BY

Harry Dent, a newsletter publisher who uses demographic trends to forecast market movements, believes that even before covid-19 blindsided the global economy, the US housing market was toast. From one of his recent interviews:

Baby Boomers are now dying at unprecedented rates and will continue to do so into 2040. That takes the net demand for real estate negative, so homes are never going to appreciate even in the next boom. A lot of boomers are realizing they didn’t save for retirement because they’re living in good times and didn’t think they needed to, and now they’re saying wait a minute, I don’t need my McMansion now that my kids are gone. I can sell that and instantly fund my retirement plan and then rent my retirement home.

For the first time in all of modern history the next generation has fewer peak buyers for everything than the baby boom, and in many countries it’s significantly less. Real estate will never be the same.

Millennials don’t buy as many houses or as big houses. They’ll be sharing McMansions they’ll be so cheap. Split them into duplexes because they’ll be selling for only a little more than an average home.

I don’t think real estate will ever again get to these prices.

In Japan real estate crashed b 60% and has never bounced back because their population is older than most others and there are more baby boomers dying than Millennials entering the housing market.

[The US] population is barely going to grow in coming decades. When I subtract the peak buyers age 42 from the diers age 78, net demand for real estate goes down for the next two or three decades. So there’s no way real estate’s going to go up as it has in the past. It’ll be lucky to go up at the inflation rate after this crash.

Dent’s thesis makes intuitive sense: If you’re 70 years old (as the oldest Boomers are), having more house than you need is a burden rather than a status symbol. And if your savings are inadequate (as is true for most Boomers) converting an expensive possession like a house with its taxes and upkeep into spendable cash makes financial sense.

Now add a pandemic-driven recession – possibly a deep one – and what might have otherwise been a leisurely process (“Let’s look into selling and maybe start the clean-up with a target of listing in 2021”) becomes varying shades of urgent, depending on what’s happening with a given retiree’s stock portfolio.

So the supply of homes for sale might spike rather than drift higher, sending prices lower, possibly a lot lower.

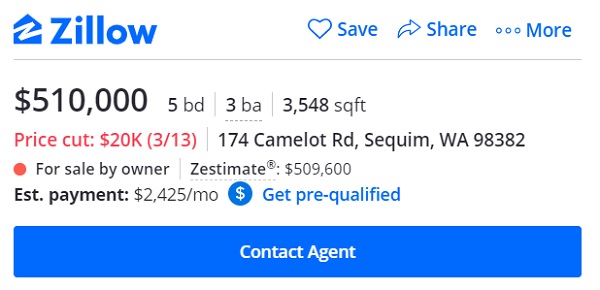

One quick way to find out whether this is happening is to track price changes on Zillow.

When reductions become big and frequent, that’s a sign that this process is gathering steam – and that the seller mindset has shifted from getting the best possible price to getting some price. Of such shifts are bear markets made.