via Zerohedge:

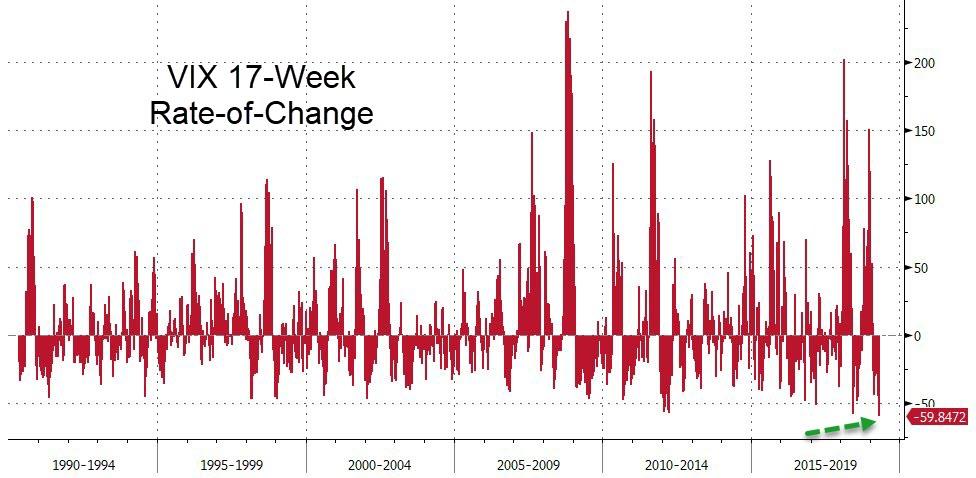

Last week we noted that something unusual had happened in the equity market volatility complex. Specifically, VIX had collapsed at its fastest pace in history.

From over 36 to almost a 10 handle a week ago, the Fed’s flip-flop had re-energized the sell-vol-at-all-costs trade that has become the bread-and-butter of so many of newly-minted ‘gurus’ in this market.

As we pointed out, this was the biggest drop year-to-date and the biggest 17-week collapse in risk since records began (in the last ’80s)

But things changed a little this week as the S&P (thanks to a panic bid at the close on Friday) pressed up to near its record intraday high, VIX ended the week higher…

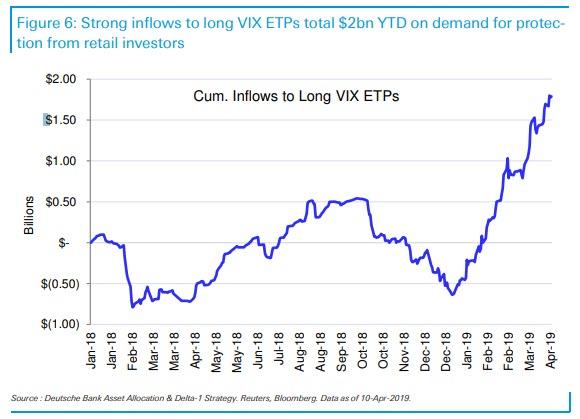

However, as we highlighted previously, when it comes to volatility-based asset flows in 2019, the picture is confused at best (remember, the S&P rise back to all time highs has occurred even as equity investors have been pulling money from equity funds week after week).

Commenting on the latest VIX flows, Deutsche Bank’s Parag Thatte reiterates JPMorgan’s point, observing that long VIX ETPs have seen significant inflows totaling $2bn YTD, as retail investors hedge equity gains. This record inflow into VIX ETPs, amounting to $2 billion in notional, is shown on the chart below.

Yet while retail investors, which traditionally prefer ETPs to hedge exposure, have been loading up on crash bets, institutional investors which traditionally prefer the greater liquidity of the futures market, are taking the other side of the volatility trade and as the latest CFTC commitment of traders report shows tonight, the speculative net short position in VIX futures has broken to a new record – the greatest short VIX position ever.

If one believes institutions, one look at the chart above confirms that market complacency is greater than it was either ahead of the Q4 mini bear market and February 2018 Volmageddon.

Ignoring the steam-roller of yield curve compression that signals this nickel-picking-up-plan won’t end well…

But we are sure all those specs will know when to exit their position and escape unharmed.

They better hope that global money supply keeps surging…

So who will be right – retail or institutions. Since both positions are at record levels, the answer should emerge in the very near future.