by Dana Lyons

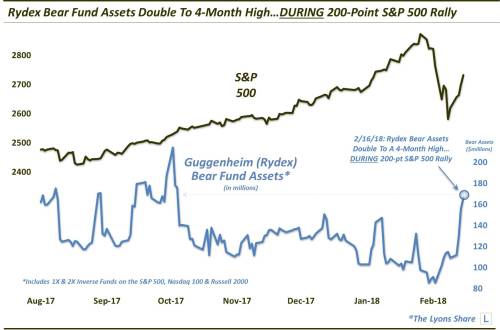

After sitting at record lows during the correction, Rydex bearish fund assets have doubled during the market rebound.

The recent market correction caught a lot of market participants off guard. Chief among that contingent were active traders of inverse, or bear, funds, specifically Guggenheim (formerly Rydex) mutual funds. These funds are, of course, designed to rise when stocks fall. Rydex originally introduced these funds for active traders to utilize in playing the downside in the stock market, or hedging. Like most sentiment measures, assets in these bear funds typically hit contrary extremes at turning points in the market, i.e., assets soar near market bottoms and plunge at tops. Not surprisingly, assets in these bear funds sat at all-time lows at the late-January all-time high in the stock market. Thus, traders in such funds were completely unprepared for the sharp correction that ensued.

As the selloff progressed, flows tied to these funds went on an interesting journey. Initially, during the first week of the correction, bearish fund assets actually dove further as traders quickly covered some of what little hedges they had on. It wasn’t until the 1000-point down day in the Dow Jones Industrial Average (DJIA) day on Monday, February 5, that money actually flowed into these funds – albeit at a very meager pace.

Behavior by these traders has been even more interesting during the sharp rebound over the past week. That’s because, despite a 2000-point rally in the DJIA and a 200-point jump in the S&P 500 (SPX), assets in these bear funds have actually doubled to a 4-month high. Further, despite the DJIA being up every day this week, by an average of 250 points, money has flowed into these funds every single day this week.

So is this after-the-fact rush to hedge into a giant rally as obvious of a contrarian bullish sign as it appears? Or are these traders onto something – like they’re about to nail a re-test. Well, given their ignominious track record, perfectly encapsulated by their complete whiff on the recent 10% market drop, history is not on their side. So while a variation of a re-test would not be a surprise, even from levels very near here, in general, we do not want to be traveling with this herd.

In a Premium Post at The Lyons Share, we take a deeper, statistical look at this behavior, including similar historical episodes, to gauge just how big of a contrarian signal this is – or isn’t.