via Zerohedge:

Since the beginning of the post-crisis recovery, stagnant wage growth has been one of the most frustrating labor-market mysteries bedeviling the policy makers at the Fed. With the unemployment rate at 3.8%, the Phillips Curve dictates that wage growth should be accelerating as employers battle for the few remaining unoccupied workers in a “tight” labor market.

One reason for this phenomenon as we have posited in the past, could be the record number of elderly Americans who have lingered in – or returned to – the workforce, unable to retire due to myriad factors, including high health-care costs and inadequate retirement savings. And of course, the advent of the financial crisis ten years ago, which robbed many older Americans of much of their life savings, didn’t help.

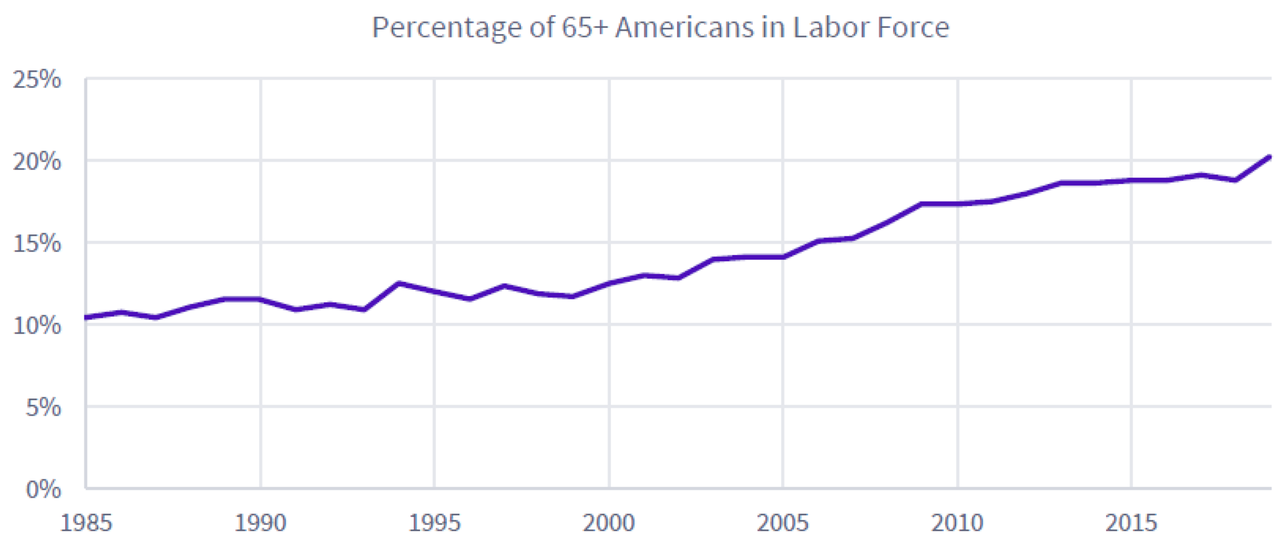

According to Bloomberg, citing a new report from money manager United Income, the labor force participation rate of retirement-age workers has cracked 20% for the first time in 57 years. Going solely by numbers, this means more seniors are working than ever before. Meanwhile, the share of working age Americans in the work force has fallen to its lowest level since the 1970s, before a large number of women entered the professional workforce. Though higher-education elderly Americans have made strong gains in income compared with people in a similar position decades ago, the buffer they’ve created for hiring managers could be one reason why many companies haven’t needed to raise wages to attract more workers.

The percentage of the labor force comprising workers aged 65 and older has roughly doubled since 1985. The biggest increase has occurred among older workers with college degrees, who now comprise 53% of all over-65 workers, compared with 25% in 1985.

In an ominous sign for millennials, who blame baby boomers for soaking up the benefits of peak American prosperity, including affordable education and home ownership, and generous retirement packages that included pensions, even with those advantages, it appears baby boomers will continue working longer then their predecessors, as millions still won’t be able to substitute enough of their working income from passive sources. While some of the better educated older workers are working simply because they can continue to enjoy a robust income, and not because working is still a financial necessity for them, many of their less-education peers, who on average earn lower wages, are working because they need to.

Just take a look at the ‘retirement math’, outlined by Bloomberg below:

The retirement math is ugly, even for those who are seemingly well-off. Teresa Ghilarducci, an economics professor at the New School for Social Research, has estimated that Social Security replaces about 40 percent to 50 percent of one’s pre-retirement income. The general thinking is that people need around 80 percent of pre-retirement income to get by after they stop working. (Online retirement calculators can give a rough sense for what you need to save, and earn on savings, to get there.)

The typical worker in the bottom 50 percent of the income distribution, earning less than $40,000 a year, has no retirement savings.

Those in the middle 40 percent of income distribution, earning from $40,000 to $115,000, have a median amount of $60,000 saved, according to Ghilarducci’s research.

Workers in the top 10 percent of income distribution making more than $115,000, meanwhile, have a median amount of $200,000 saved.

They, too, are woefully under-saved, although it’s worth noting that these calculations don’t include real estate and other tangible assets, or the chance of an inheritance.

Ghilarducci’s rough estimate of what a typical college-educated professional must amass to retire fairly comfortably? “Over $1 million or 2.” No wonder more people are working longer.

While this might explain, at least in party, why the BLS sees baby boomers as the biggest contributor to an expected rise in the labor-force participation rate over the next five years…

The BLS expects the big wave of aging baby boomers to represent the strongest growth in the labor force participation rate through at least 2024. “By 2024, baby boomers will have reached ages 60 to 78,” a BLS reportnoted. “And some of them are expected to continue working even after they qualify for Social Security benefits.”

…it doesn’t answer an even more puzzling question: What happened to all the young people? Most alarmingly, the share of working-age males who have left the workforce has risen substantially in recent decades.

While it’s tempting to blame this on the rise of gender equality in the workplace as more women earn high-dollar incomes, it’s believed that crises of drug abuse and mental health, as well as falling education rates – or simply because young people don’t want to work – have produced more ‘disconnected youths’ – that is, young people who aren’t in school or the labor force.

And if these younger men don’t want to take these jobs, there are plenty of retirement age workers who could use the extra scratch who are more than willing to oblige.