by Martin Armstrong

The conservatives are going nuts about raising the debt ceiling as if this really matters. They claim: “The United States is effectively bankrupt, but that doesn’t matter to the GOP. Once evangelists of fiscal responsibility and scourges of deficit spending, Republicans today glory in spilling red ink. The national debt is now $20.6 trillion, greater than the annual GDP of about $19.5 trillion. Alas, with Republicans at the helm, deficits are set to continue racing upwards, apparently without end.”

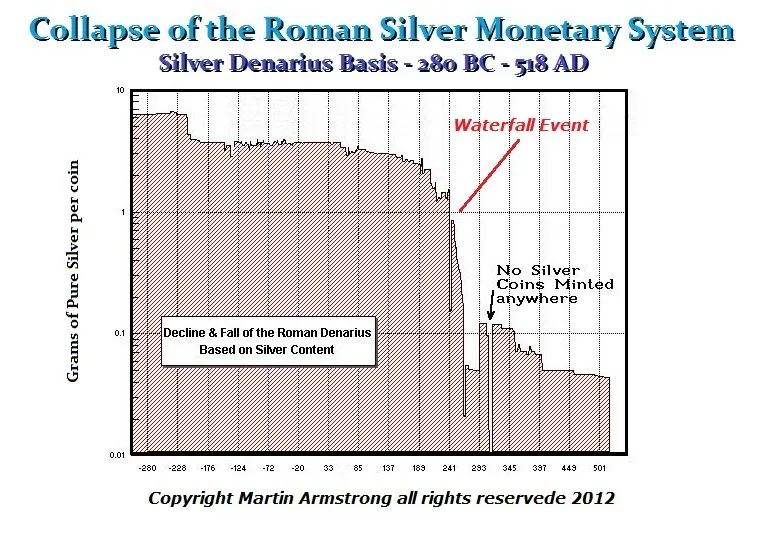

What they fail completely to grasp here is until the system is completely revamped and we adopt the way the Roman Empire was funded from 280BC to 68AD, just creating the money to fund the government instead of borrowing it, there is no hope in solving this issue. In a recession, Keynes argued borrowing can be beneficial in creating economic stimulus and shortening the recession. Governments used that statement to then perpetually borrow year after year.

In 1940 a Cadillac sold for $1675. Currently, the low-end Cadillac is $35,000. This is almost 21 times the 1940 price level. The US national debt was $51 billion before the war and it is now $20 trillion. The debt has risen 392% compared to 20.89% for a Cadillac. The minimum wage in 1940 was 30 cents per hour. Today, the minimum wage is $10.10 per hour in 2018, which is a rise of 33.6%. However, if we look at collectibles, the famous 1804 silver dollar sold for $30,000 around 1940. In 1999, one sold for $4.14 million. Here we had an advance of 138%.

In 1940 a Cadillac sold for $1675. Currently, the low-end Cadillac is $35,000. This is almost 21 times the 1940 price level. The US national debt was $51 billion before the war and it is now $20 trillion. The debt has risen 392% compared to 20.89% for a Cadillac. The minimum wage in 1940 was 30 cents per hour. Today, the minimum wage is $10.10 per hour in 2018, which is a rise of 33.6%. However, if we look at collectibles, the famous 1804 silver dollar sold for $30,000 around 1940. In 1999, one sold for $4.14 million. Here we had an advance of 138%.

Then there was the Peter Paul Rubenswhich just sold for $58 million in 2016. The owners had tried to sell during the Great Depression. Nobody was interested. They then lent to a monastery where it hung in a hallway for 20 years. Other than that exception, nothing has advanced in proportion to the national debt. Therefore, the idea that increasing the money supply will automatically result in proportional inflation cannot be proven by any means of a statistical study. It is a nice theory, but it has never been proven to work. Hence, 10 years nearly of ECM quantitative easing failed to reverse the deflation.

Then there was the Peter Paul Rubenswhich just sold for $58 million in 2016. The owners had tried to sell during the Great Depression. Nobody was interested. They then lent to a monastery where it hung in a hallway for 20 years. Other than that exception, nothing has advanced in proportion to the national debt. Therefore, the idea that increasing the money supply will automatically result in proportional inflation cannot be proven by any means of a statistical study. It is a nice theory, but it has never been proven to work. Hence, 10 years nearly of ECM quantitative easing failed to reverse the deflation.

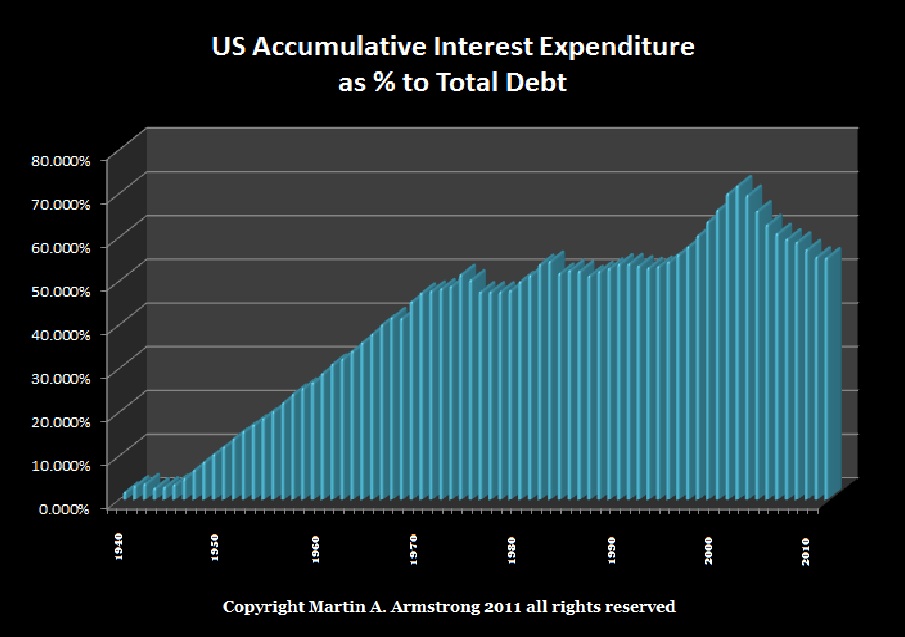

If we had simply created the money instead of borrowing it, the national debt would be less than 50% of what it is today. The government borrowing competes with the private sector reducing economic growth and creating a bid for money that raises interest rates for the average person. Inflation did not go crazy in Rome until about 250AD onward.

The theory that it is less inflationary to borrow than create meant something when government debt was not collateral for loans. You could not borrow against TBills or bonds before 1971. Ever since borrowing is more inflationary because we then have to pay interest to keep it rolling when we have no intention of paying it off. The entire system will go crazy and as interest rates rise, the debt will explode.

Debt today is simply money that pays interest.

Can We Stop the Government Borrowing & Just Print Without Inflation?

Views:

The Germans kicked the central bankers out and simply ‘issued’ money from 1933 to the end of the war. That country recovered from the Great Depression years before the West or the US did, had full employment and a vibrant economy. Central bankers didn’t like it so we bombed the country back to the stone age.