via Zerohedge:

While central banks have yet to lose control over the stock or bond market, an eventuality which even the world’s biggest bond manager warns is just a matter of time, they sure have lost control over what is arguably an even more important market metric: inflation expectations.

Take the euro-area, where despite years of NIRP, QE and corporate bond purchases, inflation expectations have slumped to a record low, adding pressure on the ECB to step up policy support for the region’s economy, even though it was the ECB’s “policy support” ever since the arrival of Mario Draghi, that has led the continent’s inflation expectations to this dismal state.

Five-year forward five-year inflation swaps, a measure of expectations for price increases in coming years, dropped on Friday to 1.1385%, far below the ECB’s target of 2%.

“Draghi is probably not very satisfied with 5y5y ILS hitting a fresh record low,” a snide Christoph Rieger, head of fixed-rate strategy at Commerzbank, said earlier this week.

Inflation expectations have collapsed even as money-markets have already priced in that the ECB will lower its benchmark rates by a further 10 bps to -0.5% by June 2020, while European yield curves have flattened on speculation the monetary authority could resume debt purchases as early as next year.

That means two things i) the ECB will have to take even more aggressive steps to revive inflation, such as restarting bond buying, or potentially even cutting interest rates deeper into negative, or 2) the market has lost credibility in the ECB’s “unconventional” measures, and after giving Draghi the benefit of the doubt after his famous “whatever it takes” speech in 2012, no longer trusts that inflation can ever rebound. This has disastrous consequences for the European bond market which is now pricing in deflation as far as the eye can see, and with European rates already negative, the only option before the ECB, and Draghi’s successor, is to push rates even more negative or start buying up equities and perhaps physical assets.

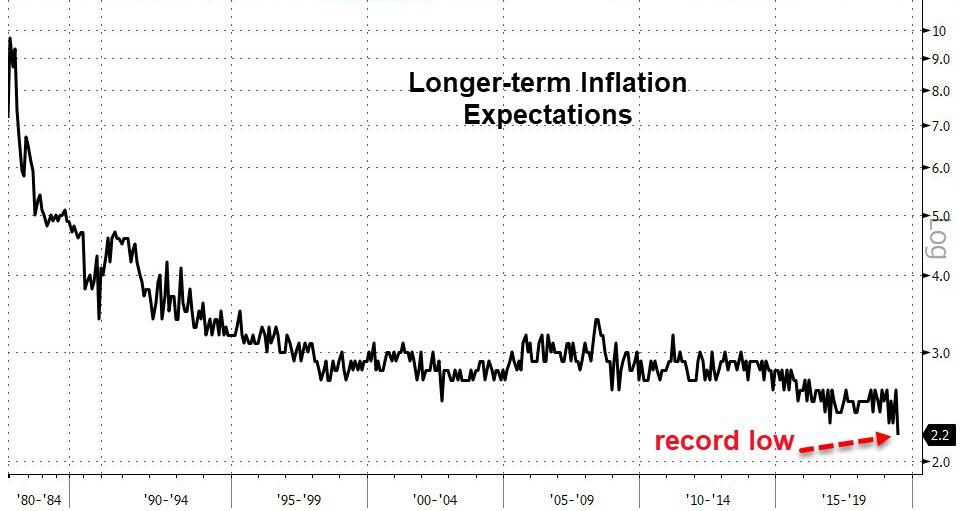

But wait there’s more, because it’s not just the ECB: in today’s UMich consumer confidence report, consumer expectations for long-term (5-10) inflation also dropped to a fresh all time low of 2.4%, hinting that the Fed too is on the verge of losing the war against unanchored inflation expectations. The good news is that this thesis will be tried and tested in the coming months, as the market is now certain the Fed will resume an easing cycle shortly. The far bigger problem is what happens if the Fed does cut – and/or restart QE – and inflation expectations fail to rebound.

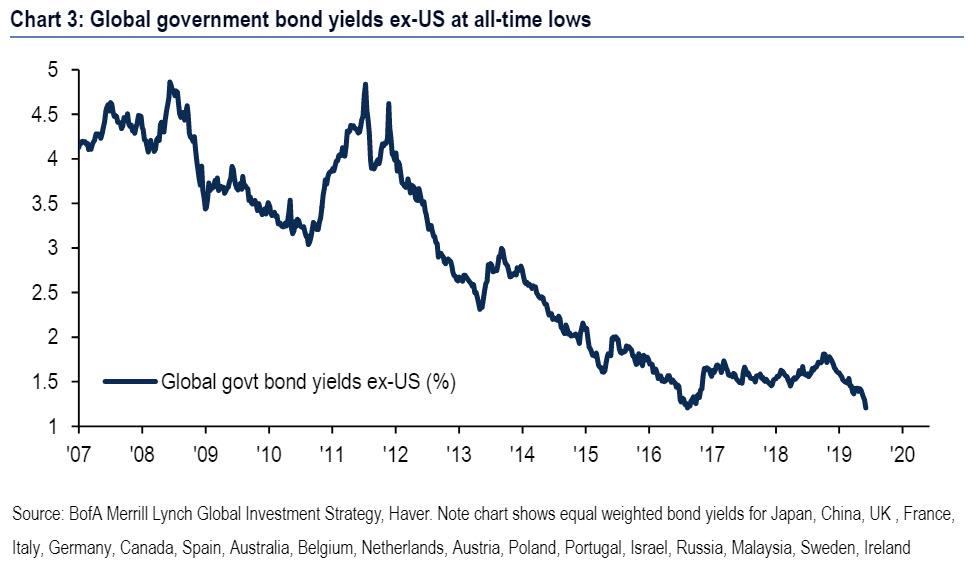

The silver lining in all this: at least US rates remain one of the highest in the world, with the 30Y US Treasury yielding about 2.6%.

But wait there’s more. Because while the Fed may still have control over the bond market, which despite inverting on various part of the curve, is still upward sloping from the short end through the 30Y tenor, other central banks are not as lucky, and as the following BofA chart shows, the average yield on global bonds (excluding the US) is now the lowest on record.

To all this one could counter – well, fine, but stocks are bonds are both at all time highs, so what if inflation expectations have become unanchored? The answer: loss of confidence always start somewhere, in this case with one of the more trivial aspects of central bank policy implementation (and purists will argue that inflation expectations are the most important charge of central banks). Once credibility is lost in one place, very soon the market will test to see just how stable the entire house of cards is. And if Pimco is right, it won’t like the answer.