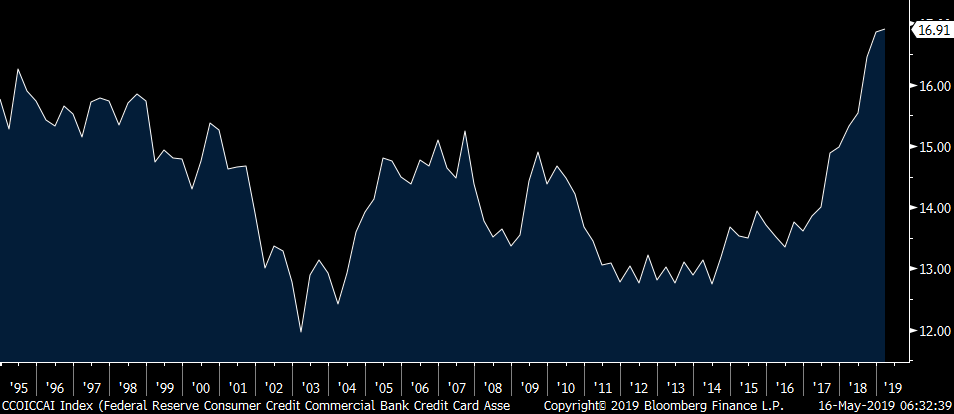

- Americans now pay their banks an average 17% interest on credit cards — the highest level recorded by the Fed.

- The rising monthly cost for U.S. consumers may be one reason they’re spending less, as April’s weak retail sales laid out. The combination doesn’t bode well for GDP growth.

- “This is key because of the obvious influence that consumers have on the overall economy,” said Peter Boockvar, Chief Investment Officer of Bleakley Advisory Group. “The trajectory is creeping up and is something that we have to watch closely.”

It costs more than ever to pay with a credit card. Consumers may be spending less as a result, which could be a drag on economic growth.

Americans now pay their banks an average 16.9% interest on credit cards — the highest level ever, according to the Federal Reserve. The skyrocketing borrowing rate does not bode well for the economic health of consumers, and therefore U.S. growth.

“This is key because of the obvious influence that consumers have on on the overall economy,” said Peter Boockvar, chief investment officer of Bleakley Advisory Group. “The trajectory is is creeping up and is something that we have to watch closely.”

With global trade slowing and worries about exports, Boockvar said the U.S. consumer has been a bright spot. Unemployment is at a 50-year lows and wages are rising. But softer-than-expected consumer spending data this week called some of that strength into question. U.S. retail sales fell 0.2% in April, the Commerce Department said Wednesday. Retail sales make up about one-third of consumer spending, which drives most economic activity.

Softness in consumer spending briefly spooked stock markets this week, which were already seesawing thanks to trade-war uncertainty. While it’s hard to quantify to what extent, Boockvar said that retail weakness could have been partially due to the high cost of credit.

“This is one of the factors that is keeping things in check,” Boockvar said. “Maybe these very high interest costs are overwhelming people’s ability to pay back. It also coincides with a decline in say the savings rate and rising gasoline prices and is something we ought to pay attention to.”

The Federal Reserve’s recent rake hikes have caused an increase in borrowing rates across the board, with credit card rates well above other forms of debt. For instance, the average 60-month auto loan rate is around 5.2% and the personal loan rate is about 10.4%, according to the Fed.

The Fed’s short-term lending rate is now targeted between 2.25% and 2.5%. However, it has gone up nine times since December 2015 and has triggered increases across the board in consumer debt instruments, due in part because it costs banks more to borrow.

Average credit card interest rates since 1994