QUESTION: During the WEC I came to understand Real Estate will crash. Then when looking at Socrates, it shows real estate indices, however I do not recognise these trends. First I thought they were in $, I need to translate them to euro base to recognise the trend. But no, the real estate indices in Socrates are in terms of euro already and going down, while currently prices are again going thru the roof. Can you please explain what I am missing here?

M

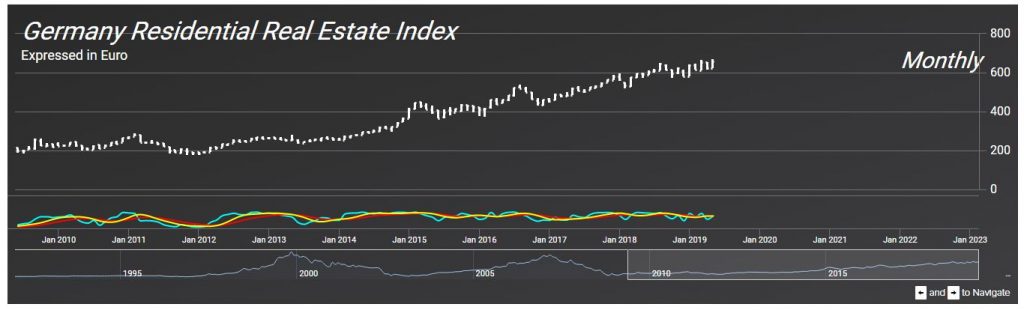

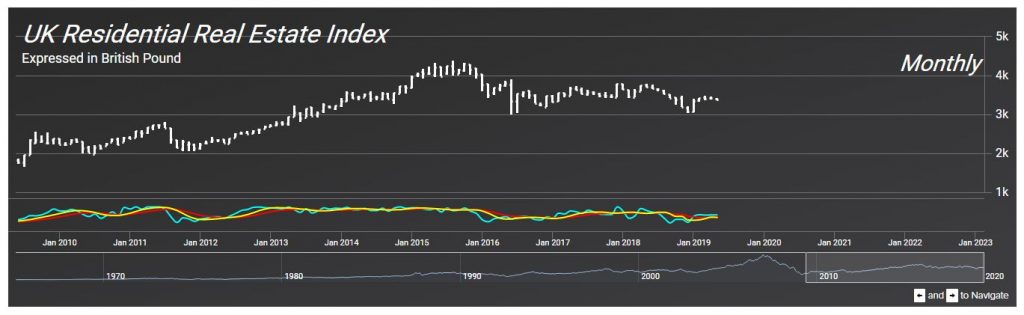

ANSWER: It all depends upon which market you are looking at. The core markets where there was a lot of speculation like Britain saw a peak in 2015 and has been declining. London is far worse. The German market was not the object of massive foreign capital inflows. They were primarily internal shifts within the Eurozone. I was in Bavaria recently and looked at houses and I thought they were cheap in comparison to the United States.

Nevertheless, the rise in the German market has been about 50% since 2015. When we look at it in dollars, the gain is about 10% less. Insofar as German real estate, it has been a peripheral market to the speculation. That means it will rise after others decline.

Keep in mind that as the currency weakens, tangible assets become the haven.