Authored by Jesse Colombo via RealInvestmentAdvice.com,

In my experience as someone who warns about the development of dangerous economic bubbles (both the mid-2000s U.S. housing bubble and the post-2009 “Everything Bubble“), I have been criticized literally thousands of times as the stock market surges year after year and the economy continues to grow. The criticisms typically take the form of “you’ve been warning about bubbles for years – you’re a broken clock!,” “you’re a permabear!,” and “you’ve been missing out on tons of profits!” I’ve heard every criticism in the book and I’m completely unfazed by them because those criticisms are based on misunderstandings of my approach and because I know that my analyses are correct.

The number one mistake that my critics make is assuming that I am calling to sell the market and go short at the very same time that I warn about a bubble. This is completely untrue because my goal is to spot and warn about bubbles as early as possible as an activist for the purpose of warning society that it is going down the wrong path. As someone who graduated college straight into the 2008 financial crisis and struggled for a number of years after, I know from first-hand experience how destructive bubbles are to the economy and overall society. As a result, I feel that it is my moral duty to help spot and warn about bubbles in an effort to prevent another 2008-style crisis.

Though my goal is to warn about bubbles as early as possible as an activist, I do not approach trading and investing the same way. I am able to separate anti-economic bubble activism from tactical trading and investing. I am fully aware that shorting a bubble too early (such as when I make my warnings) would completely wipe out any trader who is foolish enough to do so. Furthermore, I have publicly stated for years that I believe in “trading with the trend and not against it,” which is an approach that helps economic skeptics like myself avoid the bad outcomes experienced by typical “permabears” who are short all the time.

I have been warning that we are experiencing another massive bubble for eight years now (starting in June 2011) and I am proud of it (and the crowd gasps!). My belief is that our so-called economic recovery (both U.S. and global) is actually a “bubblecovery” based on the growth of dangerous new bubbles and another debt binge. These bubbles are ballooning across the globe in numerous assets, industries, and countries such as U.S. equities and bonds, U.S. higher education, U.S. corporate debt, tech startups, shale energy, China & emerging markets, Australian and Canadian property, and more. The actual driver of these bubbles is the extremely aggressive central bank policies since the global financial crisis (record low interest rates and quantitative easing) .

While most of my trolls and critics assume that I’ve been calling to short the market for nearly a decade because of my bubble warnings (and have, therefore, been wrong all along), they couldn’t be further from the truth. In April 2012, I wrote a detailed piece called “We May Be On the Verge of the Next Major Bubble Boom” in which I laid out my thesis that a new crop of central bank-driven bubbles would come out of left field and help create an economic recovery and bull market in stocks. Of course, I claimed that this so-called “recovery” would be artificial and will ultimately lead to a tremendous crash and depression once the cycle fully played out, which I said would be the result of monetary tightening as inflation makes a comeback.

Here’s an excerpt from my April 2012 bubble boom thesis that captures my thoughts in a nutshell:

If a credit-fueled bubble boom does occur, the resulting surge in economic growth will surely surprise the vast majority of people, including most economists and financial professionals. People in the bearish camp, a huge group these days, would clearly be the most surprised by a bubble boom as they typically envision either a 1929-style deflationary meltdown ahead or a quantitative easing-induced hyperinflationary holocaust – both of which are scenarios in which economic growth dives off a cliff. On the contrary, the initial stages of a credit-fueled bubble boom are likely to bring about feelings of relief as stock prices soar, jobs come back (in bubble-related areas) and economic data marches steadily higher. While the surge in stock prices and economic activity will be driven by bubbles, few people will recognize this fact and simply questioning the bubble boom may elicit harsh reactions by a public (including politicians) that is so grateful for the newfound economic growth and basking in feelings that “happy times are here again!”

Though my beliefs about the coming bubble boom, including soaring stock prices, have been proven correct, critics still hurl comments at me such as “you’ve been warning for eight years now – when are you going to admit you were wrong?!” and “you’re like one of those guys with a sandwich board sign saying ‘the end of the world is nigh!’” The reality is, as crazy as it may sound, warning about a bubble for eight years – or even a full decade – can be completely rational, provided it is done for activism purposes rather than making the disastrous mistake of shorting too early.

In a central bank-driven, fiat currency-based economy like the U.S. has had for the past few decades, a good portion of the growth and booms are actually unsustainable bubbles. That explains the dot-com bubble, the housing bubble, and the current “Everything Bubble.” Someone who is aware of the unsustainability of fiat currency-based economies (a group known as Austrian School economists) can quite feasibly spot the development of dangerous bubbles a decade before they actually collapse and cause tremendous damage to the economy and overall society.

One prime example of this phenomenon is analyst and portfolio manager Doug Noland, who chronicled and warned about the development of the dot-com, housing, and current bubbles in great detail in his must-read Credit Bubble Bulletin. I was recently pouring through the Credit Bubble Bulletin’s archives to read more about the dot-com bubble era (because I was only in middle school then!) and I was surprised by how similar it was to today’s situation. I was fascinated to learn that Doug was warning about the development of the housing bubble starting in the year 2000…even before the dot-com bubble burst! Of course, he ended up being right about both bubbles.

Here are some excerpts of his prescient U.S. housing bubble warnings from 2000 to 2007:

Of course, it is our strongly held view that we are in the midst of a momentous financial and economic bubble fueled by unprecedented money and credit excess. It is also our belief that, unappreciated by the vast majority of analysts, non-banks have developed into the leading propagators of the credit bubble. In this vein, this week Freddie Mac reported that it expanded its balance sheet by $22 billion during the fourth quarter, a 25% annualized rate. Freddie Mac and Fannie Mae combined to increase assets by $46 billion during the fourth quarter, and $155 billion for the year. After moderating growth during the first half of the year, Fannie and Freddie came on strong to increase assets by $94 billion during the second half. For the year, Fannie and Freddie increased assets by 19%. Interestingly, money market fund assets also increased by about 19% during 1999, expanding almost $260 billion. Also noteworthy, money market fund asset growth slowed during the first half but also came on very strong during the second half of 1999. Mere coincidence? We don’t think so. After all, it is Fannie and Freddie along with the aggressive non-bank lenders such as GE Capital, GMAC, and the Wall Street firms, that borrow from the money market and finance the bubble excesses. As goes their borrowing and lending, goes the fuel for the bubble. This was particularly the case during the second half of 1998, and again during the latter months of 1999.

We have believed for some time that crisis would be the unavoidable consequence of truly unprecedented credit market leverage and speculation. Eventually, markets always punish egregious excess – always. Actually, this unhealthy bubble was in the process of being pierced back in the autumn of 1998. It should be recognized today that it would have been much better for the system to have taken the medicine back then. Instead, the Federal Reserve cuts rates sharply, while Fannie Mae, Freddie Mac and the Federal Home Loan Bank System moved aggressively as buyers of last resort for the leveraged speculators. In the process, hundreds of billions of new credit was created by the GSEs that gave a dangerously maladjusted credit system another lease on life – and what a life it became. For sure, this bailout created huge moral hazard for the credit and stock markets. It incited truly unprecedented credit and speculative excess.

It is also our view that historians will look back on the fall of 1998 and see it as the critical point where the Federal Reserve truly lost control of the financial system. Since the bailout, the corporate sector has likely added over $700 billion in debt, while mortgage debt has probably expanded by $750 billion. The GSE’s have added more than $500 billion in debt and contracted for hundreds of billions of interest rate derivative protection.

Last week we made the case that the US financial sector is one massive and precarious interest rate arbitrage. Well, it is clear to us that money market funds are the key source of liquidity for this historic speculation. Instead of the expected reasonable role of funding the short-term borrowing requirements for businesses involved in actual commerce, money funds are predominantly lending to holders of securities, most likely mortgage, credit card and auto receivables. With insufficient investor demand for the now nearly $1 trillion annual increase in mortgage, agency and corporate securities, Wall Street has created a structure where conduit “funding corporations” purchase much of the long-dated loans with liquidity created through the money market funds. This is a powerful new twist to the age-old game of borrowing short and lending long. It has worked like magic as the expansion of money market fund assets has created a virtually unlimited source of loanable funds for the financial sector. If one ever wonders how our economy functions so marvelously with little savings, able at the same time to so easily accommodate an unending flood of new credit creation, we think the answer lies in the uncontrolled expansion of money market assets. The downside, however, lies in acute systemic vulnerability from the truly unprecedented leverage and related use of derivatives, as well as historic distortions and imbalances to the real economy.

During 1999, total non-financial debt increased a record $1.1 trillion, an increase of about 10% above 1998’s credit growth. For comparison, last year’s non-financial debt growth was 43% greater than 1997’s increase of $776 billion. Total mortgage debt increased $601 billion in 1999, 20% greater than mortgage debt growth in 1998 and almost double that of 1997. Commercial mortgage debt increased $122 billion during 1999, this compares to $97 billion in 1998, $51 billion in 1997 and $28 billion in 1996. Corporate debt growth was a record $444 billion, compared to $406 billion in 1998, $286 billion in 1997 and $155 billion in 1996.

We believe it is virtually impossible to overstate the importance of what is now unfolding. In past commentaries, we have often focused on mortgage and consumer credit excess. The GSEs, with their balance sheets ballooning with residential mortgage loans, have championed egregious credit growth, leading to housing inflation, a dangerous misallocation of resources, and momentous distortions to the real economy. This almost monopolizing of the conventional mortgage marketplace has only worked to exacerbate the banking and financial sector’s drift into increasingly risky lending. Indeed, an over-zealous US banking system and Wall Street have for some time joined forces to incite an historic corporate debt bubble, with technology and telecommunications lending at the heart of unprecedented lending excess. We now see the corporate debt bubble as the next key “domino” in jeopardy, with quite troubling ramifications for a financial sector with extraordinarily high exposure.

From the California Association of Realtors: “The median price of a single-family home in California hit a new record in August, rising 14% to $255,580. August also was the 42nd consecutive month that the median price of a home posted an increase compared to the previous year…resale activity posted an increase of 17.7% in August 2000 compared to July 2000.” The unsold inventory index ended the month at 3.4 months. It is truly amazing how the California real estate bubble has expanded to include the entire state, from luxury neighborhoods in Hillsborough to working class communities in Riverside County and the high desert. Year over year, prices have surged 39% in Marin County, 47% in Santa Clara, 30% in Sonoma Country, 19% in Orange Country, and 35% in San Diego. Increasingly, however, the key development appears to be the dramatic broadening of this historic real estate bubble. In the Greater San Francisco Bay area, we see year-over-year prices increased 26% in Hayward, 23% in Oakland, and 34% in Richmond, not areas traditionally recognized as the most desirable. Down south with the least expensive desert real estate, we see that Palmdale experienced a 36% increase to $117,000.

And as long as ultra-easy money stokes the booming nationwide real estate Bubble, we should expect spending to continue to surprise on the upside. Final fourth-quarter GDP was reported yesterday at a stronger than expected annual rate of 1.7%. While numbers look fine on the surface, the detail provides unmistakable evidence of an extraordinarily maladjusted economy.

Second, the “structured finance” monetary regime that retains its dominance at the epicenter of our nation’s financial system (The Master of the Great Credit Bubble) is absolutely and unalterably dysfunctional. Indelible Monetary Processes specifically direct finance to where it is not needed – to sectors where there remains an inflationary bias. The entire U.S. financial system, then, has become trapped in a consumer and Mortgage Finance Bubble that has the corporate debt and stock market Bubbles appearing quite manageable in comparison.

Yet the ramifications of the mortgage finance bubble are anything but confined to the financial arena. Indeed, the bubble’s effects on the real economy may very well prove the most intractable. Mortgage credit excess and asset inflation today foster household over-borrowing and over-consumption. Investment decisions are similarly distorted. About two million residential units will be constructed this year, approximately 45 percent higher than the 1990s average of 1.37 million. The ongoing multi-year construction boom also includes retail, restaurant, hotel and gaming, sports venues, and other consumption-related structures. Regrettably, we are witnessing a replay of the late-1990s telecommunications and technology boom-and-bust experience, where a surfeit of speculative finance fosters destabilizing over-spending in the “hot” sectors.

This is a most fascinating period for analyzing the Mortgage Finance Bubble. On the one hand, with both home transaction volumes and average prices at all-time highs, Mortgage Credit growth remains at extreme levels. Fannie’s latest forecast has Mortgage debt expanding by 10.4% this year, this following the doubling of Mortgage borrowings over the previous seven years. On the other hand, there is clearly newfound seriousness by bank regulators seeking to stymie the riskiest bank lending practices. And while home sales remain at a record pace, the inventory of unsold homes is rising. Some of the hottest markets are experiencing a rapid buildup of houses for sale. The highflying mortgage REIT and subprime stocks are coming back to earth, while MBS spreads are quietly widening. Meanwhile, the media are now all over the housing Bubble story.

As I noted again last week, it is a central tenet of Credit Bubble Analysis that if an expanding Financial Sphere provides Easy Credit Availability and Abundant Marketplace Liquidity (prospective purchasing power), the Economic Sphere will undoubtedly conceive of ways to spend it. It is also critical to appreciate that a rapidly expanding Financial Sphere creates its own reinforcing (cheap) liquidity. And it is the nature of evolving Bubbles to circumvent processes that would typically marshal adjustment and self-correction. For the past several years, Mortgage Finance Bubble excesses have fostered massive Current Account Deficits that have been easily recycled back to booming U.S. debt securities markets. This has engendered only easier Credit Availability and General Liquidity Over-abundance. Credit Bubble Dynamics dictate that, if accommodated, Credit Inflation Manifestations will strengthen and broaden. Excess feeds and is fed by Credit excess until the unavoidable bust. These are fundamental analytical constructs to guide us as we look forward.

The Mortgage Finance Bubble should have burst last year, taking the lead from housing market dynamics.But the extraordinary dynamism associated with global Credit, speculative and liquidity excesses proved overpowering. The global leveraged speculating community was in aggressive expansion mode; Bubble excesses were going to reckless extremes throughout “Credit arbitrage;” the M&A and corporate debt Bubbles were in full bloom; and securities leveraging was taking the entire world by storm.

It’s clear that Doug Noland saw the housing bubble developing early on and chronicled it great detail. Had our society – including the Fed, Wall Street, and financial media – listened to him and others who were sounding the alarm, we could have avoided the 2008 crisis and all of the damage it did to our economy and society. On top of it all, we are still suffering from the effects of the 2008 crisis – for example, our economy is still so weak that the Fed can’t even raise the Fed Funds rate more than 2.25% without causing a market panic. Our economy is still very much on life support – make no mistake about that. To tell someone who was warning about the housing bubble for seven years before it happened “you were wrong!” is, frankly, a slap in the face and extremely immature and shortsighted. I firmly believe that my “Everything Bubble” warnings since June 2011 are just like Doug Noland’s housing bubble warnings that began in the year 2000.

The reason why the general public and mainstream economics community misunderstands the bubble warnings of Austrian School economists like Doug Noland and myself is directly rooted in the dramatically different beliefs we have regarding how and why bubbles form. To put it simply, Austrian School economists believe that bubble development is a process that occurs over a potentially long period of time (such as a decade), while the mainstream economics community believes that a bubble only becomes a “bubble” near the very peak, shortly before it bursts.

Because of our skepticism of central bank-driven economic booms in fiat currency-based economies, Austrian School economists believe that such booms are actually bubbles from the very day they start until the day they burst. The mainstream economics community, however, believes that central bank-driven economic booms are legitimate and sustainable for most of their lifespans and can only be considered a “bubble” when market sentiment becomes outright euphoric and excesses become impossible to deny (and, even then, most

mainstream economists will only admit that there was a bubble after it bursts and a crisis has resulted – too late!).

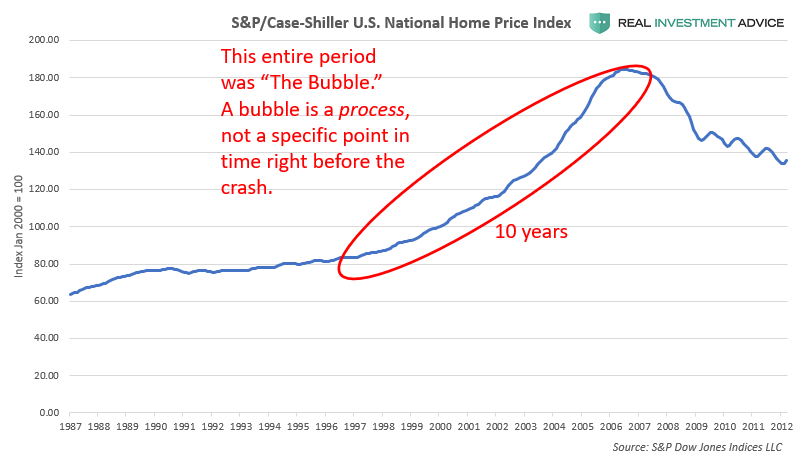

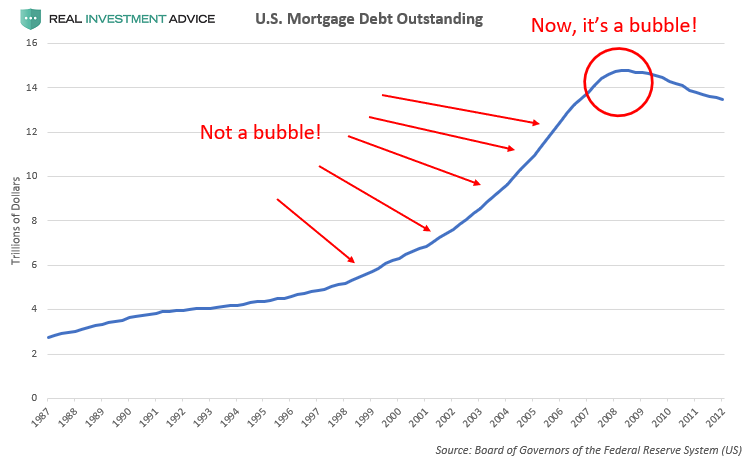

To illustrate my point, I’ve created and annotated charts of U.S. home prices and total outstanding mortgage debt during the housing bubble. The first chart shows that U.S. home prices started to rise in the late-1990s at the same time as the tech bubble (and they inflated for similar reasons – loose Fed policy). Though the bubble finally burst in 2007, it got to those lofty levels by inflating in 1998, 1999, 2001, 2002, 2003, and so on. Bubbles are a process – not a specific point in time.

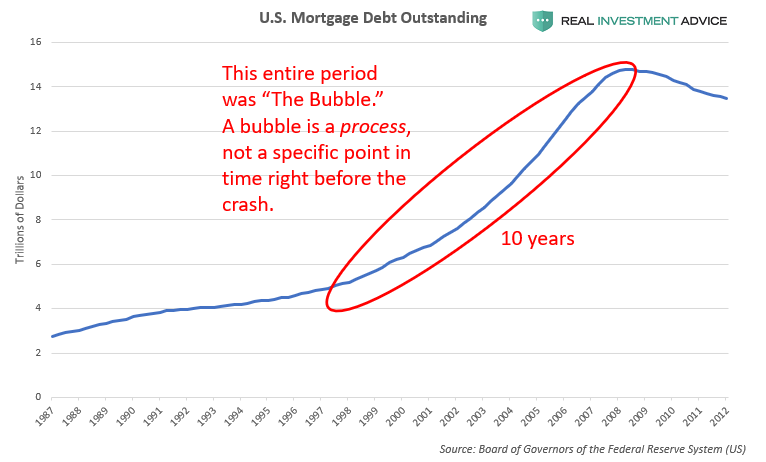

The chart of total outstanding mortgage debt shows that Americans started binging on mortgage debt in the late-1990s and using it to buy increasingly expensive homes, which is what pushed housing prices higher and higher. Those with trained eyes like Doug Noland were able to see this mortgage credit bubble developing very early on even though it took a full decade to develop. Can you imagine the frustration of being someone who was warning about this mortgage debt buildup in the early-2000s and having nobody believe you and, even worse, many thinking you’re completely crazy?!

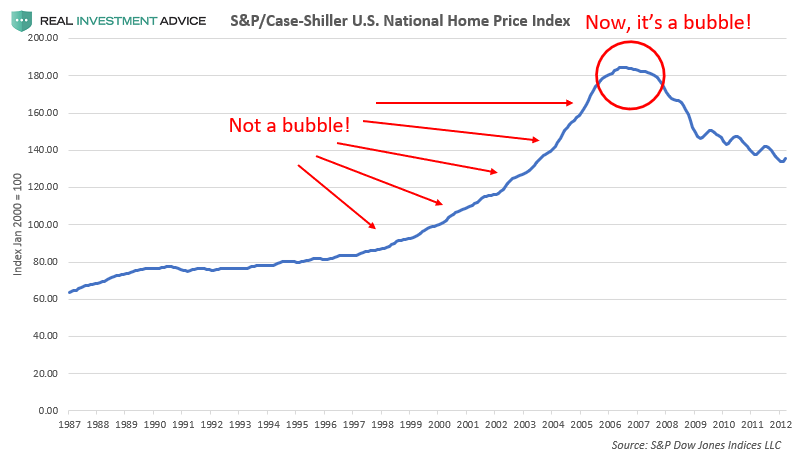

The last two charts showed how Austrian School economists think about bubbles, while the next two charts will show how mainstream economists think about bubbles. Mainstream economists see the majority of the U.S. housing price surge (from 1998 until approximately 2005) as a boom that helped to rev up the U.S. economy again after dot-com bust and September 11th attacks. In their minds, the U.S. housing bubble only became a “bubble” at the very end of the boom in 2006 and 2007 (and, even then, they only admitted that it was a bubble after it had burst, when it was too late).

Similarly, mainstream economists see the majority of the U.S. mortgage debt surge (from 1998 until approximately 2005) as a boom that helped to create jobs for mortgage brokers, bankers, etc. They believe that the mortgage boom only became a “bubble” toward the very end in 2006 and 2007.

The way mainstream economists view the development of bubbles is wrong and dangerous – end of story. It is absolutely absurd to think that the dangerous speculation, price increases, and lending activity that ultimately leads to an economic crisis only occurs at the very end of a bubble. The truth is that the buildup of risk and malinvestmentstarts at the very beginning of central bank-driven bubbles. According to this logic, the U.S. housing bubble was a “bubble” as early as 1998, 1999, 2000, and 2001. I firmly believe that. The fact that the buildup of risk and malinvestment starts so early on in a bubble explains why I believe in warning about bubbles (but not shorting!) as early as possible as an activist who is trying to prevent the human suffering that will inevitably result when that bubble bursts. Of course, you will be ridiculed, hated, and have your career sabotaged throughout that entire time that you warn about the bubble as an activist.

I have been warning about the “Everything Bubble” each year since 2011 because that is when I started to see the buildup of risk and malinvestment as a result of global central bank policies. Though I am warning about numerous bubbles around the world, I will use the chart of the U.S. stock market below to explain my early bubble warning philosophy. Simply stated, I believe that the S&P 500 stock index’s 300% rise from its 2009 low is a bubble (please read my detailed explanation about this). Though the U.S. stock market has been surging for a decade, I believe that saying it was experiencing a bubble as early as 2011 is completely accurate and rational because it is not driven by organic economic growth, but by cheap credit and central bank market meddling. In order for the stock market bubble to have become as large as it is today, it had to inflate in 2011, 2012, 2013, 2014, 2015, and so on. I believe that those early years of the current stock market bubble and “Everything Bubble” are equivalent to the housing bubble’s early years during the late-1990s and early-2000s.

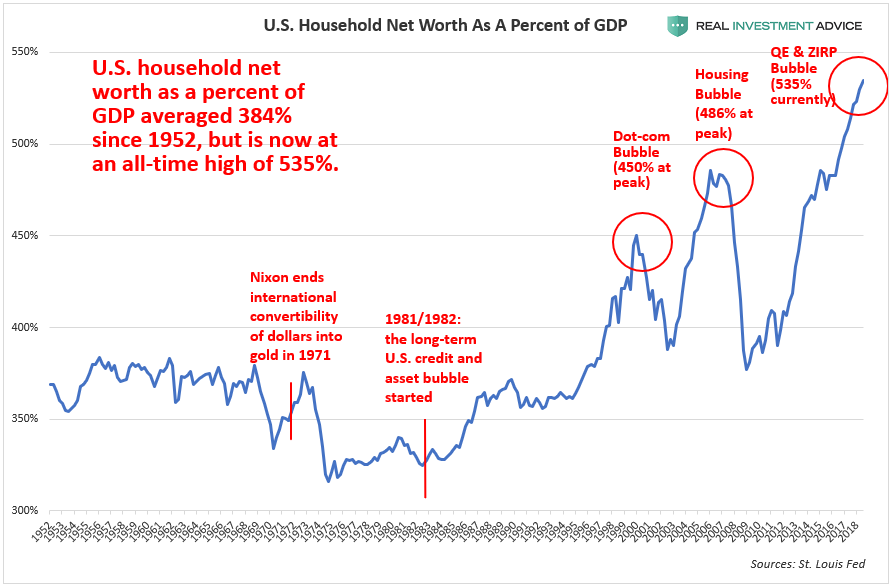

The chart of U.S. household wealth as a percent of GDP shows just how inflated asset prices (primarily stocks and bonds) have become relative to the underlying economy. Household wealth surged during the dot-com bubbles and housing bubbles, only to come crashing down again. Our current Fed-driven bubble blows the last two out of the water, and the coming coming bust will be proportional to the surge (which is a very scary thought).

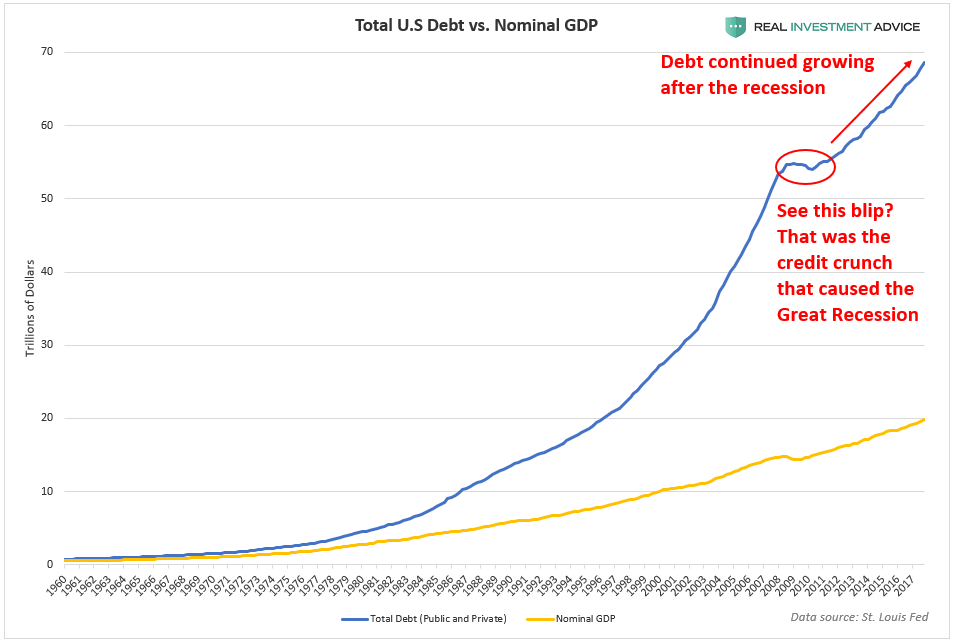

As I’ve said earlier, the only reason why the U.S. and global economy have continued to grow after the Great Recession was because we are taking on more debt and inflating new bubbles – we’re basically on the same path that we were on before 2008. According to the chart below, total U.S. debt started to grow again in the early-2010s. Someone who is concerned about another economic crisis is completely justified for warning about the resumption of the U.S. credit bubble’s growth back in 2011, 2012, and 2013, even though it didn’t immediately result in a crisis. People with high future time orientations worry about trends that are likely to cause our society problems in the future; those with low future time orientations don’t think about the long-term implications of trends – “I’m makin’ money now! Your losin’ money by worryin’” [sic].

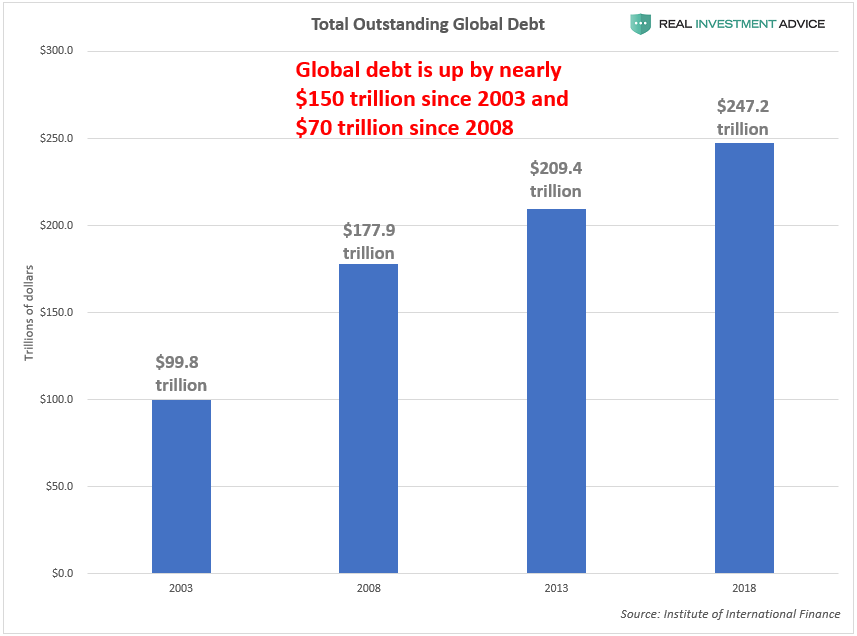

Global debt is up by nearly $150 trillion in the past 15 years and up $70 trillion since 2008. Anyone who was warning about that dangerous debt buildup each year is completely justified for doing so, in my view.It will all make sense some day when the chickens come home to roost.

To summarize, being an anti-economic bubble activist doesn’t automatically equate to “losin’ money.” We are a much more sophisticated group than we are given credit for. As proven in this piece, many of us are able to foresee powerful economic booms and bull markets well in advance simply due to our understanding of how these booms and bubbles form in fiat currency-based economies that are dominated by central banks. Though we are fully aware that shorting too early on is risky and that those bubble-driven market gains can be captured through use of trend following trading systems, we still choose to warn about bubbles for many years simply because we care about the societies we live in. Please keep that in mind next time you feel tempted to taunt a “bear.”