(Bloomberg) — Explore what’s moving the global economy in the new season of the Stephanomics podcast. Subscribe via Pocket Cast or iTunes.

Despite a 50 basis point decline in the U.S. 10-year note yield since late July, the average interest rate on credit cards continues to hover close to record levels, newly released data from the Federal Reserve show.

The U.S. prime lending rate, the rate that commercial banks to charge their most credit-worthy customers, has fallen thanks to easier Fed monetary policy. But the spread between the prime rate and the average annualized rate on credit cards widened to a record at the end of August.

Many issuers have been competing for new customers with richer rewards rather than lower rates. They may also be maintaining this record spread because risks are brewing, underscored by a pickup in delinquency rates at smaller issuers of cards. Fed data show a growing gap between delinquency rates for the 100 largest banks compared with all others. Delinquent accounts for the largest banks were at 2.44% in the second quarter, while other banks saw the rate spike to 6.34% from 5.73% the prior quarter. At 3.9 percentage points, the spread between the two measures is also at an all-time high.

finance.yahoo.com/news/credit-card-delinquencies-u-rise-140003228.html

In its latest survey of U.S. teenagers, analysts at Piper Jaffray found that 32% of teens think the economy is getting worse, an increase of 7 percentage points from the fall of 2018. Piper also found that teens this fall estimate they are on track to spend $2,371 per year, the lowest estimated annual spend for teenagers in the U.S. since the fall of 2011.

finance.yahoo.com/news/teen-spending-an-8-year-low-piper-survey-morning-brief-102954979.html

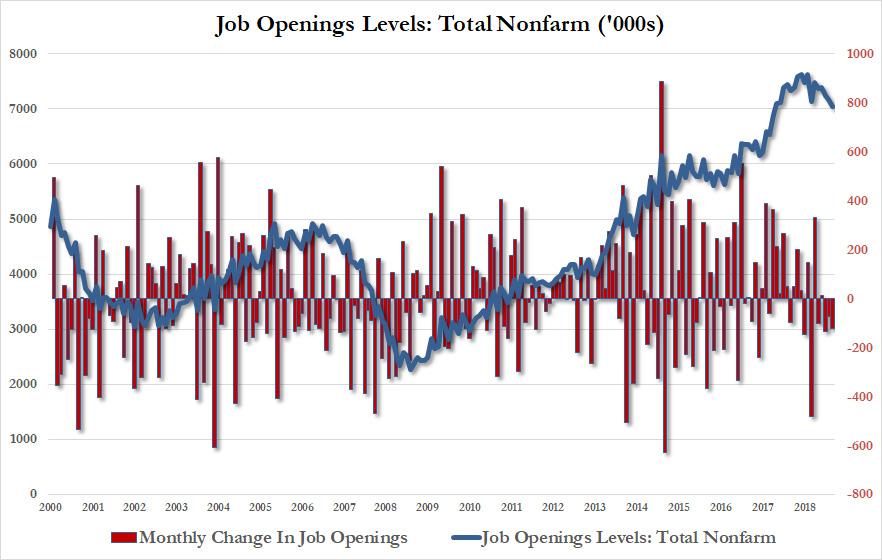

Job Openings Plunge To 17 Month Low

Just in case the last few disappointing payrolls reports weren’t sufficient to indicate that the US labor market is cooling rapidly, the latest JOLTS released today by the BLS confirmed that US workers are going through a decidedly rough patch, as the total number of job openings dropped again, sliding to 7.051 million, below the 7.250 million expected, and not only below the downward revised June print of 7.174 million (7.217 previously), but the lowest number in 17 months, since March 2018.

Slide In Hiring, Quitting Confirms Job Market Slowdown…