Too many investors are focusing on what the Fed is doing today. The REAL issue that matters is what the Fed did from 2008-2016.

When the Fed created a bubble in US government bonds, also called Treasuries, it was effectively creating a bubble in the risk-free rate of return for the ENTIRE financial system.

As a result of this, EVERY asset got bubbly. We’re talking about municipal debt, corporate debt, subprime mortgages and auto loans, commodities, and more.

This is why I coined the term “the Everything Bubble” in 2014. And it’s why those investors who are obsessed with stock prices today are going to get destroyed just like those who focused on stock prices (not housing) did in 2008.

Why?

The REAL problem, the one that is going to crash the markets, is occurring in the BOND/ debt space, NOT stocks.

The US Corporate bond market is larger, more leveraged, and lower quality than it has EVER been in history.

Today, over 34% of ALL corporate debt is high risk.. as in JUNK… as in there is a HIGH probability the corporation will default on it.

Put another way, over $1 out of every $3 in the corporate debt market is going to be defaulted/restructured during the next downturn.

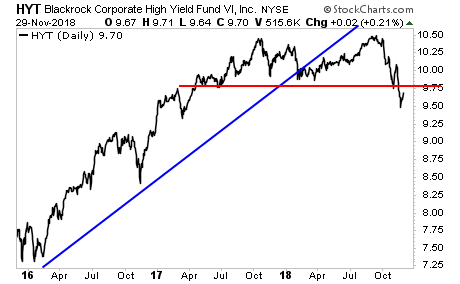

By the way, that downturn is already here. The Junk Bond markets has taken out its bull market trendline AS WELL as support. There are many ways to look at this chart… NONE of them are bullish.

As if that were not bad enough, there is compelling evidence that a significant amount of the so-called High Quality corporate market (the investment grade part) is in fact… NOT high quality at all.

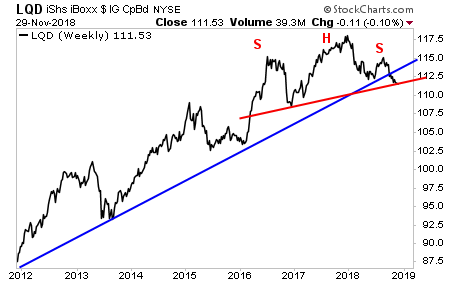

Consider that 50% of the Investment Grade (IG) bond market is rated BBB, the lowest possible credit rating within the IG space. And there is considerable evidence that much of this stuff is actually JUNK.

The Bond Market knows this too. The Investment Grade Bond market has taken out its multi-year trendline while forming a CLEAR Head and Shoulders topping pattern. Here again, there are many ways to look at this chart… NONE of them are bullish.

Again, what happens in stocks is almost irrelevant… when even the IMF expects 20% of corporates to default in the coming months, you’ve got the makings of another 2008… only this time in corporate debt, not mortgages.