Despite low rates and massive liquidity, global capital expenditure (investment) is falling.

There will be a say when central planners will undertsand the word "overcapacity" and stop the fallacy of stimulating a demand that has been overstimulated for years. pic.twitter.com/PVKWqoiJjn

— Daniel Lacalle (@dlacalle_IA) February 3, 2019

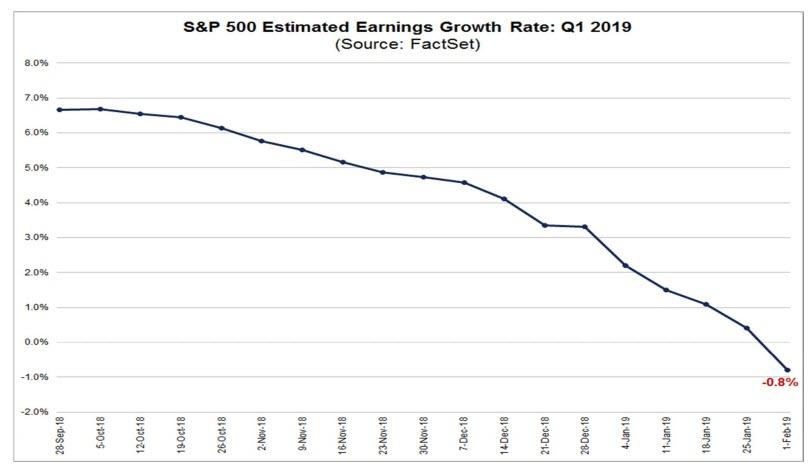

The Profit Party Is Over: Q1 Earnings Growth Crashes, Set For Biggest Drop In 3 Years

After last week’s earnings deluge, 46% of the companies in the S&P 500 have now reported actual results for Q4 2018. And according to Factset data, so far earnings season is mediocre at best with the percentage of companies reporting EPS above estimates (70%) below the 5-year average. Companies are also reporting earnings that are 3.5% above the estimates, which is also below the 5-year average. The silver lining is that in terms of revenues, the percentage of companies reporting actual revenues above estimates (62%) is above the 5-year average, and on aggregate, companies are reporting revenues that are 0.8% above the estimates, which is also above the 5-year average.

Separately, the blended year-over-year earnings growth rate for the fourth quarter is 12.4% today, which while is above the earnings growth rate of 10.9% last week, if well below the Q3 earnings growth, with positive earnings surprises reported by companies in multiple sectors – led by the Energy sector – responsible for the increase in the earnings growth rate during the week.

The recession risk over the next 12 months is now a whopping 49%. Ouch!

That is the conclusion judged by a model build on the difference between expectations vs. current conditions in the US consumer confidence data.

More in our weekly -> t.co/lywXucmv0N pic.twitter.com/pQHAOXdBvO

— AndreasStenoLarsen (@AndreasSteno) February 3, 2019

Germany is moving into recession pic.twitter.com/AoJ907AXFz

— Daniel Lacalle (@dlacalle_IA) February 3, 2019

Asset Performance: Shipping rates collapsed in January pic.twitter.com/IePBFI7PbH

— Alastair Williamson (@StockBoardAsset) February 3, 2019

S&P Leveraged Loan Index continues to flatline – need to see a turn up for equity rally to continue, otherwise, if a fade, that could pour cold water on bulls. pic.twitter.com/SZa6EFiwjG

— Alastair Williamson (@StockBoardAsset) February 3, 2019