Cash cliff spells trouble for unemployed, and everyone else…

(Reuters) – Judith Ramirez is bracing for July. That’s when the hotel housekeeper and her electrician husband – who have both been out of work for three months – expect their combined unemployment benefits to drop by more than half, and their deferred $1,500 monthly mortgage payment on their Honolulu home to come due.

Widespread Deferrals Mean Banks Can’t Tell Who’s Creditworthy…

Bankers are tightening lending standards and looking for new data that can help them figure out who’s risky and who’s not

The Fed’s reckless bailout experiment…

Reveals Bond Purchases Including AT&T, WALMART…

Food Bank Lines Reemerge As COVID Paralyzes Households

Since the COVID-19 pandemic began, food bank lines stretching for miles were seen across the US have come to symbolize the financial destruction of households triggered by an abrupt closing of businesses and unprecedented job losses.

Tens of millions of people lost their jobs, and millions more turned to food banks. The demand for food pantries was at record levels as the federal government deployed the National Guard to manage food supply chains to thwart disruptions.

In March, April, and May, food bank systems nationwide reported unprecedented demand as millions of hungry, jobless, and broke Americans, with insurmountable debts and no savings, had no meaningful way of putting food on their tables. To be more specific, food security among households in San Antonio, Texas, was a huge issue, resulting in more than 23 million pounds of food, serving 240,000 cars at drive-through distributions and 5,800 home visits – was seen at the San Antonio Food Bank over the three months.

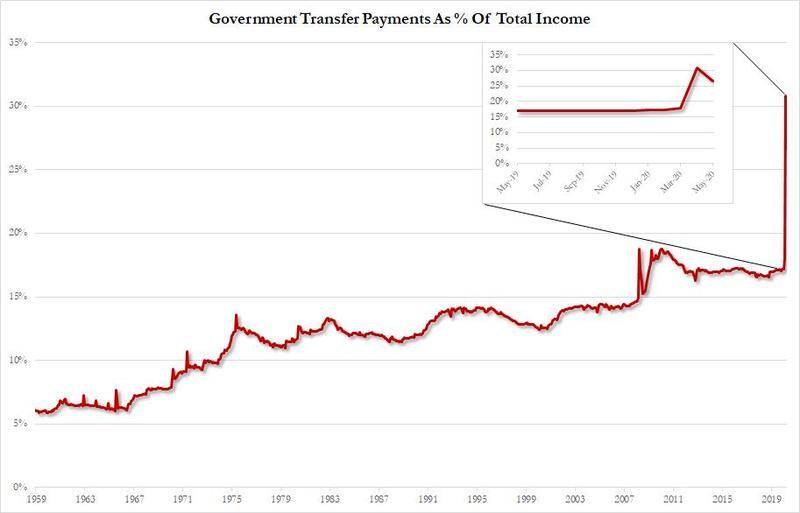

During the period, retails sales bounced modestly after a stunning record decline – mostly because a quarter of all personal income was derived from the government. Essentially what this means is that the Trump administration activated the money helicopters to avoid a total collapse of the US economy – via unemployment and emergency benefits, welfare checks, and so on.

Massive Wave Of Student Loan Defaults Is Coming

There are increasingly urgent signs that an unprecedented wave of student loan defaults could be arriving within a matter of months. A cratering economy and expanding pandemic are about to collide with the expiration of critical temporary student loan relief programs, and the end result could be catastrophic.