via UPFINA:

On Twitter we had a conversation with the viral @StockCats on how overheated the stock market is, where stocks have moved up too fast and sentiment is too high. On the one hand, stocks have had a remarkable year. On the other hand, many of the bears are more confident than ever in their recession calls. Skepticism is great for bull markets, although, to be clear, the data needs to prove the skeptics wrong or else stocks will fall. Obviously, sentiment isn’t everything. That’s why the discussion of how overheated the market is starts off this article, rather than making up its entirety.

One great measurement of the size and scope of rallies is the percentage of stocks in the S&P 500 above their 50 day moving average. As you can see, 78.2% of stocks are above their 50 day moving average which is much higher than the low late last year and slightly below the high this February.

room to run? pic.twitter.com/8OST7dk87l

— StockCats (@StockCats) July 11, 2019

This indicator was a great bottom signal in December, but it wasn’t a great top signal this year since the percentage was elevated in February and the correction was in May. Similar to this index, the CNN fear and greed index shows there is some overvaluation in the market, but it’s not the highest of the year. The index is at 58 out of 100 which signals greed.

Economic Surprise Index Differs From Stocks

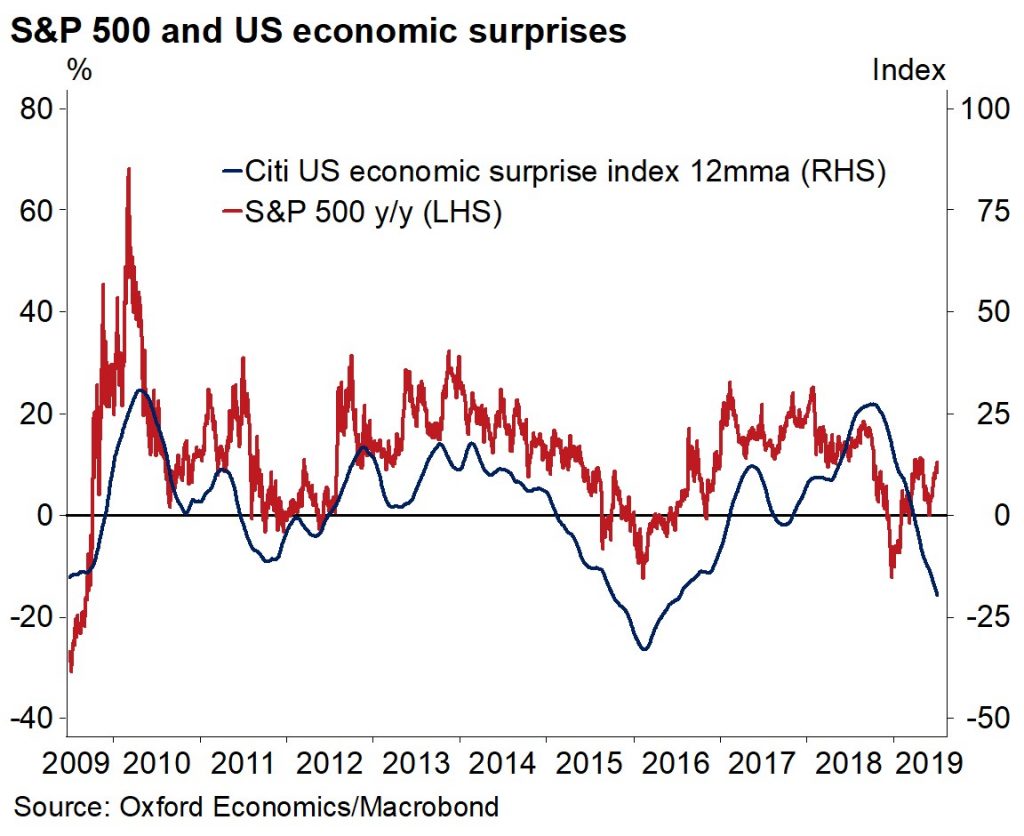

The US economic surprise index and the S&P 500 seem to act independently, but Oxford Economics found a correlation. Specifically, since the start of the expansion, the 12 month moving average of the U.S. surprise index and the yearly change in the S&P 500 have tracked each other up until recently.

The S&P 500 has obviously been rallying and economic reports have been missing estimates. Recently, job openings, small business sentiment, the ISM non-manufacturing PMI, and the ADP report have missed estimates. The BLS employment reading and the ISM manufacturing PMI beat estimates. Clearly, economists aren’t fully on board with the slowdown happening. They should be because the Q2 GDP report will likely show weakness as the median growth estimate is 1.7%.

Powell’s Testimony Keyword: Crosscurrents

Wednesday was a big day for monetary policy because Powell gave a testimony to the House financial services committee and the Fed’s June Minutes came out. Powell ended up telling us what the Minutes were going to say a few hours early. The two were consistent which is useful because it means the solid BLS report and the latest news that America and China are restarting trade negotiations (which seems to be already reversing) haven’t caused the Fed to change its mind.

There always seems to be one word or phrase that defines the Fed’s thinking. Usually, it’s a unique terminology that sums everything up. In late 2018, the term was ‘autopilot’, which caused a big decline in stocks. The term earlier this year was ‘patience’ which ended up being incorrect because the Fed is about to cut rates in July. That’s not much patience. The Fed stated it would be patient “for some time” in May. Apparently, some time is just over 2 months.

The keyword in Powell’s testimony was ‘crosscurrents’. He stated, “Inflation has been running below the Federal Open Market Committee’s (FOMC) symmetric 2 percent objective, and crosscurrents, such as trade tensions and concerns about global growth, have been weighing on economic activity and the outlook.” The Fed is cutting rates in July because inflation is below its target and falling, global growth is weakening, and the trade war is creating uncertainty.