Many investors are salivating to trade the dips in a stock market which is becoming increasingly more volatile. It’s because Wall Street for the week ended March 13th according to the headlines had its worst week since 2008. Its human nature to want to buy at fire sale prices.

March 13, 2020 headline:

“After Worst Week Since 2008, What’s Next For The Stock Market?” , Benzinga March 13, 2020

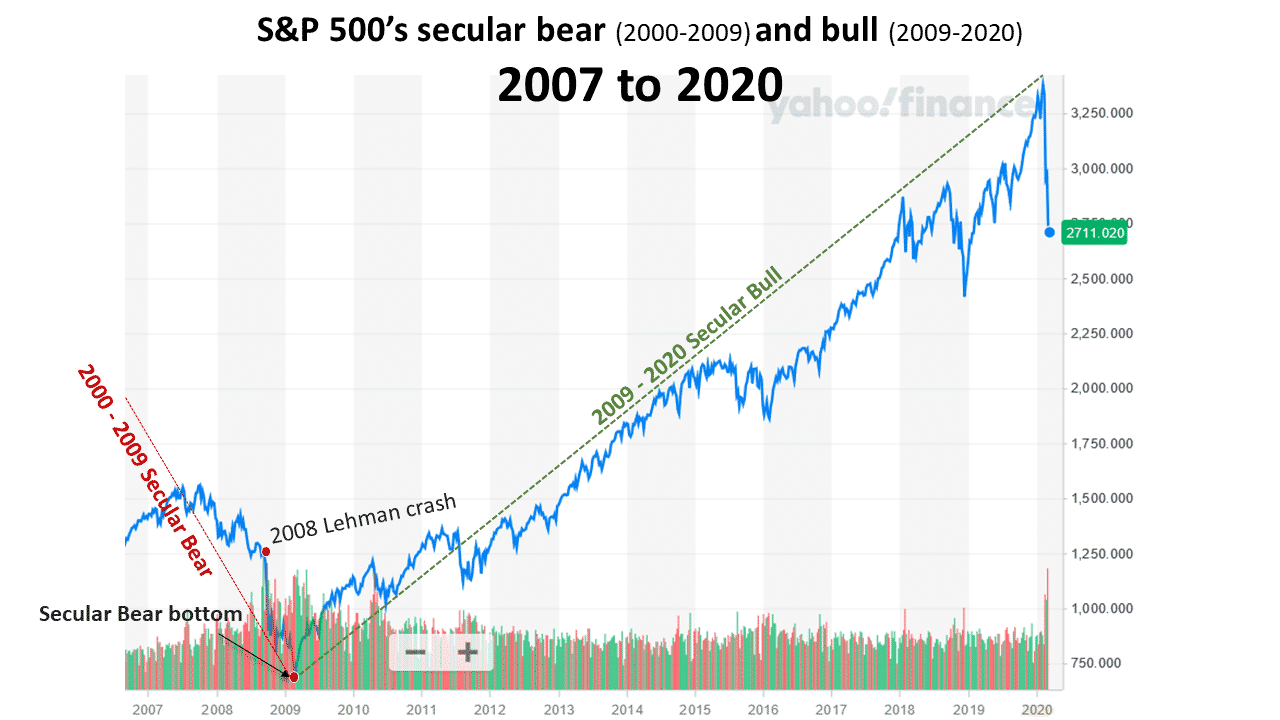

Investors became conditioned to buy the dips after the record setting 2008 crash. The S&P 500 made a quick recovery after crashing down by 40% within six months to its lowest level since 1996 after Lehman declared bankruptcy in September 2008.

Those who jumped in the last time the markets had their worst week since 2008, the week ended February 28, 2020, lost 8.2% in 10 days based on the S&P 500’s March 13th close. Secular bear markets are famous for producing one sensational headline after another as a market continues to reach new lows.

February 28, 2020 headline:

“Wall Street has worst week since 2008 as S&P 500 drops 11.5%”, Associated Press February 28, 2020

From September 12, 2008, the last market close prior to Lehman’s bankruptcy to the bottom of the 2000 to 2009 secular bear market which began in 2000 and ended on March 9, 2009:

- Passive buy and hold investors lost 39%

- bullish traders who precisely got in at all bottoms and sold at tops made 136.5%

- bearish traders who precisely sold short at all tops and bought the shares back at all bottoms made 162.3%

What likely happened due to the extreme volatility as depicted in the chart below most non-professional traders lost money. Buy and hold bargain hunters who bought during the first five months after the 2008 crash began lost a minimum of 20%. From February 9, 2009, which was five months after the decline began, to the March 9th final bottom the market declined by an additional 22%.

The table below reinforces the difficulties that anyone but a professional investor had to make money from the 2008 crash. $100 traded from September 12th to March 2009, would have declined to $74.20 at the 2000 secular bear’s final bottom.

The current market is much riskier than the 2008 market for dip buying. Instead of being at the bottom of secular bear, the chart below depicts that the S&P 500 has been in a secular bull market since 2009. In my March 5th article when the S&P 500 was 10% higher included my prediction that the secular bull likely reached its all-time high on February 19, 2020 and the secular bear began the very next day on February 20, 2020.

Based on my recent empirical research findings from analyzing prior crashes which have similar traits as the crash of 2020, the probability is high that the decline from the top to the bottom will be from 79% to 89%. The final bottom will be reached between October and December of 2022. For the rationale and empirical data which supports my crash bottom forecasts read my 2020 crash related articles.

My prediction is that the S&P 500’s secular bull market which began in March 2009 ended on February 19, 2020. The ninth secular bear since 1802 began on February 20th. Based on the peaks of the last three secular bull markets as compared to the troughs of the of the three most recent secular bears, the S&P 500 could decline by an additional 37% to 60% from its March 13, 2020 close.

The video of my “Secular Bulls & Bears: Each requires different investing strategies” workshop at the February 2020 Orlando Money Show is highly recommended. The educational video explains secular bulls and bears and includes strategies to protect assets during secular bear markets and recessions, etc.

BullsNBears.com which covers all of the emerging and declining economic and market trends is an excellent resource site. Click here to view one-minute video about the site and here for my 2020 crash updates.

A strategy to liquidate all mutual fund holdings and the majority of all stock holdings should be deployed immediately. Time is of the essence. To understand why diversification does not work and why penny and low-priced stocks should be held watch Money Show workshop video.

To maximize the liquidation amounts a registered investment advisor (RIA) who has been vetted by BullsNBears.com should be utilized. The advisor must have the expertise to technically trade the market so that higher liquidation prices can be obtained.

Since any referred RIA would be able to utilize the Bull & Bear Tracker’s signals to manage a portion of a portfolio, losses could quickly be recouped. The Bull & Bear Tracker enables professionals to produce significant profits in declining and in volatile markets. Read “February 2020, Bull & Bear Tracker’s 8th consecutive profitable month” article.