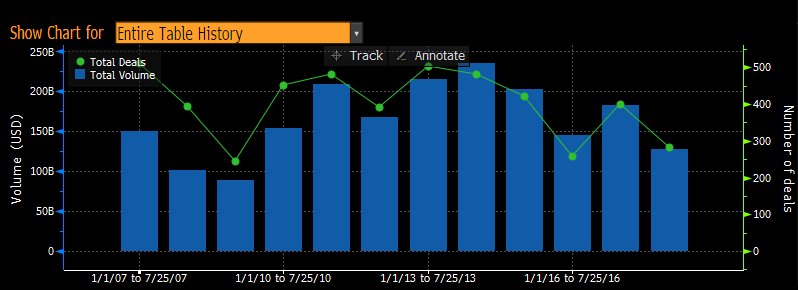

U.S. high-yield bond sales are on track to be the lowest for a year since 2009.

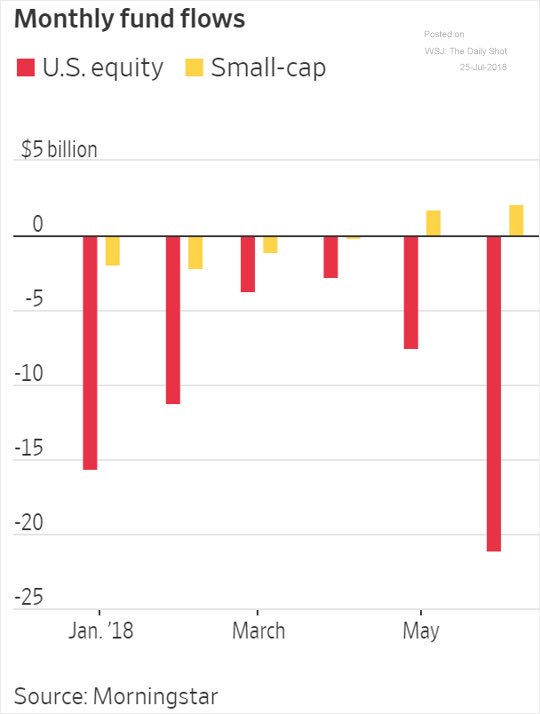

Another recent shift in performance away from #SmallCaps could start to reverse #FundFlows

@WSJ @soberlook @MorningstarInc

Stock Outflows Swell as Investors Seek Refuge in Bonds

“Flattening curve reengaged!” h/t @TheBondFreak $TLT $TNX

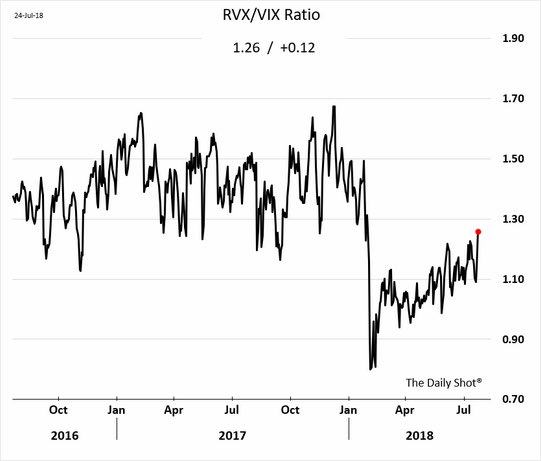

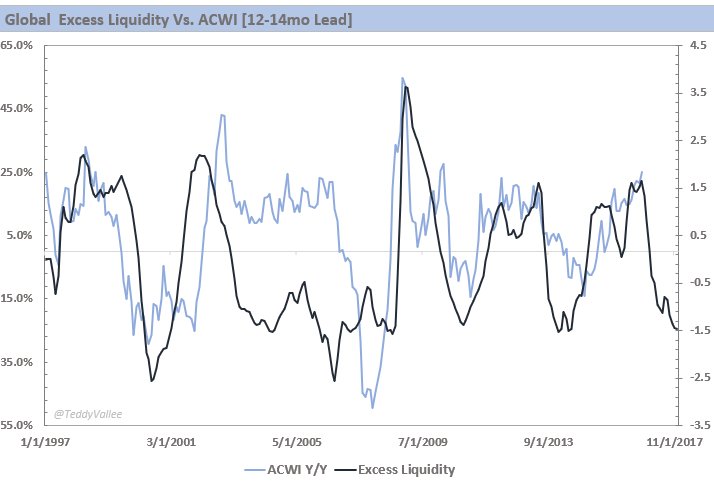

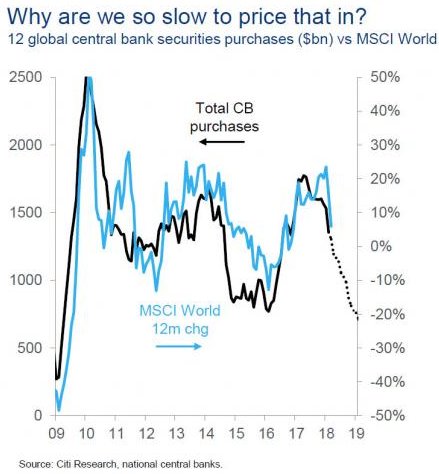

One of the more important charts of 2018.

US 5-Year Notes:

– High Yield: 2.815% Vs 2.719%

– B/C: 2.61 Vs 2.55

– Direct: 8.7% Vs 9.5%

– Indirect: 67.2% Vs 62.0%

– WI: 2.825%— LiveSquawk (@LiveSquawk) July 25, 2018

US 2-year debt cost hits decade high after Trump’s remarks

Nasdaq–19 hours ago

The Treasury Department sold $35 billion of two-year government notes at a yield of 2.657 percent, the highest at an auction of this maturity since July 2008, …

Views: