via upfina:

Changes to weekly aggregate hours worked includes the changes to the length of the workweek and the growth in payrolls. It gives a more detailed picture of the changes to the labor market than headline job creation.

We touched on changes to aggregate hours worked in our previous article. Let’s delve deeper. For manufacturing, in August aggregate hours growth was 0.5% on a monthly basis which was a big improvement partially because it had a very easy comparison. On a yearly basis, growth wasn’t as great as it improved from -0.3% to 0.1%. Growth was even worse for production and non-supervisory workers as it improved from -0.9% to -0.8%. July’s reading was the weakest of this cycle. Manufacturing is the only sector where we have data on overtime. For all manufacturing employees, overtime hours worked per week fell from 3.3 to 3.2 hours which is the lowest since April 2017. For production and nonsupervisory workers, hours stayed at 4.2.

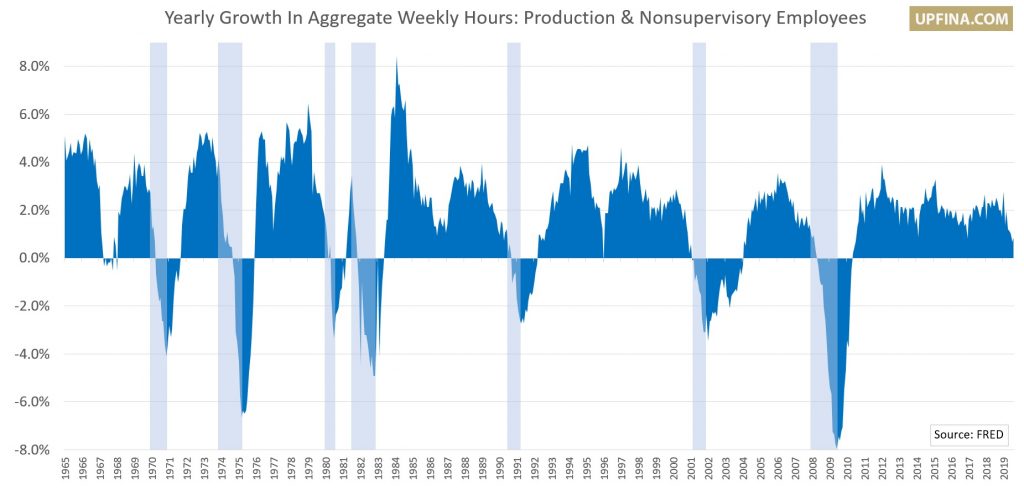

Now let’s look at the overall private sector. Aggregate yearly hours worked growth improved from 1.1% to 1.2%. July’s reading was a few basis points from the cycle low. The chart below shows yearly growth in private sector aggregate weekly hours worked for production and nonsupervisory workers. This growth rate improved from 0.7% to 0.8%.

July’s reading was the lowest of the cycle. As the recession bars indicate, there is usually a recession soon after growth gets this low. The notable exception was in 1967.

That’s not to say production and nonsupervisory workers are doing terribly. They had hourly wage growth of 3.5% in August which is tied for the cycle high. Overall wage growth was 3.2%. Real wage growth should be solid for both categories if headline CPI hits expectations of 1.8%.

US Sector PMI

It’s no surprise there was weakness in the US Markit sector PMI since there was weakness in the composite PMI. As you can see from the chart below, the industrial output index was barely above 50 as it had its lowest reading since April 2016.

US Industrials (Sector PMI)$FED #FOMC #FederalReserve #TwentyFiveOrFifty pic.twitter.com/wALjgjBnDb

— Callum Thomas (@Callum_Thomas) September 10, 2019

The healthcare industry had a slowdown in business growth which is in tune with the weakness in the BLS report. In August, there were only 24,000 healthcare jobs added which is below the 12 month average of 33,000. In the Markit report, the healthcare industry expanded at the lowest rate since December 2017.

The best part of this report was the growth in technology and consumer goods. With real wage growth so solid, it’s no surprise consumer spending growth is strong. Both had the fastest growth in 4 months. Tech was the strongest and consumer goods was second. The financial sector was the worst as it was the only one with an index below 50. That was the first sub-50 reading since January. This sector doesn’t like low yields and a flat/inverted curve.

Sequential Global Weakness Driven By Services

Now let’s look at global PMI data. Similar to the US, the global service sector PMI played catch up with the weakness in manufacturing. The slowdown is spreading and can’t only be blamed on trade now. The global services PMI fell from 52.5 to 51.8 in August which was a 3 month low and one of the worst readings in the past 3 years. Global service sector business sentiment was the worst since the calculation started in October 2009. The future activity index fell from 58.9 to 57.4. The new business index fell from 53.2 to 51.9 which signals the lowest growth rate in over 3 years.