Image by iStock/guirong hao

From Frank Holmes at Frank Talk:

Besides lifting rates, the Fed has also signaled that we can expect two more hikes in 2018, suggesting it sees less and less need to accommodate a booming U.S. economy. Since the start of this particular rate hike cycle two and a half years ago, we haven’t yet seen four increases in a single calendar year.

This raises the question of how close we are to the end of the business cycle.

Rising rates, among other indicators, have often preceded the end of economic expansions and equity bull markets. Among other telltale signs: a flattening yield curve, record corporate and household debt, an overheated jobs market and increased mergers and acquisition (M&A) activity. So far this year, the value of global M&As has already reached $2 trillion, a new all-time high. The last two periods when M&As reached similar levels were in 2007 ($1.8 trillion) and in 2000 ($1.5 trillion), according to Reuters. Careful readers will note that those two years came immediately before the financial crisis and tech bubble.

Now, the world’s largest hedge fund, Bridgewater Associates, has reportedly turned bearish on “almost all financial assets,” according to one of its most recent notes to investors.

In the firm’s Daily Observations, co-CIO Greg Jensen writes that “2019 is setting up to be a dangerous year, as the fiscal stimulus rolls off while the impact of the Fed’s tightening will be peaking.”

Don’t miss the opportunities…

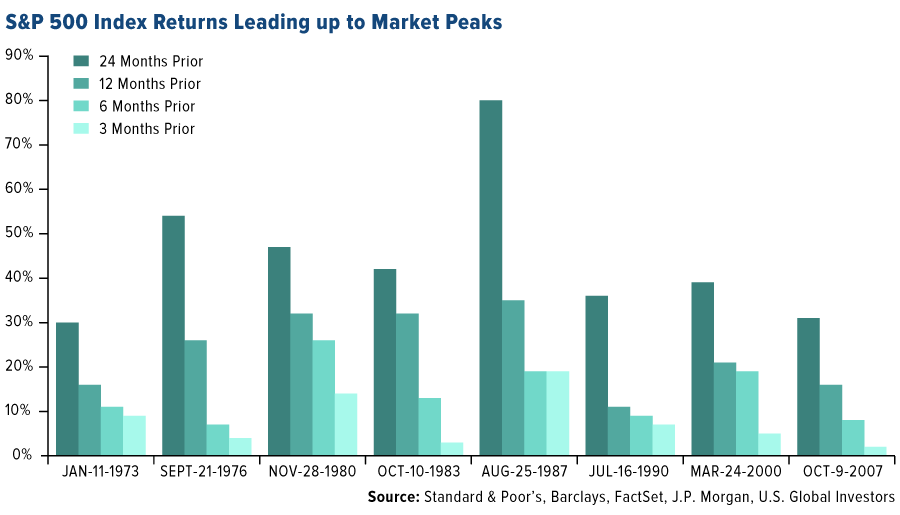

Calling the end of the cycle would be a fool’s errand and could result in missed opportunities, as J.P. Morgan’s Samantha Azzarello points out in a recent note to investors. Late-cycle returns can still be quite substantial, she says. Take a look at the chart below, which highlights returns 24 months, 12 months, six months and three months leading up to the past eight market peaks. Obviously returns were higher in the longer-term periods, but even the three-month periods delivered some attractive returns—returns that would be left on the table if skittish investors exited now. According to Azzarello, it’s important to “rebalance, stick to a plan and remember: get invested and stay invested.”

As further proof that many investors still see plenty of fuel in the tank, the June survey of fund managers conducted by Bank of America Merrill Lynch (BAML) found that equity investors are overweight U.S. stocks for the first time in 15 months. Commodity allocations are at their highest in eight years. And two-thirds of managers say the U.S. is the best region in the world right now for corporate profits, which is at a 17-year high.

That’s not to say there aren’t risks, however. Forty-two percent of survey participants said they believed corporations were overleveraged. That’s well above the peak of 32% from soon before the start of the financial crisis. Fund managers cited “trade war” as the biggest “tail risk” for markets at present.

This is largely why we find domestic-focused small to mid-cap stocks so attractive right now. These firms are well positioned to take advantage of Trump’s high-growth “America first” policies, yet because they don’t have as much exposure to foreign markets, they bypass many of the trade war pitfalls large multinationals must face. Since Election Day 2016, the small-cap Russell 2000 Index has outperformed the large-cap S&P 500 Index by more than 8.5%…