Volatility may be here to stay — but there’s a lot investors can do to prepare for it.

“Hedges against late cycle volatility bursts in credit, dispersion and cross-asset volatility as the equity/bond correlation itself becomes more volatile” are one key theme in Societe Generale SA’s second-quarter outlook from strategists led by Kokou Agbo-Bloua, the firm’s head of flow strategy and solutions. The outlook was published March 30.

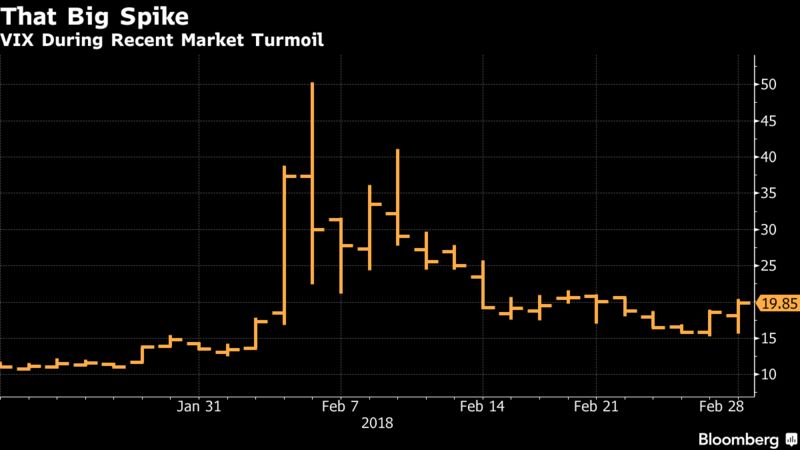

The report, titled “Macro ‘Black Mirror”’ after a U.K. television series that looks at unanticipated consequences of technology, warns that advances such as algorithmic trading are exacerbating trading issues with “profound distortions in market liquidity or the illusion thereof,” citing the volatility spiral in early February as an example.

The strategists also say that 2018 will be the first year since 2009 when net inflows of liquidity provided by all central banks will turn negative, setting the stage for regime change in both correlations and cross-asset volatility and risk premia.

The report’s suggested volatility-related trades include:

- Hedge credit risk with a high-yield basket (SocGen created a basket comprised of about 200 of the most liquid stocks that are among the Markit iBoxx USD Liquid High Yield Index constituents, and is equal-weighted)

- Buy VIX May/June 18/24 calendar strangles; this would capture all the upside in case of another volatility spike and is also long volatility of volatility

- Buy Euro Stoxx 50 Dec. 3700 calls given implied volatility near historical lows

- Buy USD Rates vs S&P/ASX 200 variance spread; SocGen likes buying volatility on U.S. fixed-income amid central-bank policy changes, among other factors, and sees Australian stocks as a good financing leg because superannuation allocation into equities is significant and growing, and miners are far less levered now