via MarketWatch:

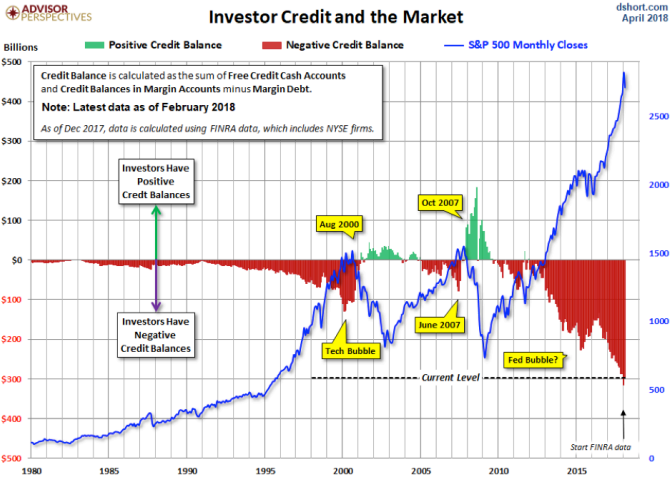

We are in store for the margin call to potentially end all margin calls. The peak of margin debt, one of the primary factors in the 2000 dotcom bubble collapse, never got close to $100B.

Investor margin debt is currently over $300B. And as the below chart reveals, that very margin debt (this time, concurrent with Fed money printing liquidity) has bid up stock market asset prices.

Remember, when the market falls dramatically, margin sellers don’t get to wait it out. Brokerages and banks sell their shares whether they want them sold or not in order to make sure they get their loan back before shares go to zero. And that selling drives further margin selling. It’s a hellish recipe for incredible, unstoppable losses that happen at breathtaking speed.

Brad Lamensdorf, manager of the AdvisorShares Ranger Equity Bear, warns this market could be about to get “nasty” for the bulls.

“How much credit is out there, borrowed against stock portfolios? Trillions of dollars,” Lamensdorf said in a report co-written with John Del Vecchio. “As interest rates creep up and more portfolios have been used to finance asset purchases, a huge storm can be created if stocks and bonds take even a minor dip.”

As the old saying goes, you can always buy a boat, but you can’t always sell one. “Shedding assets when everyone else is feeling pain leads to terrible deals for the seller,” Lamensdorf wrote, adding that we may be reaching a tipping point.

“Right now, small changes in rates might not be noticeable. However, like boiling a frog in a pot, it all adds up,” Lamensdorf concluded. “Investors with sizable portfolios have the most to lose. But, they also have the most to gain if they can navigate the market unemotionally and be greedy when others are fearful.”

ORIGINAL SOURCE: Trillions of reasons why a ‘huge storm’ may be looming for investors, in one chart by Shawn Langlois at MarketWatch on 5/30/18

HANSON: Mortgage-Mageddon; Refi’s At 17.5 Year Lows

Don’t Wait Until It’s Too Late: Allocate for a Correction Now

very very bullish pic.twitter.com/ikey44wTNu

— Alastair Williamson (@StockBoardAsset) May 29, 2018

please do not panic $DB. Everything is awesome. pic.twitter.com/rdWRIQsfNa

— Alastair Williamson (@StockBoardAsset) May 29, 2018

#HousingBubble1 was a direct result of the #FedFundsRate ⬇️ to 1% 🔵 following the #TechBubble. HB1 🗯 after the 🔴 FFR ⬆️ 5% (among other reasons). #HousingBubble2 was created as a direct result of the ⚫️ FFR ⬇️ to 0% for nearly a decade. HB2 🗯 after the FFR…….. pic.twitter.com/L7JuegMSaW

— OW (@OccupyWisdom) May 28, 2018