via Steven Hansen

Summary

- There are contrary indicators for growth of consumer credit.

- Current levels of consumer debt are at historical highs, whilst consumer debt payments are historically low (but are rising).

- The Fed’s increase in the Federal funds rate will slow economic growth – but the question is how much.

I have been saying for years that the rate of growth of consumer credit is not sustainable in the long term. Has the rate of growth begun to slow?

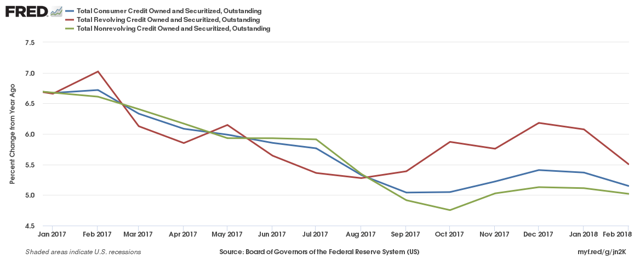

The short answer is that it is too early to tell, but it does appear consumer credit is slowing. However, it is not necessarily obvious as credit spending after the past hurricane season did cause a spike in consumer credit. The graph below shows the gentle deceleration of the rate of growth of consumer credit outstanding (blue line in graph below) over the last year:

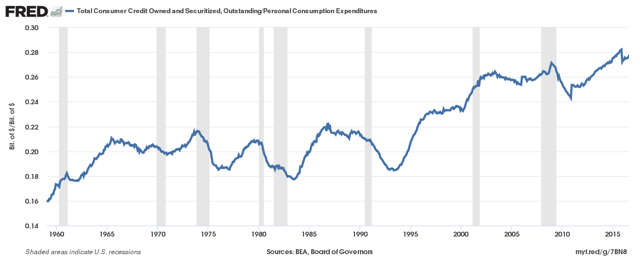

Note that consumer credit data series does not include mortgages. The graph below shows the ratio of consumer credit outstanding to consumer spending. This ratio is now near historic highs and well above the averages before the mid 1990s.

RATIO OF TOTAL CONSUMER LOANS OUTSTANDING TO CONSUMER SPENDING

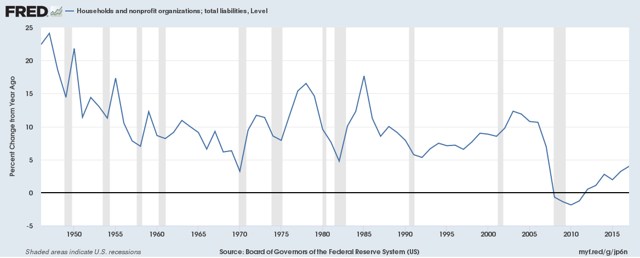

Including mortgages in the discussion of consumer credit is misleading, as most either pay money for rent or for a mortgage. Few have enough cash to buy a residence. So mortgages can be viewed as spending on accommodation for the purposes of this consumer credit. The graph below shows total credit for households is now growing but at a rate still slower than seen since 1970.

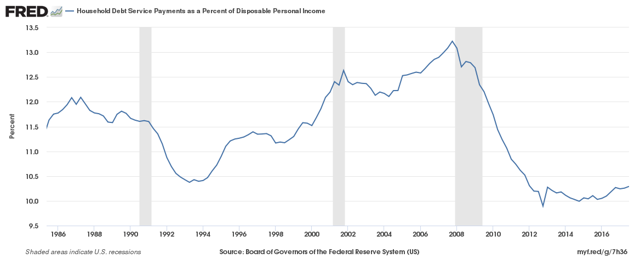

Even though debt is expanding, the counter-balance is the low interest rates which translate into low debt service payments.

Credit interest rates are now on the rise. The expenditures for debt service payments will rise. The cost of borrowing money will take a larger chunk of income. Something will give, as we are currently beginning to see a slowing of the rate of increase of consumer credit growth. For a complete analysis of the latest consumer credit data from the Federal Reserve, click here.

Will this translate into a slower growing economy? It will be a headwind, but consumer credit is just one of the forces acting on the economy.