Policy-makers are urgently trying to stem China’s economic slowdown amid an escalating trade war, record corporate defaults and a plunging stock market.

China Banks Fall on Concern Loan Targets Are a Step Too Far

China’s biggest banks dragged down the stock market on Friday as investors took a dim view of the government’s unprecedented move to tell firms exactly how much they must lend to the country’s struggling private sector.

At least a third of new loans should go to non-state companies, Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission, said late Thursday. Private lending was less than a quarter of banks’ outstanding debt in September.

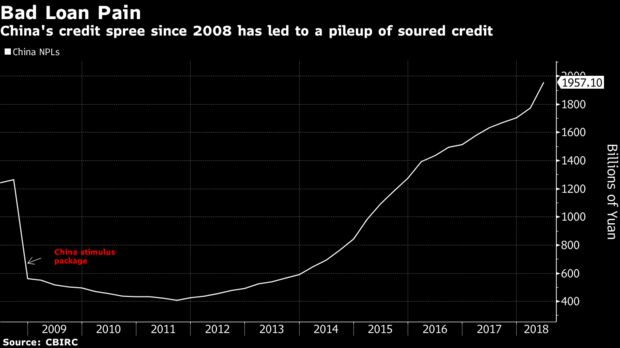

Publicly setting targets reflects policy makers’ urgency as they try to stem China’s economic slowdown amid an escalating trade war, record corporate defaults and a plunging stock market. While they may be achievable, concerns are mounting among analysts and investors that regulators have put too much pressure on banks to work with the embattled private sector, and as a result more bad loans will ensue.

“There is desperation among regulators, and sometimes muddled polices are difficult to avoid under this kind of pressure,” said Jiang Liangqing, a Beijing-based fund manager at Ruisen Capital Management. “Investors are voting with their feet.”

Why Chinese Authorities Are Freaking Out

It’s always a fine line for authorities. There are times when avoiding intervention is more effective than intervention. That’s particularly true when the efficacy of whatever proposed policy is in doubt. If you don’t know for sure that it will work, maybe don’t do it. There are often grave risks associated with plunging forward recklessly.

In other words, officials can and do just make things worse. By pushing the envelope rather than calm markets or the economy they can further enflame them. Crises are never so binary – until they are over. Heading into one, there is so much ambiguity that can either work for you or against you.

Government desperation is one of those where it makes things worse. People may doubt there is a downside or how deep it might be, but if authorities are obviously unsettled that can’t be a good sign. From the official perspective, perhaps there just aren’t any alternatives.

China last night:

“There is desperation among regulators, and sometimes muddled policies are difficult to avoid under this kind of pressure,” said Jiang Liangqing, a Beijing-based fund manager at Ruisen Capital Management. “Investors are voting with their feet.”

In the last week, things have gone from bad to worse but all in the future tense. Right now, there isn’t any sign China’s economy is on the verge of collapse or even contraction. But the number of negative factors which could push it that far are piling up; mostly in the monetary therefore financial system.