Authored by Jesse Colombo via RealInvestmentAdvice.com,

During an economic bubble like the late-1990s dot-com bubble or the U.S. housing bubble, frivolous, hubristic investments and business decisions become appealing to many people who are what I call “bubble drunk.” In a bubble, money is flowing, the social mood is euphoric, and asset prices are surging – greed is the dominant emotion and risk is barely an afterthought. In this type of environment, speculation in art and collectibles becomes popular, often leading to an art bubble (for example, Japan’s bubble fueled an art bubble in the late-1980s). Of course, after a tremendous surge, the bubble eventually bursts and speculators are left holding works of art that are worth a fraction of what they paid. For the past several years, there has been an art bubble that has been primarily driven by the Greater China region – here is a recent anecdote reported by Bloomberg:

Millennials snapped up $28 million worth of art inspired by the Simpsons television show, along with skateboarding shoes and cans of spray paint at a Sotheby’s auction in Hong Kong as a new generation of collectors comes of age.

“The auction room suddenly got a lot hipper, with all these cool millennial buyers in hoodies,” said Edie Hu, art advisory specialist at Citi Private Bank in Hong Kong. “Their tastes are very different from their parents, and Sotheby’s is tapping into that.”

The highlight of the 33-lot auction of items belonging to Japanese fashion designer Nigo was a painting by Brooklyn street artist KAWS based on the Beatles’ “Sgt. Pepper’s Lonely Hearts Club Band” album but populated with Simpsons characters. It sold to an unidentified buyer for $14.8 million including fees, a record for the artist and about 15 times the estimate.

A young Chinese buyer with a short back and sides haircut, who was wearing a green army camouflage jacket, shelled out $2.6 million for another KAWS piece called “UNTITLED (KIMPSONS #3).” The work depicts the Simpson family sprawled unconscious on their couch, with the artist’s signature crosses for eyes.

“I am not surprised by the demand, but I am surprised by the final number,” said Max Dolgicer, a New York collector who’s been buying the artist’s work for seven years. “It’s a very fast-moving market.”

‘The Kaws Album’, KAWS. Courtesy Sotheby’s.

Young, hip millennials paying jaw-dropping amounts for trendy, lowbrow art is the type of behavior that you see in a bubble. That Simpson’s “art” is tacky and sophomoric – it’s what would pass as art in the year 2505 in the movie Idiocracy, except this is real life. Art from 500 years ago is objectively more beautiful and sophisticated than that Simpsons art, which is just more evidence of the dumbing down of modern culture. These young, hip millennial art buyers in Asia are drunk on easy money – plain and simple. In the next few charts, I will explain why a dangerous bubble is inflating in China and Hong Kong, where the Sotheby’s auction discussed earlier took place.

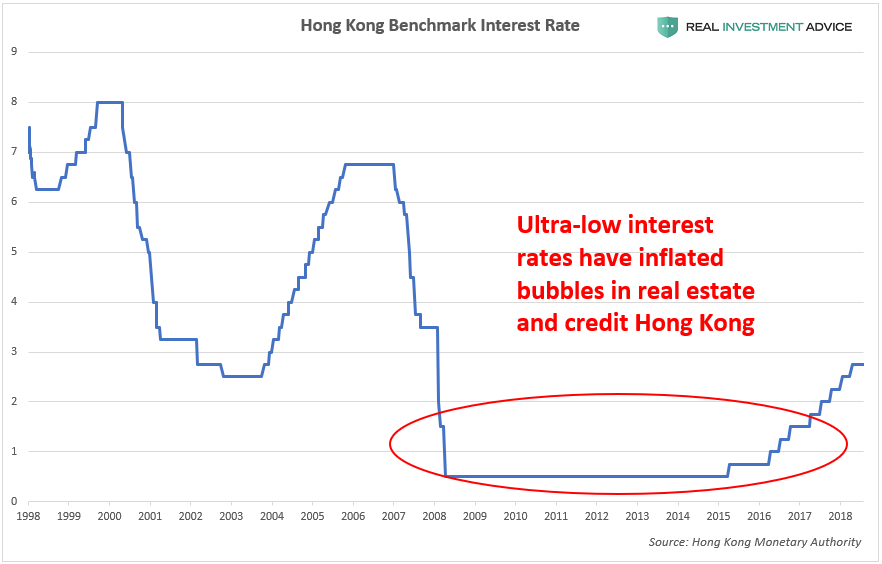

Since the 2008 global financial crisis, Hong Kong has held its benchmark interest rate at record low levels for a record length of time. These interest rates were far too low for Hong Kong’s economy – this anomalous situation only occurred because Hong Kong was trying to match U.S. interest rates to keep the currency exchange rate between the two countries stable. After 2008, the U.S. was a post-bust economy that was struggling with deflationary pressures – Hong Kong was not. Unfortunately, Hong Kong’s excessively low interest rates have helped to inflate a massive credit and asset bubble.

Hong Kong’s housing prices have quintupled since 2003:

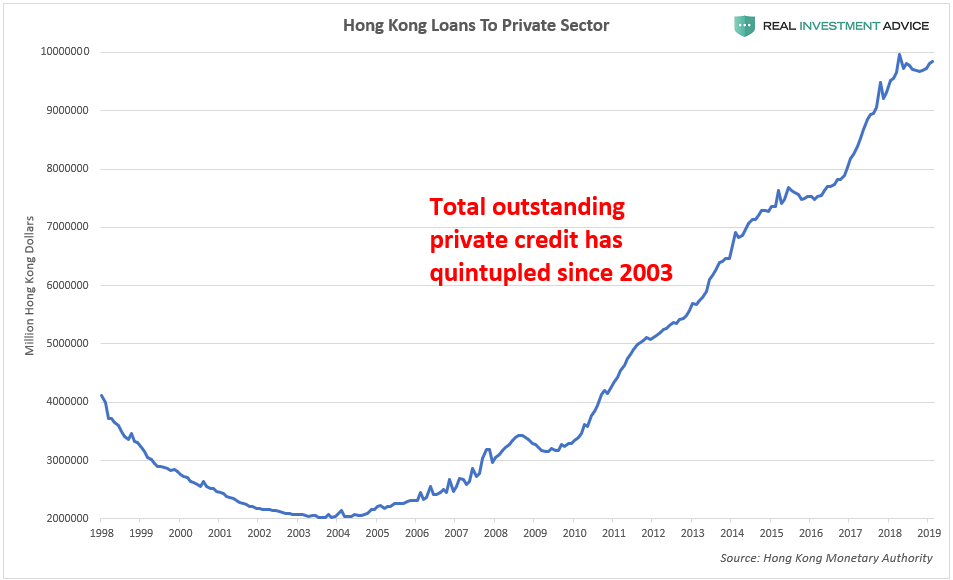

Similarly, total outstanding private sector loans have quintupled since 2003:

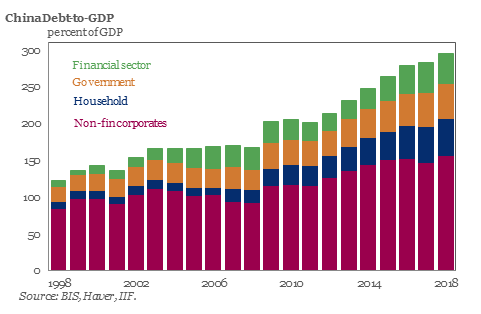

Mainland China has also been experiencing a tremendous credit bubble in the past decade that has been artificially boosting economic growth:

Ultra-low interest rates and other stimulative central bank policies are creating bubbles (and stupid decisions) across the globe. These bubbles are everywhere from China to Singapore to Australia to the U.S. to Canada to Western Europe. When asset prices are soaring and cheap credit is flowing, the result is “easy money” that finds its way into art and supercars. Unfortunately, as the Japanese art speculators experienced in the early-1990s, art bubbles always burst. The Chinese are going to be taught this lesson very soon. Even if you don’t live or invest in Asia, you are still tied into the same global economic system, which means that your investments and way of life are at risk.