In this way, the system is so FUBAR that Banks and Shadow banks/hedgefunds effectively can print there own money now, when the Fed is buying rehypothecated UST IOUs. We do not have a CB anymore. Funny money gone wild!”

I think that about sums up the current state of the US treasury market, and it only looks a lost worse for the corporate bond market!

Aricool continued, “This time it is fraud and financialism scams the Fed is buying/bailing out. The financial system is now almost completely moral hazard and what will collapse it is collateral calls, b/c it ain’t there…. Fed is almost certainly clueless about this problem and the politicians for 100% sure are. No-one’s risk models assumed global economic shutdown for any period of time. So, they’ll all be way behind the curve as the (collateral call) tsunami comes and collateral chains collapse.”

It is just like no one’s risk models during the housing crisis assumed the possibility that housing prices would decline for months, which would turn ARMs into underwater timebombs.

And this repo madness is now forced to be endless because, as Peter Schiff puts it,

“How else is the fiscal stimulus paid for? It’s paid for by the Fed. The Fed ends up doing more QE to buy all the bonds that have to be sold to finance the stimulus”

It’s a dangerous financial circle when even USTs are not safe because you don’t know who in all the flurry really owns the right to sell them or, to put it more precisely, who has already pledged those exact treasures you are buying as collateral for their own high-risk schemes that are now blowing apart.

So, I got out. You might as well braid bonds into a hangman’s rope and hang yourself with them.

The Bond Bubble is beginning to burst, and when that happens, stock action in the last few weeks will seem like a mild foreshock. It’s about to get real ugly in everything because that is how we have loaded our entire economy with crap … and called it “strong.”

The president and the Fed and all the permabulls said “the economy is strong.” The president said it is the “strongest economy ever.” Well, the “strongest economy ever” is about to burst along every one of a thousand fault lines that we built in throughout the Fed’s Great Recovery!

And the fall of the giants has begun as, just today …

S&P, confirming it would move quickly on rating downgrades this time following a near record plunge in the price of oil last week, downgraded Exxon from AA+ to AA as Exxon’s “Lower Oil Price Assumption Weakens Cash Flow/Leverage Metrics”; and since the outlook is negative, it means more downgrades are coming.

Expect many more downgrades where that came from. Literal collateral damage is here.

The Epocalypse is here, too! You haven’t even seen economic hell yet! This is just economic Armageddon. Wait until the fires in the pit come on when the bonds stored down there begin to burn! That’s when the banks above go up in flames. There is a lot more hell to pay for years of benefiting from and praising total financial profligacy.

The Everything Bubble is just starting to crack apart, and the bursting of the bond bubble inside of it will be even worse than the stock bubble. It will become an unstoppable raging inferno once the downgrades cause collateral backups through the entire system.

(More on that to come. Fortunately, now that I cannot write fast enough to keep up with our economic collapse, I have a paid month off work as result of our economy going into planned hibernation at the end of winter. I’ll do what I can to eulogize the economy as all of this plays out and to lay out how the pieces are likely to fall from here on out. I hope you’ll support that effort.)

![By Marcosleal (Own work) [CC BY-SA 3.0 (https://creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons](https://thegreatrecession.info/blog/wp-content/uploads/BalloonAndStorm.jpg)