Sometimes you can get what you want but then wonder how it came about? An example of that has taken place this morning. Regular readers will be aware that I am a fan of low inflation as I feel the behaviour of wage growth has been weak for some time and is thus likely to fall behind and make workers poorer. Well unless you are in the camp who actually believe the official report yesterday that wages are rising at an annual rate of 8.8%, which means that all we needed to fix the real wages issue was an economic collapse!

The Housing Cost Issue

So we can start with what on the surface looks really rather welcome.

The Consumer Prices Index (CPI) rose by 2.0% in the 12 months to July 2021, down from 2.5% to June; on a monthly basis, CPI was unchanged in July 2021, compared with a rise of 0.4% in July 2020.

That is rather awkward with so many things pointing upwards such as producer prices. A small dip was possible on a technical basis ( last year saw a 0.5 rise in the index as the economy re-opened for a while) but a 0.5% fall is quite a surprise.

We can keep going and head over to the measure that we keep being told is the most comprehensive one.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 2.1% in the 12 months to July 2021, down from 2.4% in the 12 months to June.

So it fell too in terms of the annual increase and whilst that decline was smaller it was even more awkward when we were also told this.

UK average house prices increased by 13.2% over the year to June 2021, up from 9.8% in May 2021; this is the highest annual growth rate the UK has seen since November 2004…….UK average house prices reached a record high of £266,000 in June 2021, which is £31,000 higher than this time last year.

So the most up to date official numbers for house prices show quite a surge with house prices rising by £11.400 in the month of June. So we have seen a monthly rise of 4.4% which is more than double the annual rate of the measure which supposedly includes owner occupied housing costs. We can go further because whatever one thinks of the monthly rise in house prices it was based on a lot of actual transactions and thus is a real number.

Monthly property transactions statistics published by HM Revenue and Customs show that the seasonally adjusted number of transactions in June 2021 was estimated to be 198,240. This is higher than the previous record of 183,830 transactions completed in March 2021.

I can crunch some numbers for you that include this. If we keep the weights the same and simply put the house price growth in then CPIH would be growing at 4.3%. Actually if we used house prices the weight would likely be halved so a better CPIH measure using real rather than imputed prices would be at 3.2% now.

On this journey let me remind you that we have another inflation measure which does include house prices via a depreciation measure.

The all items RPI annual rate is 3.8%, down from 3.9% last month.

Now the inflation fall is much smaller and I am sure you have spotted that the recorded rate is quite a bit higher. Part of the reason for this is that the house price element I just mentioned rose by 1.9% in July alone. So in terms of joined-up thinking and measurement it is recording this area rather than ignoring it (CPI) or singing along with Earth Wind and Fire as CPIH does.

Every man has a place, in his heart there’s a space

And the world can’t erase his fantasies

Take a ride in the sky, on our ship, Fantasii

All your dreams will come true, right away

More Problems

If we return to our official inflation measures there were further problems in July. We can start with the other side of the coin because the expected rises or “ups” were in fact present.

The largest upward contribution to the CPIH 12-month inflation rate came from transport (0.85 percentage points)………Price rises for second-hand cars, compared with falls a year ago, resulted in the largest, partially offsetting, upward contribution to change (0.18 percentage points in July 2021).

Let me give you a specific example for transport.

Average petrol prices stood at 132.6 pence per litre in July 2021, compared with 111.4 pence per litre a year earlier. The July 2021 price is the highest recorded since September 2013.

So how did we see such a large fall then? Step one is that the clothing and footwear sales which had so far been missing in 2021 turned up.

before rising in subsequent months to June. In July, prices fell as usual during the summer sales season, albeit the incidence of sales in the datasets for both June and July was less than in recent years.

To be specific the index fell from 105.7 to 103.5 so the sales effect was strong.

Then a wildcard which we have noted in the past came into play.

The effects from recording media and games, toys and hobbies came from CDs and computer games respectively. Prices for these products could have been influenced by the coronavirus restrictions changing the timing of demand, though it is equally likely to be the result of the CDs and games in the bestseller charts used when collecting price quotes.

The best seller charts issue leading to swings in price when games or CDs fall out of fashion is something of a copy of the problems the inflation numbers have had with fashion clothing. At times the latter has got so bad I have seen suggestions we should leave that section out. After all the much larger owner-occupied housing sector is ignored by the CPI measure. But for this month it has given inflation a nudge lower.

Next comes an issue also from recreation and culture that is worse than awkward and frankly looks very wrong to me. Here is the official explanation and the emphasis is mine.

The index for package holidays was imputed in June 2020 because the component items were not available during the coronavirus lockdown whereas the July 2020 index was mostly based on collected prices. Both monthly indices were imputed in 2021. As a result, in both 2020 and 2021, the monthly price movements between June and July for package holidays have been estimated because the component items have not been available for both months.

Yes we have imputed package holidays. Yes they have also reduced prices. I find that hard to believe if we allow for factors like this explained by Which.

Tui offers a test package for £60 to ‘green list’ countries that require a PCR test for entry and includes the lateral flow test to return to the UK and the PCR test for day two after landing home. For countries that only require a cheaper, lateral flow test for entry the package is £20. For countries on the amber list, tests will be £50 if they only require a lateral flow test and £90 if they require a PCR test.

I know people who have paid much more. But the issue here is that there has been a clear rise in the cost of living and I do hope the inflation numbers have not missed it out.

Comment

So the fall in inflation which at first looked welcome is I am afraid singing along with Imagination.

Could it be that… it’s just an illusion?

Putting me back in all this confusion?

Could it be that. it’s just an illusion, now?

Could it be that… it’s just an illusion?

Putting me back in all this confusion?

The issue of best-seller charts and the related one of fashion clothing is a genuinely difficult issue and maybe the best answer is to produce numbers with and without them. The timing of the sales season is a pandemic issue. But I am sorry to say that the housing and package holiday issues are systemic and misleading. Even the RPI could be improved here by making the house price numbers explicit and more up to date.

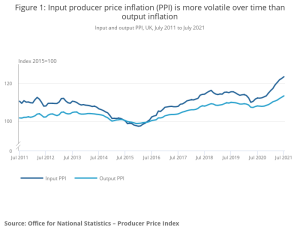

As to the trends well the producer price numbers suggest that the heat remains on.

The headline rate of output prices showed positive growth of 4.9% on the year to July 2021, up from 4.5% in June 2021…..The headline rate of input prices showed positive growth of 9.9% on the year to July 2021, up from 9.7% in June 2021.

Tucked away in the detail we are told this which seems fairly clear.

this is the highest the annual rate of output inflation has been since December 2011.

There is always the issue of how this feeds into consumer inflation and exactly when but we know the pilot light is on.