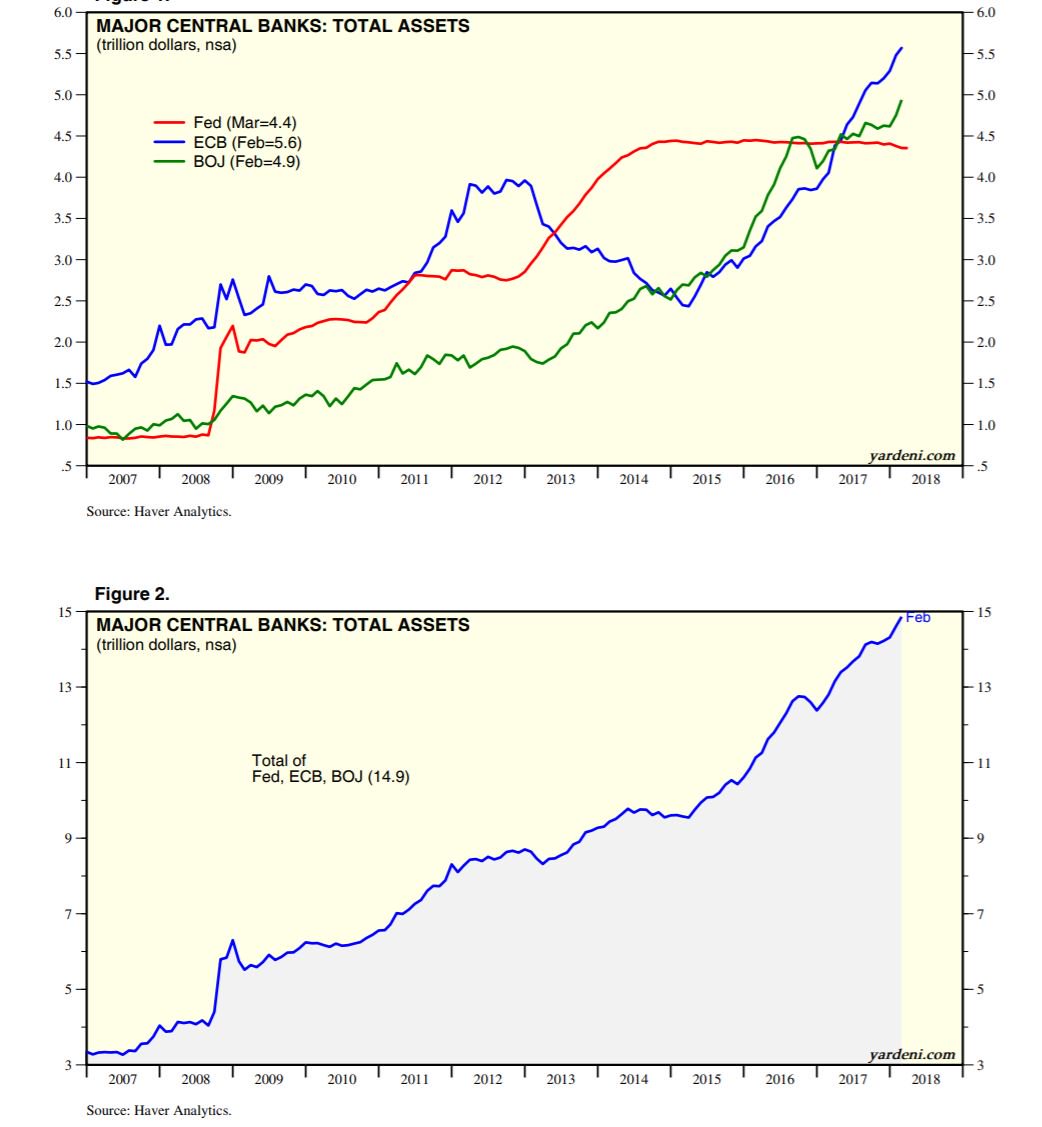

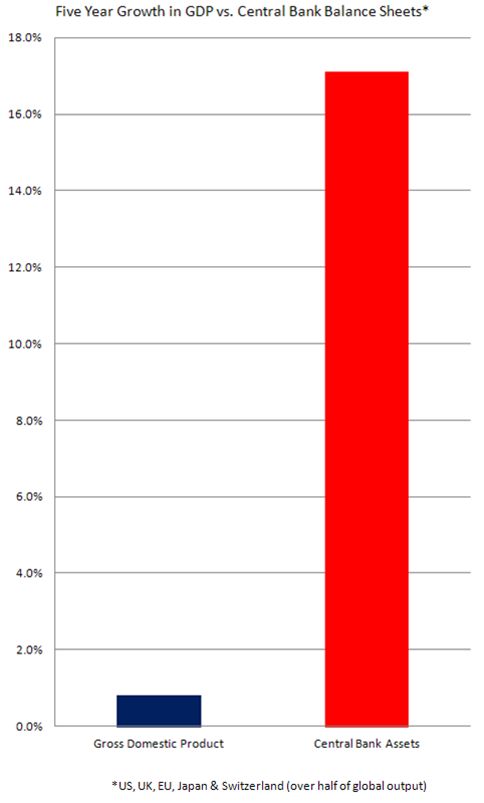

The reason why capex is poor is that QE perpetuates overcapacity. Growth is poor because QE props up unproductive government spending and -as u said- housing bubbles

Debt accumulation and saver repression are not social policies.

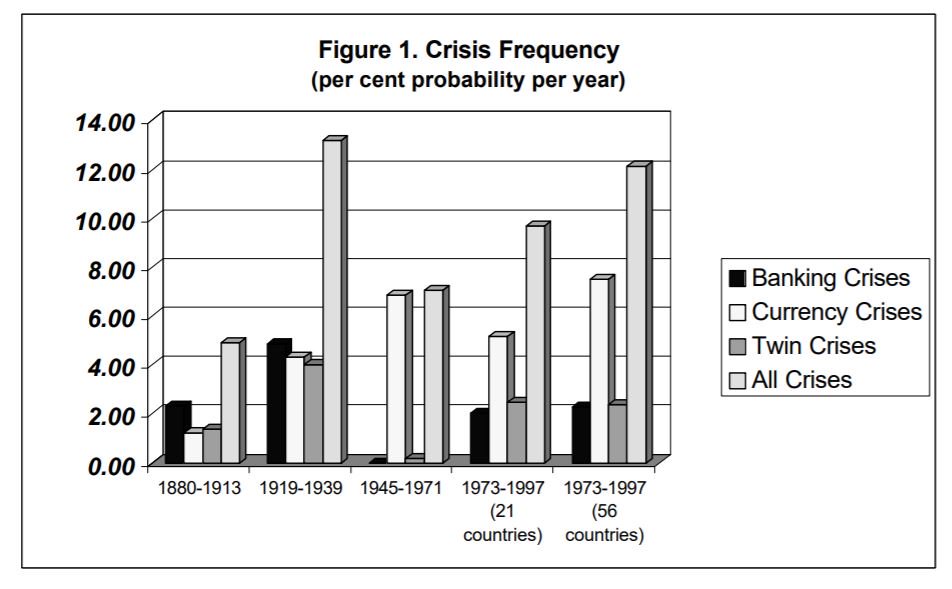

The Global Implementation Of Demand-Side Debt-Fueled Policies Has Made Crises Widespread and More Frequent.

(Bordo et all)

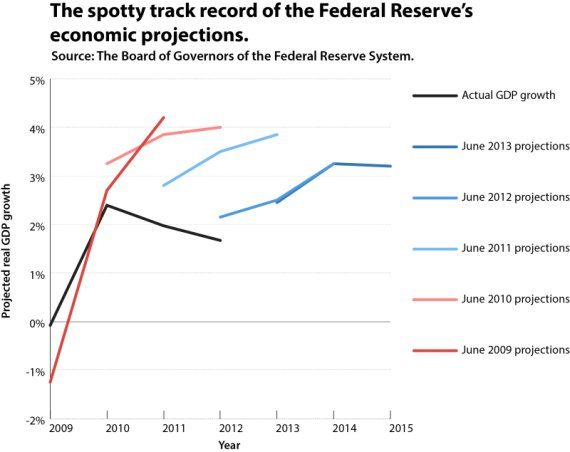

The #Federal Reserve’s Track Record At Making Estimates Is Abismal.

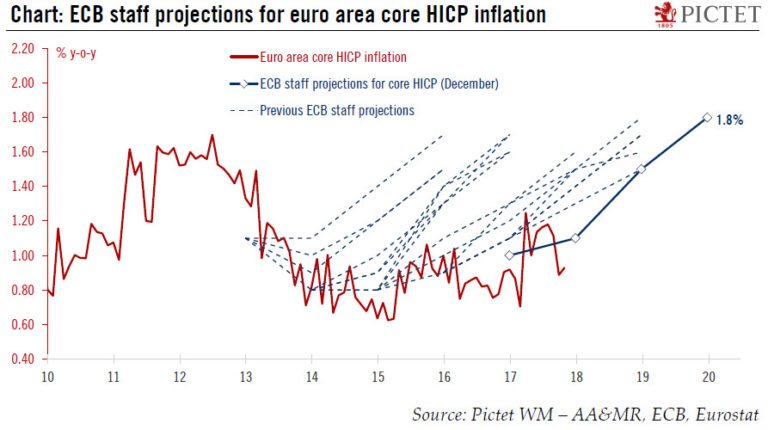

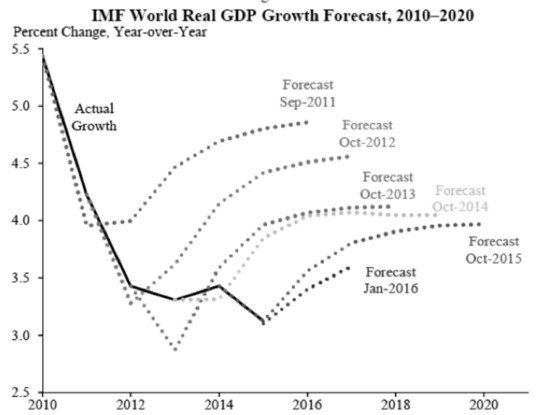

The #ECB and the #IMF’s Are Beyond Atrocious.

Yet almost the entire market starts CIO morning meetings with “The ECB-Fed-IMF estimates are still strong”.

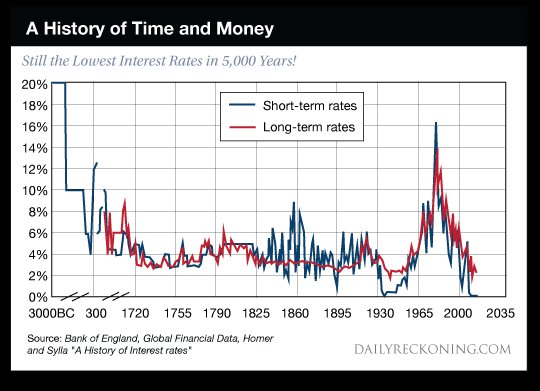

Two generations of market participants have seen nothing but expansive monetary policies.

. No wonder we consider small rate hikes “hawkish”.

. No wonder we find it almost impossible to find value.

. No wonder we believe crises come from small hikes after massive cuts.