by jessefelder

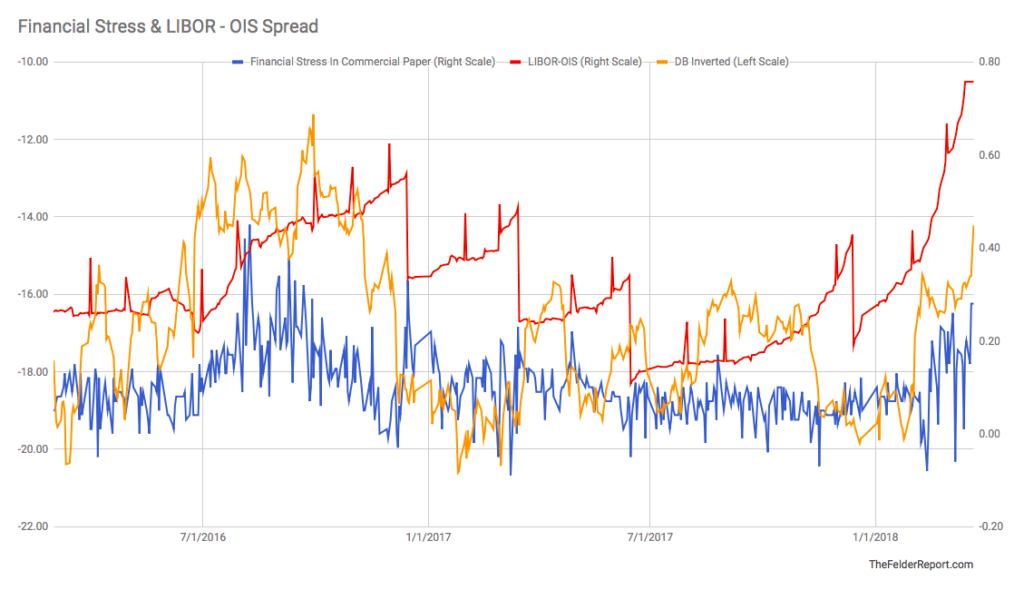

Many have noted recently that the spread between 3-month LIBOR and the overnight interbank lending rate has now risen to the highest level since the financial crisis, typically a sign of rising financial stress. At the same time, many have noted that this time there are other dynamics at work that suggest the rise is not due to increased financial stress but simple technical factors like the liquidation of commercial paper as part of the repatriation of overseas funds on the part of large American companies.

Still, it’s not just the LIBOR-OIS spread that is potentially pointing to rising financial stress. The relative stress in financial commercial paper as compared to non-financial commercial paper has also been rising in concert with this indicator. In addition, the share price of Deutsche Bank, which carries the largest derivatives portfolio on the planet, has also been faltering again. Put these three together and the message becomes much more difficult to ignore.

Now this is not to say that financial stress is rising to the point of triggering another crisis. However, as Bloomberg pointed our recently, there are $350 trillion of financial products and loans linked to LIBOR. These include leveraged loans, interest rate swaps and some mortgages. Perhaps this is also why spreads are widening again as rapidly rising funding costs inevitably create a strain in these areas. And to dismiss all of these signs seems a bit too pollyannaish.