via GreekFire23:

via Jesse Felder:

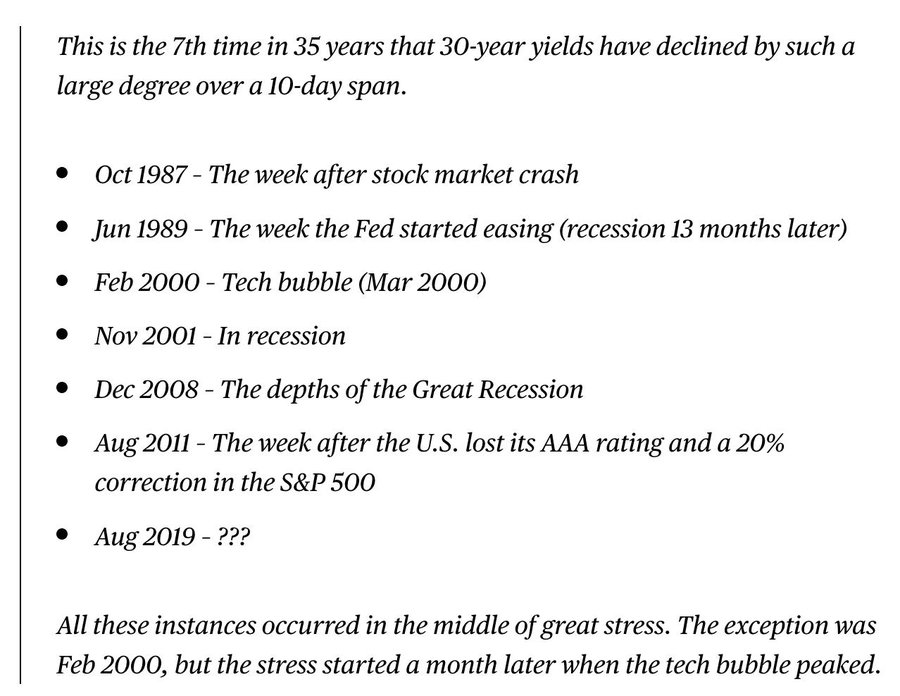

‘This is the 7th time in 35 years that 30-year yields have declined by such a large degree over a 10-day span. All these instances occurred in the middle of great stress.’ bloomberg.com/opinion/articl

via Eric Basmajian:

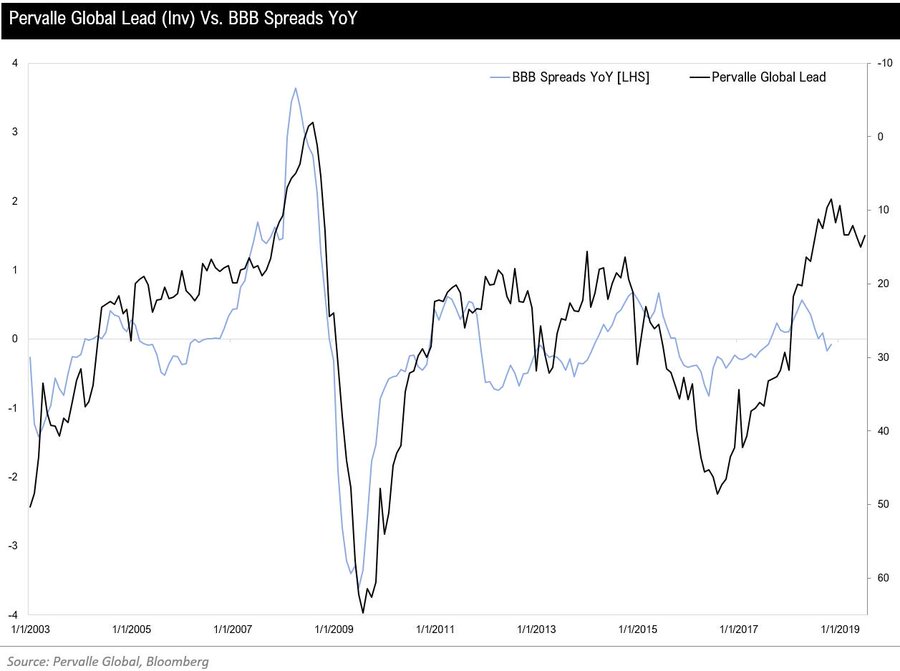

Here is our long lead (inv) vs. BBB spreads YoY. It is indicating that BBB spreads should be 100-160 bps wider by December.

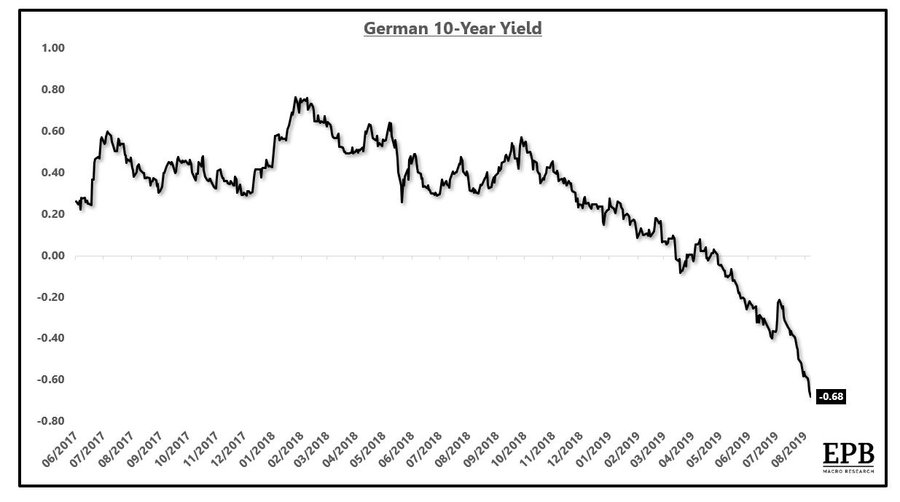

As the US 30-year yield hits a new record low of 1.97%, German 10s are also hitting a new low of -0.68%

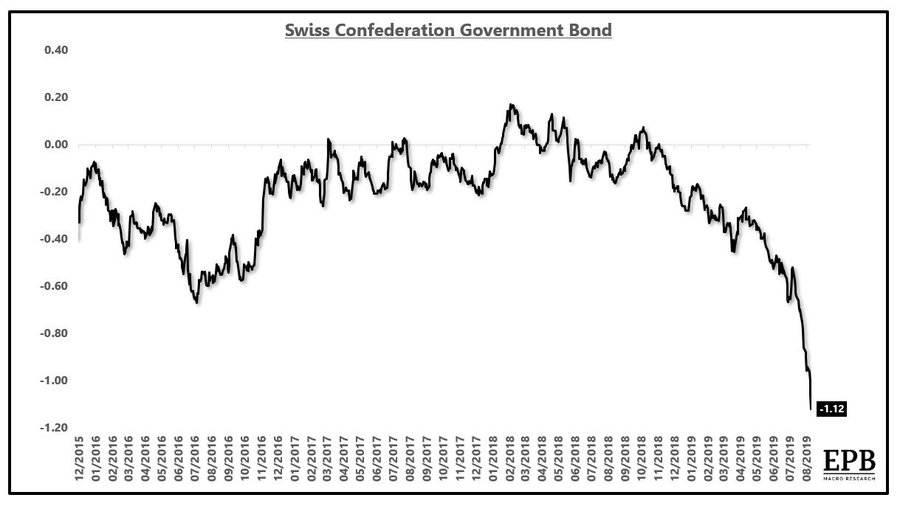

Swiss 10-year falls to -1.12%

John Burbank on Tech 2000, Financials 2007

“In markets, price is really just a balancing of liquidity, it’s NOT the proper discounting of the future. The question is, where is liquidity now, RELATIVE to where it’s going to be.”

July 2018

10-Year Treasury Yield Falls to Three-Year Low Below 1.5%

10-year rate declines to record low. The historic drop in long-term U.S. bond yields comes shortly after interest rates on the closely watched 10-year and 2-year Treasurys inverted.

Mexico Cuts Rate for First Time in 5 Years as Economy Staggers

Mexico’s central bank reduced borrowing costs for the first time in five years after inflation slowed, the economy faltered and the U.S. cut its own rate.