The Fed continues to push the narrative that inflation is transitory.

On one level, Fed officials are correct. Everything is transitory. But the Fed isn’t being philosophical here…it’s attempting to argue that they don’t need to do anything, and the current wave of inflation will naturally dissipate.

I know, this is ridiculous. But the Fed is so desperate to maintain its $120 billion per month money printing scheme, that it must come up with ridiculous excuses.

First it tried Climate Change, but since it’s not clear how printing money fixes the weather, they’ve shifted gears to claiming inflation isn’t an issue and will go away on its own.

Why do this?

Well, it’s difficult to claim that printing $1.4 TRILLION per year is a benign enterprise when the cost of living is rising by double digits. And so we end up with ridiculous situations in which Fed officials are forced to make foolish claims such as their biggest concern is that we won’t have enough inflation.

I’m not kidding.

Yesterday, Chicago Fed President Charles Evans stated the following whopper: “I am more uneasy about us not generating enough inflation in 2023 and 2024 than the possibility that we will be living with too much.”

It’d be hilarious if it wasn’t causing so much suffering for everyday Americans. Anyone who’s been to the grocery store or filled up their cars at the gas station knows this is bunk.

The same goes for anyone who is paying attention to what the markets are actually saying. If you turn off the news and simply focus on the charts, it’s clear the market is SCREAMING “inflation!”

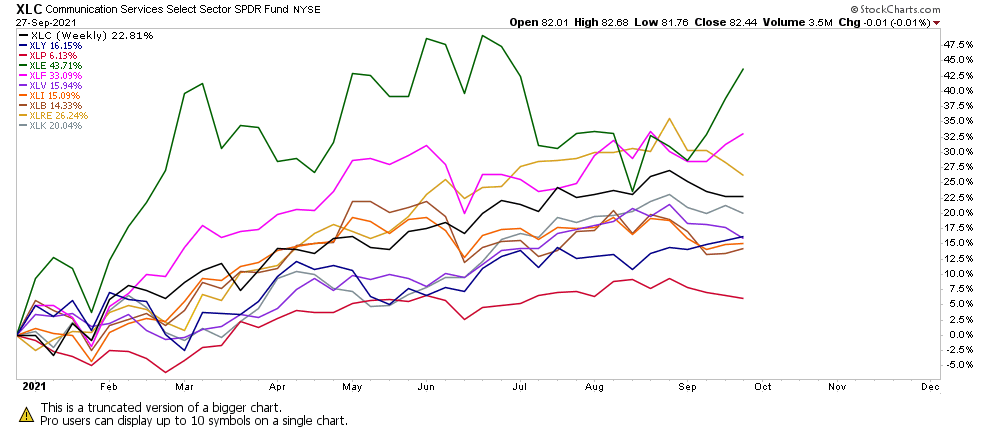

The top performing asset classes this year are Energy (XLE), Financials (XLF) and Real Estate (XLRE). They are up 43%, 33% and 26%, respectively.

These are all inflation plays.

Energy and real estate are obvious. And Financials rally when yields rise (and yields are rising due to inflation). Heck, even Goldman Sachs has figured this out and is warning its private clients about a commodities super-cycle courtesy of an inflationary storm.

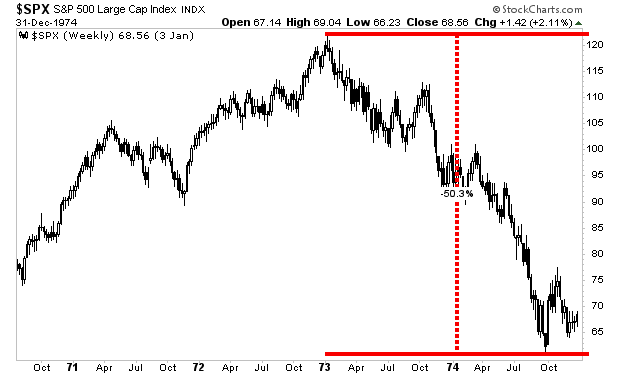

If you think this will be great news for the stock market, think again. During the last major bout of inflation in the 1970s, stocks collapsed some 50%. Even worse, they finished the decade DOWN.

Put another way, a crash is coming. The big question is, “WHEN?”

To figure this out, I rely on certain key signals that flash before every market crash.

I detail them, along with what they’re currently saying about the market today in a Special Investment Report How to Predict a Crash.

To pick up a free copy, swing by

phoenixcapitalmarketing.com/predictcrash.html

Best Regards