This week so far has brought is up to date with the economic state of play in Italy, so let us open with this morning’s official release.

In the fourth quarter of 2020 the seasonally and calendar adjusted, chained volume measure of Gross

Domestic Product (GDP) decreased by 2 per cent with respect to the previous quarter and by 6.6 per cent

over the same quarter of previous year.

Some parts of the Euro area have managed to escape much of an end of year downturn but sadly not Italy. Also the detail is of a widespread decline.

The quarter on quarter change is the result of a decrease of value added in all main economic sectors, i.e.

agriculture, forestry and fishing, industry and services. From the demand side, there is a negative

contribution by both the domestic component (gross of change in inventories) and the net export

component.

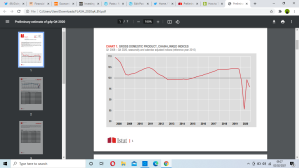

In fact the annual comparison is flattered a little by the fact that the end of 2019 saw a quarterly decline of 0.4%. This reminds us of our “Girlfriend in a Coma” theme highlighted by the chart below.

As you can see from the screen shot our theme was established because Italy’s economy never recovered from the impact of the credit crunch. There was a nascent recovery in 2010 and 11 but that was torpedoed by the Euro area crisis. This was followed by a period of stagnation before what has become known as the Euro area boom around 2017/18. For Italy that was essentially 2017 with quarterly growth of 0.4% or 0.5% and an annual rate of growth which peaked at 1.9%. After that the next two years saw quarterly growth if you add them up of 0.2%, so Italy had returned to stagnation at best and maybe worse as we note the -0.4% at the end of 2019.

Looking Ahead

If we now move forwards the OECD is producing a weekly tracker that up to the 23rd of January has the GDP of Italy some 9.1% below a year before. So more grim news although we do get some relief from the Markit PMI business survey.

Italy’s manufacturing recovery continued into 2021, according to the latest PMI® data, with conditions improving at the sharpest rate since March 2018. Output growth was the fastest for three months, while the upturn in inflows of new work quickened to a solid pace.

Indeed according to the PMI there is hope for the rest of this year.

“Goods producers remained confident of higher output

over the coming year during January, and indeed the

manufacturing sector remains in relatively good stead

as we enter 2021, with the recovery gathering further

momentum in spite of ‘red zone’ restrictions in some

areas.”

There is something of a curiosity in at least part of the cause.

Gains in sales also came from abroad during the first month of 2021, as new export orders rose for the fourth time in five months and solidly, amid reports of stronger demand from both Europe and north America.

Italy does in general trade well if I may put it like that.Some of it is due to tourism to a delightful country but there is more to it than that as the data below shows.

In 2020 the trade balance with non-EU27 countries registered a surplus of 57,036 million euro compared to

the surplus of 52,339 million euro in 2019; excluding energy, the surplus was equal to 79,542 million euro,

down compared with a 90,427 million euro surplus in 2019.

That is just the trade balance for goods but economics 101 would project strong GDP numbers from this.The problem is that the apparently competitive country never grows much and in fact has shrunk in the credit crunch era.

The Labour Market

Here again the PMI was hopeful for manufacturing.

Meanwhile, firms continued to take on additional staff into

January, with the latest rise in employment attributed to a

surge in sales. The rate of job creation was unchanged from

December’s 29-month high and moderate.

But that has not been backed up by the wider economy as yesterday’s official release showed.

On a monthly basis, the decrease of employment (-0.4%, -101 thousand) concerned women and all age

classes, with the exception of over50 people, while men were substantially stable. Overall, the

employment rate dropped to 58.0% (-0.2 p.p.).

This meant that employment was lower than a year ago.

Compared to December 2019, employment showed a decrease in terms of figures (-1.9%, -444 thousand)

and rate (-0.9 percentage points).

Actually the decline began pre pandemic as the employment level peaked at 23.4 million in the summer of 2019 and then started to fall which the pandemic accelerated. Now it is falling again and has slipped below 22.9 million.With the various furlough schemes the trend is more important than the absolute number at the moment.

Switching to unemployment we learn little from the absolute numbers for the reasons I have discussed before. But it does appear to be rising again.

In the last month, the number of unemployed people returned to grow (+1.5%, +34 thousand) and the

increase was generalized for both genders and all ages: only among people aged 15-24 years a decrease

was registered. The unemployment rate rose to 9.0% (+0.2 p.p.) and the youth rate to 29.7% (+0.3 p.p.).

Also I note that in spite of the various schemes youth unemployment is recorded at around 30%. If trade shows the good side of the Italian economy then youth unemployment shows the bad side.

Social Media

After all the hard data above I am sure you were all wondering, what does Twitter think? Well do not worry as the Italian Statistical Office has been on the case.

On average, this procedure elaborates through sentiment analysis techniques about 58,000 tweets per day……..The first three weeks of November saw an upturn in the trend, followed by a more marked downturn that continued until Christmas. The month of December then closed with a stabilization of the trend.

Round and Round we go

Andrea Orcel is on his way to being the next CEO of Unicredit and is described as a “master deal maker” by Bloomberg.What deals did he do?

As global head of Merrill Lynch’s financial institutions team and later global origination, Orcel advised Britain’s Royal Bank of Scotland, Santander and Belgium’s Fortis in the ruinous 71 billion euro ($86 billion) takeover of ABN Amro.

RBS and Fortis were both later nationalised, with the deal in part blamed for their fate as the financial crisis brought banks across the region to their knees. ( Reuters)

Yes an absolute disaster. But wait there is more.

Before that deal closed, Orcel advised Monte dei Paschi on buying ABN Amro’s Italian business Antonveneta from Santander. The Tuscan bank paid 9 billion euros, even though Antonveneta had been valued at about 6.6 billion euros in the broader ABN Amro deal just months before.

Monte dei Paschi later admitted it had done no due diligence. ( Reuters)

Monte dei Paschi collapsed as a result of this but Andrea.

The following year, as Europe’s banks battled to survive the crisis, Orcel received a bonus of some $33.8 million.

This is classic Yes Prime Minster stuff with an Italian twist. In any sane world he would never get a job in banking again. In reality I expect him to absorb Monte dei Paschi into Unicredit and to be a “safe pair of hands” for the state. After all he has skin in that particular game.

Comment

The last section is I think revealing as to why the Italian economy has struggled so much. The same old crew run the banking sector in spite of the fact that it goes from bad to worse.You might reasonably think that even Monte dei Paschi cannot get worse and then something like this pops up again.

To be able to cut its 64% stake in MPS, Italy still needs to find a solution for the 5 billion euros in residual risks……..

If that plan doesn’t work, the government would revert to a previous scheme where the legal risk itself would be spun off to another, unspecified entity, a source said.

Actually I thought it was 10 billion Euros. Also do not forget that the legal structure for the banking system is call the (Mario) “Draghi Laws”.

Returning to the real economy the collective economic decline is worse on an individual basis. The population grew by around 1.1 million between 2010 and 2020.