Wolf Richter wolfstreet.com, www.amazon.com/author/wolfrichter

Like a centrally directed disinformation campaign. Here’s what happened.

And it was everywhere. Misleading headlines about retail sales, from which reporters then extrapolated silly conclusions about the consumer while clamoring for a rate cut from the Fed.

Barron’s:

“The American consumer – backed by strong wage growth – has offset weakness in corporate profits and capital spending for much of the past year. The Commerce Department’s latest update of retail and food service spending, published Wednesday, suggests the growth spurt is over.

“The upshot? The slowdown could prompt a more vigorous “midcycle adjustment”—read: interest rate cuts – by the Federal Reserve when it meets at the end of the month….”

The Wall Street Journal:

“American shoppers pulled back on spending in September, signaling a key support for the U.S. economy this year could be softening amid a broader global economic slowdown.”

Bloomberg’s masterpiece about the suddenly “shaky” consumer:

“U.S. retail sales unexpectedly posted the first decline in seven months, suggesting consumers are starting to become shaky as the main pillar of economic growth and potentially bolstering the case for a third straight Federal Reserve interest-rate cut.”

So here is what happened.

The Commerce Department released its “Advance Estimates of U.S. Retail and Food Services” this morning. This is the first estimate for the month that will get revised – often substantially – in following months as more data become available. And the report said that in September compared to September last year:

- Total retail & food services (restaurants, cafes, etc.) rose 4.1%.

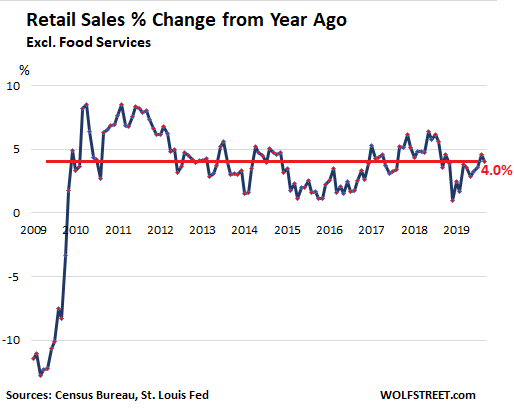

- Retail sales without food services rose 4.0%.

- Food services sales rose 4.9%.

- Retail sales without gasoline sales rose 4.7%.

- Retail sales without gasoline, motor vehicles & parts sales rose 4.5%.

- Sales at non-store retailers (ecommerce, vending machines, door-to-door, telemarketing, home parties such as Tupperware, etc.) rose 12.9%.

So, a 4.0% year-over-year increase in retail sales is pretty strong – and about in line what you’d expect from the mythic figure, the indomitable American consumer. It’s the second highest percentage increase (behind August’s 4.6%) since October last year:

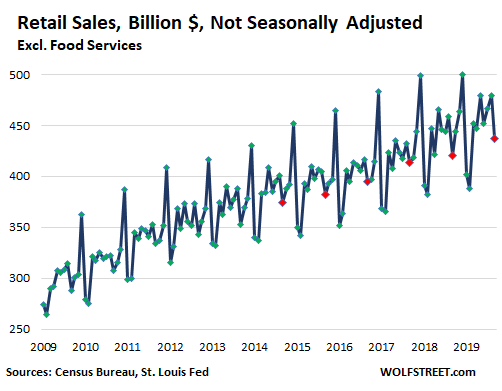

But retail sales are very seasonal. And September sales, which always follow the back-to-school burst in August, always drop sharply from August, every year. So, here are the not-seasonally adjusted retail sales in billions of dollars. I marked the last six Septembers with red dots:

Not seasonally adjusted, retail sales in September fell 8.9% from August. Last year at this time, they fell 8.3%. In 2017, they fell 4.5%, in 2016, 5.4%. But in 2013, they fell 9.2%.

Labor Day weekend is big for retail, but it was pulled into August.

This year, Labor Day fell on September 2, and August 31 was a Saturday, which for accounting purposes in many industries pulled Labor Day sales into August. This includes auto dealers which closed their books on the first working day after the weekend, which was Tuesday, September 3.

Those sales showed up in August and not in September. This is not unusual. It happened in 2013, as well, when Labor Day Monday fell on September 2, and August books were closed on September 3, pulling all those sales into August. Hence the 9.2% drop from August to September 2013. In quarterly reporting, this noise disappears.

These effects of seasonality and calendar are well known (except among reporters).

To tone down the noise of these seasonal and calendar effects, the Commerce Department comes up with large “seasonal adjustments.” For example, the seasonal adjustments reduced the 8.9% drop in September from August to a 0.3% drop “seasonally adjusted.” This 0.3% drop is what the media got hung up about.

Not seasonally adjusted, retail sales in September were $436.7 billion, down 8.9% from August’s $479.6 billion. That’s a seasonal drop from month to month of $43 billion.

After seasonal adjustments, sales in September were suddenly $460.4 billion, down 0.3% from August’s seasonally adjusted $461.9 billion.

How huge are the seasonal adjustments? In September: $23.7 billion. This is the difference between the estimate of actual sales in September ($436.7 billion) and seasonally adjusted sales ($460.4 billion).

If these seasonal adjustments are off just a little bit, if for example, the seasonal adjustment should have been $2 billion more, a tiny amount compared to the magnitude of retail sales, retail sales would have risen +0.2%, instead of falling -0.3%.

In other words, seasonally adjusted month-to-month retail sales growth is only as good as the seasonal adjustments. It should either be ignored or be looked at after studying the other data first, as we have done a little bit of here.

Retail sales don’t turn around on a dime — unless there is a huge national crisis. And to claim, based on seasonally adjusted month-to-month data, that retail sales turned around from strong growth in August to sudden decline in September because the consumer suddenly got “shaky” is nonsense.

And if the financial media – which should know better – base headlines on this seasonally adjusted month-to-month retail sales growth figure, and if they extrapolate grander themes for the overall economy and even monetary policy – such as rate cuts – from that singular seasonally adjusted month-to-month retails sales growth figure, it’s either braindead reporting or willfully manipulative reporting with an agenda behind it (such as clamoring for a rate cut).

OK, now I feel better. Got this off my chest.

Cleveland Fed’s Underlying Inflation Measure Hits 3.0%, Hottest in the Data. Read… Without the Outliers, Inflation Is Running Hot. Fed Has Started Mentioning these Measures in the Minutes