The Fed tightens and stocks tank. The Fed promises to stop tightening and stocks soar. The Fed implies that it might actually cut rates and stocks soar some more. The Fed appears to take back the rate cut promise and the markets turn choppy.

It’s been a wild ride. But during the past four months of it, the Fed has yet to actually do anything other than talk.

Meanwhile, contradictory signals from the economy threaten to keep the Fed paralyzed. Consider:

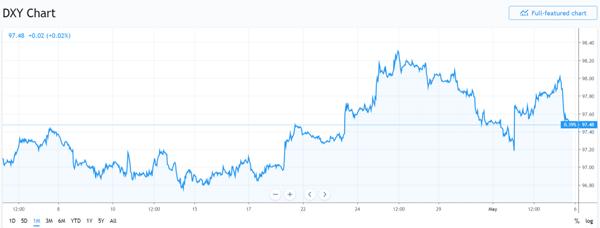

The dollar is rising. This is deflationary because it makes US goods more expensive overseas, other things being equal lowering corporate sales and profits. A too-strong dollar would normally lead the Fed to cut rates to relieve the pressure on exports.

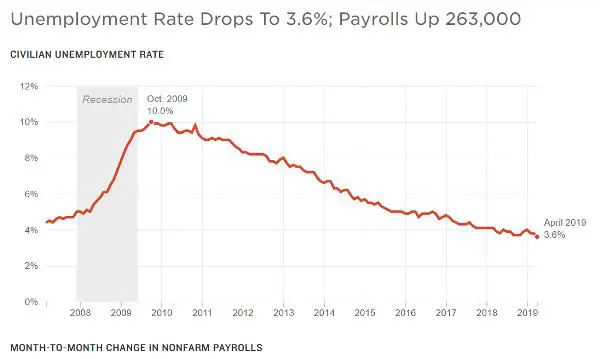

Unemployment is plunging. In April, the US added 263,000 jobs, sending the official unemployment rate to a five-decade low of 3.6%. Average hourly pay rose 3.2% year-over-year. Meanwhile, anecdotal evidence of labor shortages is becoming comical, with companies eliminating drug testing while recruiting from local high schools and jails.

This is a signal for the Fed to tighten aggressively to head off a spike in wage inflation (which, as noted above, is already well ahead of the Fed’s 2% inflation target).

Long-term interest rates are down. The yield on the 10-year Treasury bond (from which mortgage rates, among other things, are derived) has fallen from 3.2% in November to around 2.5% today. This implies a slowing economy and therefore an excuse for the Fed to ease.

Stock prices are back at record highs. The main reason the Fed to stopped tightening was the flash-crash in stocks near the end of 2018. But now stocks are back to pre-crash levels, while tech IPOs are being greeted with feeding frenzies. By any previously reliable measure, stocks are back in the kind of bubble (the chart below is the tech-heavy NASDAQ) that in the past has convinced the Fed to tighten.

There’s more, but you get the point. Whatever the Fed does from here on out – including nothing at all – will likely cause serious problems. Easing might send wage inflation to levels last seen during the 1970s currency crisis. Tightening might send the dollar up to unsustainable levels, invert the yield curve, and cause stocks to crater, setting off a 2008-style Wall Street implosion. Staying the course and just talking as in the past five months might lead to either of the above.

The people running the Fed want to give the impression of control, but the fact is they’re just as baffled by the contradictory data as everyone else. Which is why their words – increasingly the only tool they have left — make less and less sense.