by Daniel Carter

About a month and a half ago, I wrote an article that predicted a strong rally in stock prices. I reminded readers again in this article once the setup became clearer. Since my initial prediction, the S&P 500 has rallied about 5% and may push even higher. However, I am now beginning to reduce my position in stocks as global risks begin to overshadow recent economic growth.

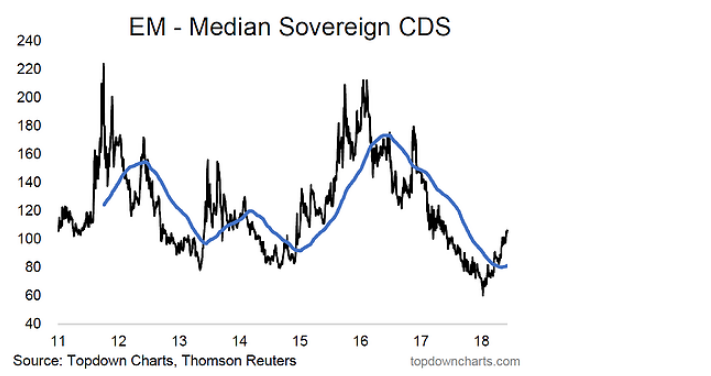

A rise to new all-time highs for the S&P 500 would not be a huge surprise, but the downside is looking larger every day. Let’s look at Emerging Markets for a clue of what might come for US markets. The premium for Emerging Market Credit Default Swaps (CDS), which measures the risk of default, has risen sharply this year.

As you can see from the chart, a sharp rise in CDS premiums also took place before the corrections of 2011, 2015 and 2016. Could we be in for another big drop in stock prices? Emerging Market stocks may already be leading the way. You can now see a large divergence between EM stocks and the S&P 500 in the chart below.

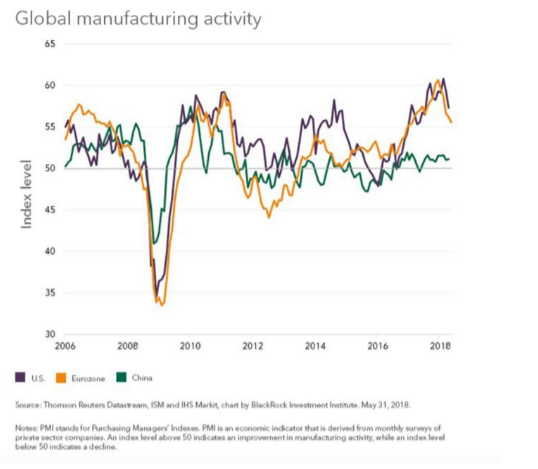

Growth in other parts of the world seems to be slowing as well. It appears that manufacturing activity for Europe and the US peaked during the early part of 2018. We saw a similar peak before the Great Recession of 08-09.

Although global growth is slowing, the Federal Reserve and the European Central Bank (ECB) don’t appear to be planning on injecting any more liquidity into markets. This week, the Fed raised interest rates and the ECB ended its stimulus program. The Fed also continues to shrink its enormous balance sheet, which you can see below. All these actions will eventually put a dent in stock prices.

fred.stlouisfed.org/graph/?g=kb0K

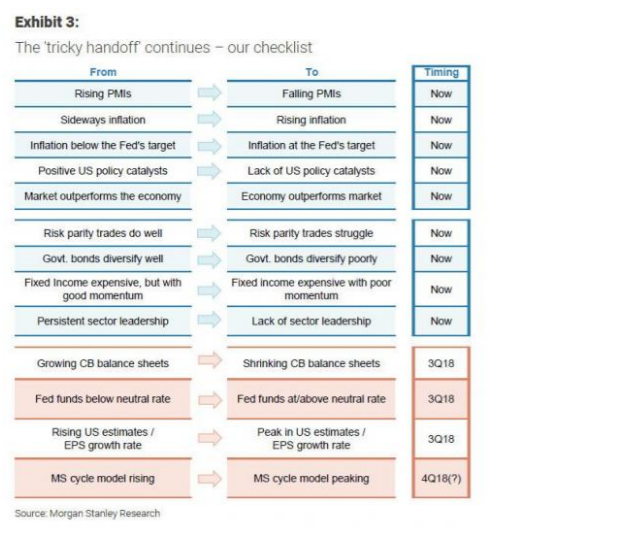

Morgan Stanely has come up with a checklist to determine how close we are to the end of the economic cycle. As you can see from list below, the economy is setup for a contraction soon. And this list does not even consider the intensifying trade war between the US, China and many other nations.

A month and a half ago, the market was set up for a nice bounce, so I took advantage of it. However, now, it’s becoming harder to justify current price levels due to rising risk. I would not be surprised if we pushed to new all-time highs, but I don’t see much upside beyond that point. It’s time to be cautious and reduce stock positions. Please do your own research and/or consult with a financial professional if you are considering making major changes to your portfolio.