Survey: Americans Spent $1.4B on Credit Freeze Fees in Wake of Equifax Breach

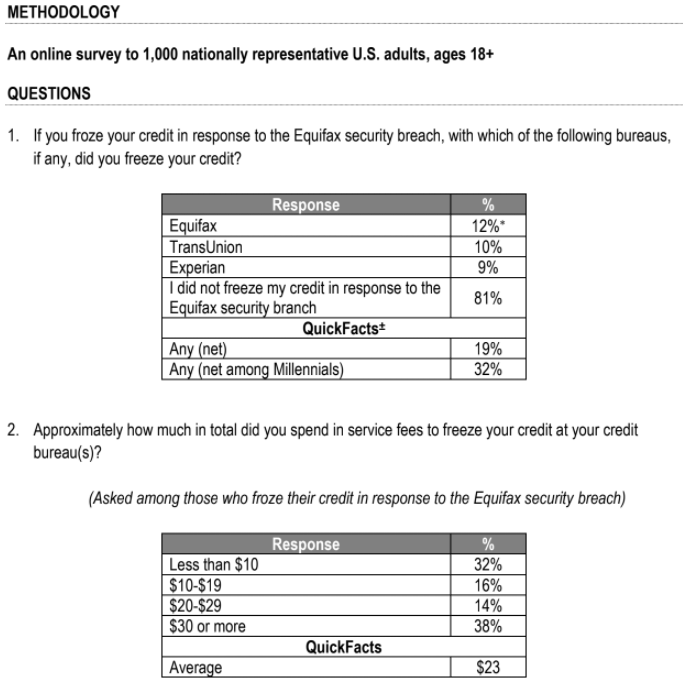

Almost 20 percent of Americans froze their credit file with one or more of the big three credit bureaus in the wake of last year’s data breach at Equifax, costing consumers an estimated $1.4 billion, according to a new study. The findings come as lawmakers in Congress are debating legislation that would make credit freezes free in every state.

The figures, commissioned by small business loan provider Fundera and conducted by Wakefield Research, surveyed some 1,000 adults in the U.S. Respondents were asked to self-report how much they spent on the freezes; 32 percent said the freezes cost them $10 or less, but 38 percent said the total cost was $30 or more. The average cost to consumers who froze their credit after the Equifax breach was $23.

A credit freeze blocks potential creditors from being able to view or “pull” your credit file, making it far more difficult for identity thieves to apply for new lines of credit in your name.

Depending on your state of residence, the cost of placing a freeze on your credit file can run between $3 and $10 per credit bureau, and in many states the bureaus also can charge fees for temporarily “thawing” and removing a freeze (according a list published by Consumers Union, residents of four states — Indiana, Maine, North Carolina, South Carolina — do not need to pay to place, thaw or lift a freeze).

Image: Wakefield Research.

MP