Wolf Richter wolfstreet.com, www.amazon.com/author/wolfrichter

But it’s curing a housing crisis where middle-class households are priced out of a market, inflated by rampant international speculation and large-scale money laundering, says BC’s Finance Minister.

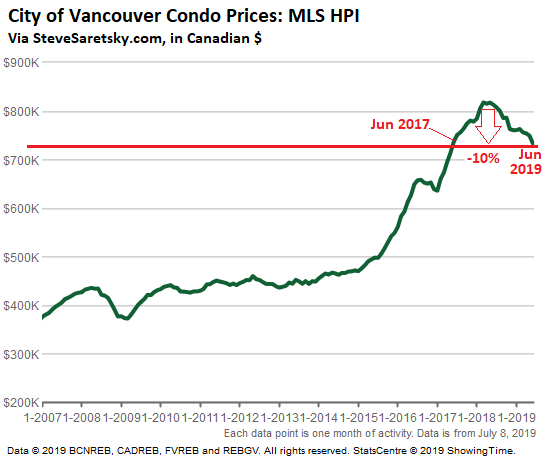

In the City of Vancouver, BC, Canada, condo sales in June plunged 28% from the already weak June last year to just 343 units. Inventory for sale jumped 32%. Prices – however you slice them – follow volume and supply: The median

In Greater Vancouver, condo sales – the largest segment in the market ahead of detached houses and town houses – plunged 24% from June last year to just 976 units, the lowest number of sales since 2002.

“This is particularly concerning, given this doesn’t account for the increase in population growth and new condo stock during that time period, says Vancouver Realtor Steve Saretsky, in his June report on the Vancouver housing market.

Inventory of condos for sale in Greater Vancouver rose 48% from June last year to 5,887 units, for over six months’ supply. The median price fell 7.4% year-over-year to C$565,000. The MLS Home Price Index for condos, fell 8.9% to $C654,700.

And it gets a lot worse: detached houses.

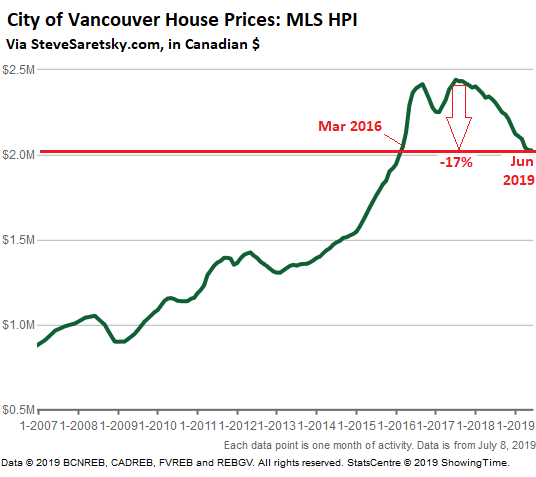

In the City of Vancouver, sales plunged 16% to 151 houses. Inventory ticked down to 1,614 houses, as dispirited sellers pulled their houses from the market, leaving the market with about 11 months supply.

Prices inevitably follow volume and supply: The median price dropped 12% year-over-year to C$1.78 million. The average price fell 14% year-over-year and has now plunged 28% from the twin peaks in April 2016 and in October 2017 (each at $3.08 million), representing a decline of C$876,000. This is starting to be real money.

The MLS HPI for detached houses in the City of Vancouver has dropped 17% from the peak in July 2017, to C$2.025 million, the lowest “benchmark” price since March 2016:

In Greater Vancouver, detached houses, the second largest segment behind condos, is confronted with a market where buyers and sellers are too far apart to make deals. Sales in June plunged 61% from the peak in 2015, to just 761 units, the fewest transactions in the data going back to 1991 (when there had been 1,931 sales). Inventory for sale in Greater Vancouver rose to 7,025 houses.

The median house price in Greater Vancouver fell 9.4% year-over-year to C$1.284 million. The average price fell 14% to C$1.51 million.

“Buyers remain very cautious, and low-ball offers have become commonplace,” said Saretsky, who is also the author behind Vancity Condo Guide. He added: “When priced right, there is still adequate demand willing to provide liquidity.”

“Priced right” – that’s what the market is currently trying to figure out. And sellers are grappling with what that price means for them.

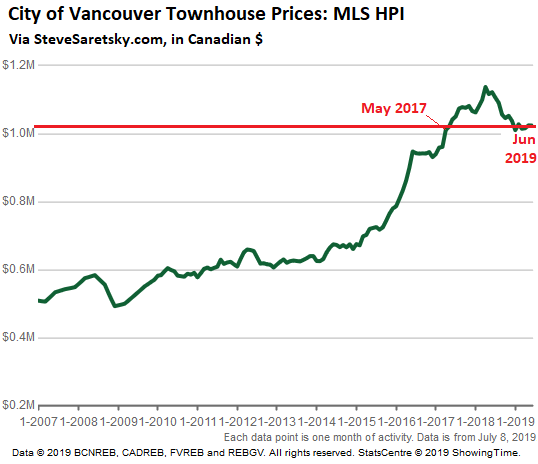

Townhouses galore, suddenly.

Townhouses confront a similar fate. In Greater Vancouver, sales in June fell 8% year-over-year to 341 units, as inventory for sale jumped 42% to 2,017 units. And the median price fell 10% to C$735,000.

In the City of Vancouver, the median price of townhouses fell 13% to C$955,000. And the “benchmark” price of the MLS HPI for townhouses, at C$1.024 million, is now down 10% from the peak in April 2018:

“Prior to the start of the year, many market watchers and industry pundits alike rightfully noted the importance of the spring market, suggesting it would dictate what to expect for the year ahead,” said Saretsky. “After a sluggish finish to 2018 and an equally weak start to 2019, there were hopes the historically resilient Vancouver housing market could shrug it off. However, month after month that proved not to be the case.”

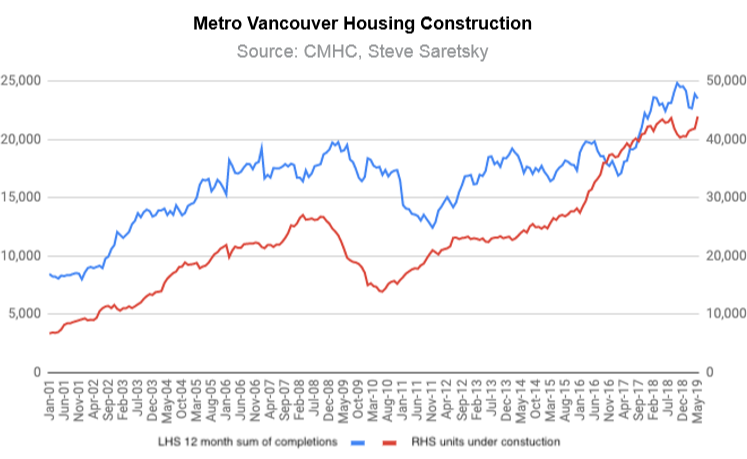

Now come the fruits of the building boom…

After years of a blistering building boom, a record number of new housing units are or will be coming on the market in Greater Vancouver. Saretsky, citing data from the Canada Mortgage and Housing Corporation (an entity of the Canadian government), points out that an all-time record of 43,000 units are under construction (red line, right scale) and an additional 23,000 units have been completed (blue line, left scale) over the past 12 months:

But it’s working…

Carole James, British Columbia’s Minister of Finance and Deputy Premier, expressed her approval with these developments, as a cure to the housing crisis in Vancouver, where local households with middle-class incomes are still priced out of the market that has been inflated by rampant international speculation and large amounts of money laundering, into one of the world’s craziest housing bubbles that is now, apparently satisfactorily, deflating.

She tweeted: “Through measures like the Speculation and Vacancy Tax and our world-leading work to end hidden ownership, we’re tackling the housing crisis and money laundering head-on to build a more sustainable economy that works for everyone.”

And she tweeted: “We’re leading the country in our work to ensure that housing is used for people, rather than a haven for speculation or worse, money laundering. I’ll continue to watch the housing trends closely but am cautiously optimistic that the housing market is returning to balance.”

And she tweeted: “After years of skyrocketing prices we’re finally starting to see more balance in the housing market. We’re seeing moderation in the cost of condos, townhomes and detached homes, while housing supply is at a five-year high.”

Let her rip – that’s the message. And kudos. It’s not common that governments express support for the deflation of these kinds of destructive housing bubbles. What we’re used to seeing instead are desperate governments calling for an immediate reflation and bailout, whatever the real costs to society may be.