via Bloomberg:

hat just happened? I last wrote one of these newsletters on Dec. 20, the day after the last Federal Reserve monetary meeting. (More on my disappearance later in this commentary.) Since that date, stocks have staged a spectacular decline worldwide, accompanied by an equally spectacular rally in government bonds that has pushed yields lower. However, there has been an emphatic bounce in stocks, bond yields and the price of oil that was only briefly interrupted by Apple Inc.’s disappointing announcement that iPhone sales had fallen below projections.

Nevertheless, the reversal in markets was given extra fuel on Friday, when the monthly U.S. employment report came in stronger than forecast and Fed Chairman Jerome Powell made remarks at a panel that were widely — and in my view correctly — seen as an attempt to walk back some hawkish comments he made on Dec. 19 as the central bank raised interest rates for the fourth time in 2018.

It would be absurd to claim that the Fed had nothing to do with the market ructions of the last few weeks. What the Fed does and says is always of paramount importance to markets, and it was plain that Powell’s comments on Dec. 19 about continuing to reduce the size of the Fed’s balance sheet assets despite the market turbulence — and, thus, at the margin reducing the demand for bonds and riskier financial assets — had come as a nasty surprise for many.

But we cannot attribute all of this to some botched communications by a Fed chairman who has still not completed his first year in the job. The December sell-off began after Powell had given a notably dovish speech in New York, which was interpreted as such at the time. And it is not as though the world’s markets have all obediently returned to their levels of the morning of Dec. 19. Rather, if you want to view it as just a huge but necessary and healthy correction, there is a surprising amount of evidence on your side. First, the epicenter of this correction was plainly the U.S. This is how the S&P 500 has fared compared to MSCI’s index for the rest of the world this decade:

The U.S. plainly finds itself as the driving force for the world economy at the moment, but there are limits to how long this can last. Even after the sharp correction relative to the rest of the world, the worst it has suffered since 2011, U.S. stocks have still outpaced their global peers by more than 100 percent this decade. This correction could have further to go — and the December Federal Open Market Committee meeting may have provided a catalyst for people to realize that the U.S. is in a Catch-22. Either its economy can continue to expand while others stagnate, in which case the Fed will have to tighten monetary policy further and really spoil things for investors, or it cannot, in which case stocks are still too expensive.

This is also one of those rare times when emerging markets have managed to outperform the developed world even as developed-world stock markets are falling. Almost invariably, healthy conditions in the developed world have in the past been a necessary condition for emerging markets to outperform. Going back to 2000, as this chart shows, the last month has seen the strongest performance for emerging markets when developed markets are weak:

What explains this? The hawkish Dec. 19 FOMC meeting should have damaged emerging-market assets. Higher U.S. bond yields and a stronger dollar have a well-documented tendency to inflict pain as well. This looks like a correction where investors simply grasped that their bet on a resurgent U.S. while everyone else had suffered had gone beyond the bounds of logic. The charts suggest there is room for this correction to continue.

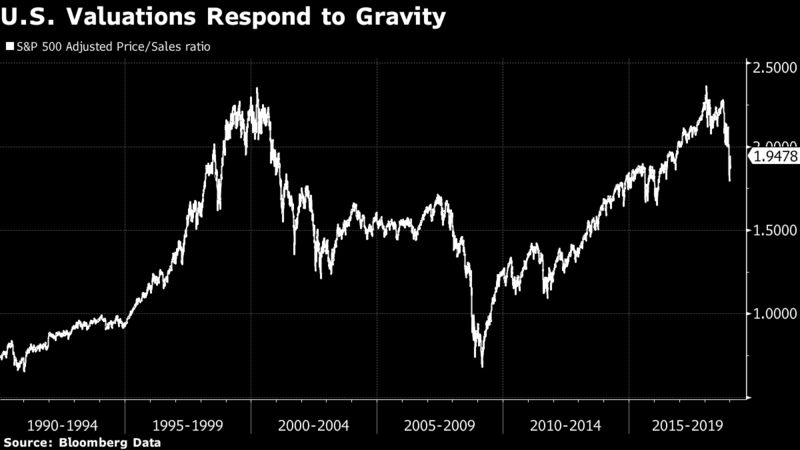

Looking at raw valuation data for the U.S., we again come up with a plausible case that what we just witnessed was a drastic but welcome correction. Earnings have been boosted by the one-off impact of the corporate tax cut and by a widening of profit margins. Looking at stock valuations as a multiple of sales, the U.S. reached a level of overvaluation last January only seen once before in the last three decades — during the dot-com bubble of 1999 and 2000:

Declines as sharp as this one have happened only during the major bear markets that followed the peaks of 2000 and 2007, so the argument in terms of valuation does not necessarily suggest that this was merely a correction and that everyone can now relax. If you are one of the many who view the rally of this decade as primarily a byproduct of the Fed’s quantitative easing measures that pumped trillions of dollars into the financial system, we should brace for a continuing return to normality in valuations. Even if Powell is trying to sound less hawkish, he is not going to resort to more QE unless the financial markets stage a full-blown collapse.

Exactly how much have financial conditions loosened? Both inflation expectations and nominal rates have dropped significantly, and real long-term rates (my favorite measure of financial pressure) have corrected slightly. After a brief trip above 1 percent in real rates in what appeared to be a true break-out, investors seem to have decided that that was more than the market could stand:

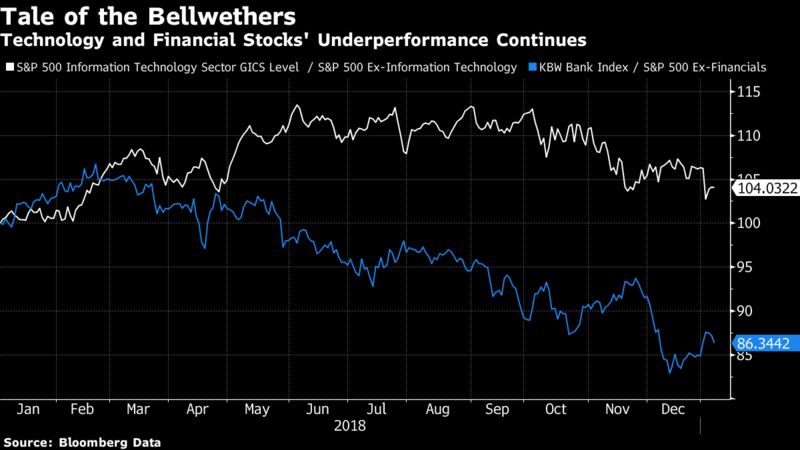

What of the underlying view of the economy that comes from the markets? The outlook still looks bearish — and possibly too bearish given the strength of the latest U.S. employment data. The relative performance of the tech sector, thanks to Apple, is right down around its lows from mid-December. Its leadership is sorely missed. Meanwhile, the underperformance of big banks continues apace. This has much to do with a yield curve that is still as flat as Iowa, but it is a telling sign of lack of confidence:

Where does all this leave us? Regrettably, this does not look like a sell-off and recovery sparked by rookie errors from the new chair of the Fed. Rather, it looks like a necessary and healthy correction to a market that had reached untenable levels, catalyzed and exacerbated by the Powell comments. The sell-off on Christmas Eve did have the look of revulsion or catharsis about it, which implies a positive. But we have already enjoyed quite a bounce, and some of the underlying illogicalities of the market remain in place. We can expect further corrections and further volatility, no matter how Powell measures his words.

Jay Powell interview, Jan 10, 2019: "We don't see any asset bubbles… or imbalances"🙄😙🤨🙈💩 Dear Jay, what would US GDP be w/o the excessive gov't spending; asset prices w/o $15T QE?

cc: @DiMartinoBooth @marydalyecon @EricRosengren @RobSKaplan @neelkashkari @RaphaelBostic pic.twitter.com/lFLcROJmS3— M/I_Investments (@MI_Investments) January 10, 2019