By Bob Shanahan

The full scale and scope of the student loan debt bubble is far from fully understood. Millions of young Americans continue to be encouraged to go to massively expensive universities for useless undergraduate degrees. The result has been a generation of young people with thousands of dollars in debt and no preparation for today’s job market.

Parents and their high school aged children need to take a serious look at whether college is a sound investment anymore. Statistics are regularly thrown around about how college graduates make much more money than those with a high school education. But what about the trades? What about more profession-specific schooling? What about the thousands of dollars of debt they will struggle to pay off for decades? Millions of college graduates are now unable to buy a house, start a business, or buy a car because of the mountain of student loan debt they have. These loans are not backed up by any real asset, therefore, a massive wave of defaults is coming and has already started to begin.

Eerily similar to subprime lending circa 2008 is it not?

More than 44 million people in the U.S. now owe more than $1.5 trillion in student loans. And with women going to college in far greater numbers than men these days, they suffer more from student loan debt than their male counterparts. A recent report from the American Association of University Women pointed out that 56 percent of today’s college students are women, but they have $890 billion in student loan debt.

The report found on average that women left undergraduate education owing $21,619, compared with $18,880 for men.

For those tracking the many debt bubbles about to pop, outstanding student loan debt now exceeds auto loan debt ($1.1 trillion) and credit card debt ($977 billion), according to the Federal Reserve. Even with borrowing occuring well below pre-2008 levels, Americans are getting comfortable again with taking on loads of debt to pay off school, a car, or other material needs.

Seven out of 10 students take out loans to go to college and many statistics put the average amount owed at about $30,000 each. In addition, roughly 20 percent owe more than $100,000 as colleges become more and more expensive each year and the return on one’s investment declines dramatically with each passing semester. College education has risen 150 percent over the past four decades while household income has barely budged during that same time frame. Recent data has also unearthed the troubling fact that 11 percent of these borrowers are now 90 days or more delinquent on their payments.

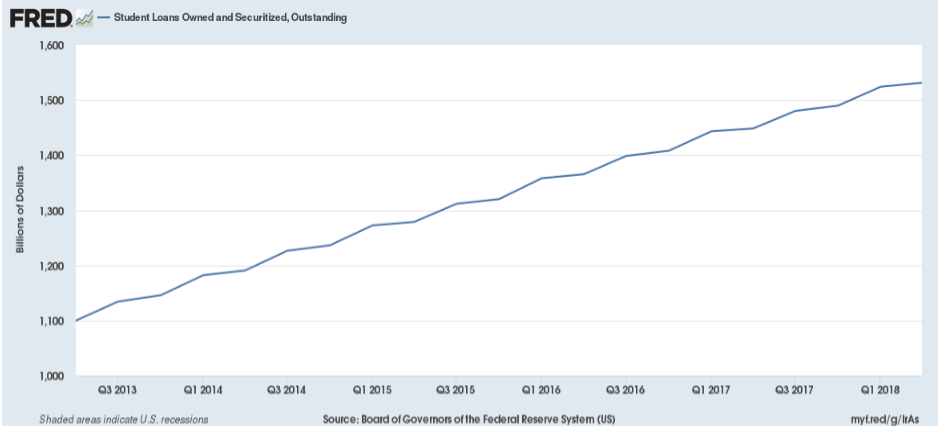

It’s only a matter of time before the increasing level of student loan debt has a debilitating effect on the nation’s current economic growth. Earlier this year, Fed Chairman Jerome Powell stated that the rising level of student loan debt could slow down economic growth in the near future. Powell went on to say that educational debt spiked to $1.38 trillion at the end of 2017. And it’s continued on that steep upward trajectory through the first nine months of this year. In fact, since Trump took office, the country’s total student debt burden has ballooned by $110 billion, to an eye-opening $1.41 trillion (though other statistics have it at $1.5 trillion), while the number of debtors has grown to about 45 million Americans, up 2 million.

Democratic Socialists want to wipe away student debt and make college free for all. But that is an unworkable solution that would put the burden on taxpayers, not to mention the fact that the banksters won’t have it.

Student loan debt remains the rarely talked about monster under the bed. The amount of debt these borrowers have is crippling their finances and holding them back from making stimulating economic decisions. Furthermore, it is estimated that 40 percent of these borrowers are expected to fall behind on their loans by 2023.

A new report put out on September 13th by AARP and the Association of Young Americans stated that more than 33 percent of Millennials and Baby Boomers can’t buy a home because they are unable to afford it and have too much debt already. In addition, some 24 percent of Gen Xers are unable to buy a car because of their student loans.

It is becoming increasingly obvious that a large portion of the country’s total student loan debt will never be repaid. The writing is already on the wall as 25 percent of student loan debtors are in some state of delinquency or default today.

A new survey by NeighborWorks America found that people with student loans outstanding are putting off buying a home and are constantly worried about their finances. Since 2008, student loan debt increased 130 percent with Millennials feeling the brunt of that burden. With the consumer debt crisis continuing to spiral out of control, it is only a matter of time before this economic calamity will affect the rest of the economy and spark another devastating recession.

Stop borrowing money to go to college. It’s not worth it. Work your way through school, start working after high school, or find a trade school or vocational school in an interesting and rewarding field. College has become unaffordable and far too many Americans are borrowing to get their degree only to be saddled with debt during their prime money-making years. Student loans are destroying America and will cripple the economy before you know it.

Follow me @BobShanahanMan

Bob is a freelance journalist and researcher. He remains forever skeptical of the mainstream media narrative and dedicated to uncovering the truth. Bob writes about politics (in DC and CA), economics, cultural trends, public policy, media, history, real estate, Trump Derangement Syndrome, and geopolitics. Bob grew up in Northern California, went to college in Southern California, and lived in Seattle for four years. He now lives in sunny Sacramento. His writing also appears in Citizen Truth and has been posted on ZeroHedge and Signs of the Times.