by John Ward

What connects professional football, bent economic data, corporate debt, consumer debt, dodgy bonds, the gold price, Brexit, mediocre EU leadership, British politics, blind ideology and serious social unrest? The answer is, a dearth of reality. Ignoring reality leads to extreme solutions.

¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤¤

We all consume information on various different levels – sport, economic, political, fiscal, national, international, social, global, ecological, scientific and so forth. But whatever theatre of news you enjoy most, it has never been more obvious that reality has left the theatre.

In England’s Premier football League, the “business model” (if one can flatter it with such a term) has been plutocratic sugar-daddy ego-money for nearly two decades now. Two years ago, Sportingintelligence’s Global Sports Salaries Survey put the average annual wage of Premiership players at £2,642,508 – or £50,817 per week. Today, that average is over three million pounds.

The chief income sources for Premiership clubs are ticket sales, replica kit marketing, sponsorship, television fees and prize money. There are three top-flight things to go for each year: the Champions League, the Premiership, and the FA Cup. There can only be three winners, although high positions do grant access to European competitions.

Earlier this year, at the end of last season, the Top Ten Premiership clubs had the following debts to service:

- Manchester United – £495.8m

- Brighton & Hove Albion – £207.1m

- Arsenal – £205.3m

- Liverpool – £201.7m

- Spurs – £180.4m

- Sunderland – £161.7m

- Newcastle – £152.3m

- Stoke – £122.7m

- Cardiff – £115.1m

- Blackburn Rovers – £112.8m

The top four English clubs have aggregate debts of £1.2 billion.

Most of the owners have made money in energy, entrepreneurial business and multinational interests. The majority are exposed to the world’s bourses in one way or another.

Do we see a major correction in those bourses coming? Is the Pope a Catholic?

The classic safe haven Gold was treading water at $1300 an oz last March; today it is testing $1518.

In 2007, total global indebtedness was $112 trillion; today, that number stands at $250 trillion. Last year alone, the combined debt of the world’s four largest economies increased ten times faster than gdp.

The prevalence of negative yielding bonds, sub-prime zero-down mortgages, sub-prime auto loans, a deeply inverted yield curve, collateralized loan obligations and US corporate junk bonds is higher now than it was at the peak of the 2008 wobble. The corporate bond market BBB-rated debt has doubled as a percentage of the size of the US economy since those dark days when the FT headlined ‘Fear stalks the global markets’. Worse rated bonds than that are higher in real terms than in 2007.

Bullish late last year about the outlook, the US Fed has been forced to reverse its tightening policy. The US Treasury itself just issued over $1 trillion of new debt to fund the deficit caused by a surge in federal costs of 30%, when tax revenues fell by 3%.

What of the EU economy? Outgoing Central Bank head Mario Draghi has warned Brussels that “the economic picture is worsening”. QE has not, in the end, worked. He argues strongly for more of the same. The question of where the money’s coming from to do that is being studiously avoided.

Whatever the Remainer media tell you, Britain leaving the EU is a catastrophe for Brussels. We’re not talking ‘one member’ here: we’re talking the 2nd biggest economy in the Union – as big as the 19 smallest EU members combined.

In real, hard economic terms, the EU’s gdp size will shrink from 27 member-states to 9. This is what a senior Bundestag Opposition politician had to say about that last week:

“In the face of such an enormous event, the EU reaction verges on a pathological denial of reality……German prosperity and jobs are at stake here. It is clearly in Germany’s interest that trade and investment continue unhindered. But, out of blind loyalty, Merkel follows France, which wants to deny Britain access to the Single Market. Yes, Merkel is considering not allowing Britain access to the European Economic Area, because France does not want it.”

This is where the Franco-German power axis hits crunch-time….as I have been saying since 2013 that one day it must: without the UK as a EU member, Germany will lose its ability to assemble a blocking majority (35%) in the Council, and without this ability to block, Germany may not be able to stop the crisis-ridden, Club-Med States and France from reaching into community funds.

The willingness of the UK mass media to self-censor this reality is one of the greatest crimes ever committed by a free media pack. More than all other factors put together, it proves that – love or loathe the guy – Boris Johnson is in a strong position to force Brussels to the negotiating table. Astonishingly, even despite that reality, the new lunatics at the top of the Commission look set to ignore the Russians shelling their Berlin bunker.

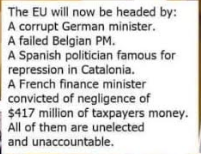

For sugar daddies across Europe – and thus for soccer everywhere – this is going to be a disaster. Are the freshly-picked top wallies in the EC up to it?

Well, I found this summary both clinically accurate and terrifying:

Meanwhile, back in Blighty, the US is still making very warm offers to the UK of further new export opportunities. As we have a large trade surplus with the States, this all looks like good news.

But with stock et al markets looking insanely overvalued – and both fiscal and citizen financial debt continuing to fuel any economic growth available – things are going to be horrendous for us because of our uniquely massive overdependence on financial and banking services. Financialised capitalism is a Ponzi scheme, and Britain is at the heart of it.

In the light of such future attractions, are we going to see a speedy route to Brexit, and the obsessive rearguard nonsense of Remainers drawing to a close? Will we emerge from this crisis with a new look House of Commons led by a strong Party and run by a Leaver?

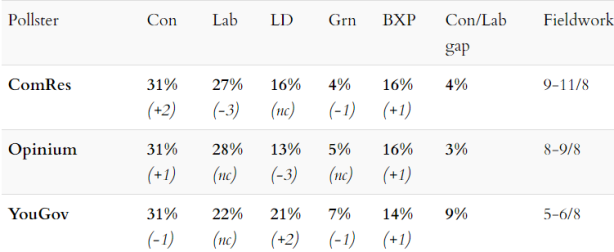

The answers still remain, I’m afraid, no, no and probably not. This is how the Parties stand today, according to Comres, Opinium and YouGov:

The likelihood of an overall Conservative majority emerging from this is not high. Let us say, for instance, that (taking the Comres study conducted over the last six days) Labour, the LibDems and the Greens go for a full-on electoral pact, and the Brexits plus Tories do the same.

This would mean each alliance having exactly 47% of the vote.

That is (a) very unlikely to happen, and (b) even more unlikely to be translated into more seats on all sides. Further, Boris has not as yet had the chance to purge his Party of Diehard EUnatics.

We will get (and are already seeing the emergence of) increasingly cynical Parliamentary tactics designed to hound Johnson from Office and then push through, at the very least, a legal block on No Deal, and perhaps a revocation of Article 50.

Whatever happens, come mid October we may be in chaotic anarchy, with Leavers angry that their wishes expressed in 2016 have been ignored, and Momentum in aggressive mode because their beloved Hard Left has been roundly defeated.

None of this will be good for Sterling, and an already nervous City could push the FTSE into panic selling.

In this post, I have presented a series of dangers, likelihoods and realities. They suggest unbalanced industries, vastly overvalued financial markets, all forms of debt at ludicrous levels, economies slowing down despite the application of such debt to them, and political mayhem on the horizon.

The longer no reality perception is applied to these problems and outcomes, the worse things will be when reality hits the citizenry by sheer force majeur. As the Buddhists say, “Everything is connected”.