Chinese banks quietly lower daily limit on foreign-currency cash withdrawals

-

Lenders have reduced the ‘scrutiny benchmark’ for US dollar withdrawals to US$3,000 from US$5,000 on the instructions of the central bank

Chinese banks have increased their scrutiny of foreign-currency withdrawals and quietly reduced the amount of US dollars people are allowed to withdraw, tightening the country’s capital controls as the nearly year-long US-China trade war bites.

The issue was thrust into the spotlight on Friday when a viral video clip showed a bank cashier unable to answer a furious customer demanding to know why she was not allowed to withdraw US$200 from her dollar-denominated account, even though she was within her quota.

The client was so incensed by the refusal that she filmed the incident on her phone at the unidentified branch of China Merchants Bank (CMB).

She also asked why the bank insisted she could only withdraw her US dollar savings by converting into yuan, the Chinese currency. The cashier seemed caught off guard, unable to address the woman’s questions.

It later emerged the woman had been placed on a “watch list” of customers making frequent withdrawals.

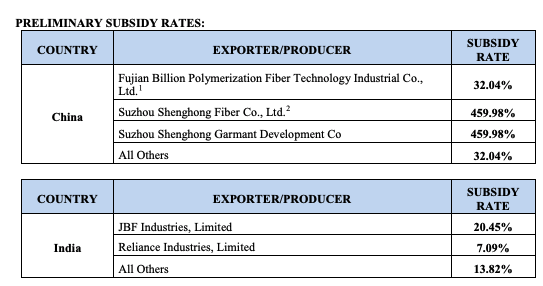

The US Department of Commerce (DoC) announced earlier this week that countervailing duty investigations discovered polyester textured yarn from China and India were unfairly subsidized, damaging American producers. In response, the DoC is expected to slap Chinese producers with tariffs of between 32% and 460% and Indian producers of between 7.1% and 20.5%, reported the DoC Office of Public Affairs.

The DoC notified US Customs and Border Protection (CBP) about the issue, has instructed all customs agents to collect only cash deposits from importers of the yarn from China and India based on the preliminary rates below.

The deepening trade war comes as two American yarn producers claim in petitions that China and India have severely crippled their domestic operations by dumping low-cost, subsidized imports of yarn into North American markets.

“This is an important issue with respect to US producers of fiber and textile products,” the petitioners’ attorney, Paul Rosenthal of Kelley Drye & Warren in Washington, DC, told Law.com in an interview Thursday. “We’re happy that our allegations concerning subsidies by the Chinese and Indian governments have been found to be accurate and has resulted in some preliminary duties.”

The petitioners are Unifi Manufacturing Inc. in Greensboro, North Carolina, and Nan Ya Plastics Corp. in Lake City, South Carolina, have demanded that DoC impose antidumping and countervailing tariffs on foreign subsidized yarn. The DOC said a preliminary determination on the antidumping duties would be announced shortly.

The final decision on duties by the DoC will be made in the next three to five months. In the meantime, Chinese and Indian yarn producers are subjected to increased countervailing duty payments of 20% to 460%.

China March Automobile sales -6.88%. Vehicle Production -2.7% YoY

3M Average Automobile Sales -13.98% #ThinkTank pic.twitter.com/HjJRpER59D— Real Vision Research (@RVAnalysis) May 4, 2019