Just remember, the US economy had strong employment figures just prior to the 2008 Great Recession and financial crisis, so US Treasury Secretary Yellen, Biden’s economic cheerleader Bernstein and Obama’s economic cheerleader Sperling are all relying on a bad indicator of economic health to justify that the US economy is in great shape.

(Bloomberg) — Treasury Secretary Janet Yellen expressed confidence in the Federal Reserve’s fight against inflation and said she doesn’t see any sign that the US economy is in a broad recession.

“We’re likely to see some slowing of job creation,” Yellen said on NBC’s “Meet the Press” on Sunday. “I don’t think that that’s a recession. A recession is broad-based weakness in the economy. We’re not seeing that now.”

With US consumer prices rising at the fastest rate in four decades, a growing number of analysts say it will take a recession and higher joblessness to ease price pressures significantly. The Federal Reserve raised rates in June by the most since 1994 and is expected to approve another 75 basis-point hike this week.

Inflation is “way too high,” Yellen said, while renewing the Biden administration’s argument that it’s also high in many other advanced economies.

“The Fed is charged with putting in place policies that will bring inflation down,” said Yellen, a former Fed chair. “And I expect them to be successful.”

Dammit, Janet. All of Biden’s anti-fossil fuel orders are still in place and Biden/Pelosi/Schumer are still trying to pass the highly-inflationary Build Back (Inflation) Better bill. And The Fed still has not shrunk it massive balance sheet yet.

But Janet, the US Treasury 10Y-2Y yield curve remains inverted (historically ahead of a recession) while the Atlanta Fed GDPNow Q2 tracker is at -1.6% which would make the second quarter in a row of negative real GDP growth in a row (historically a definition of recession).

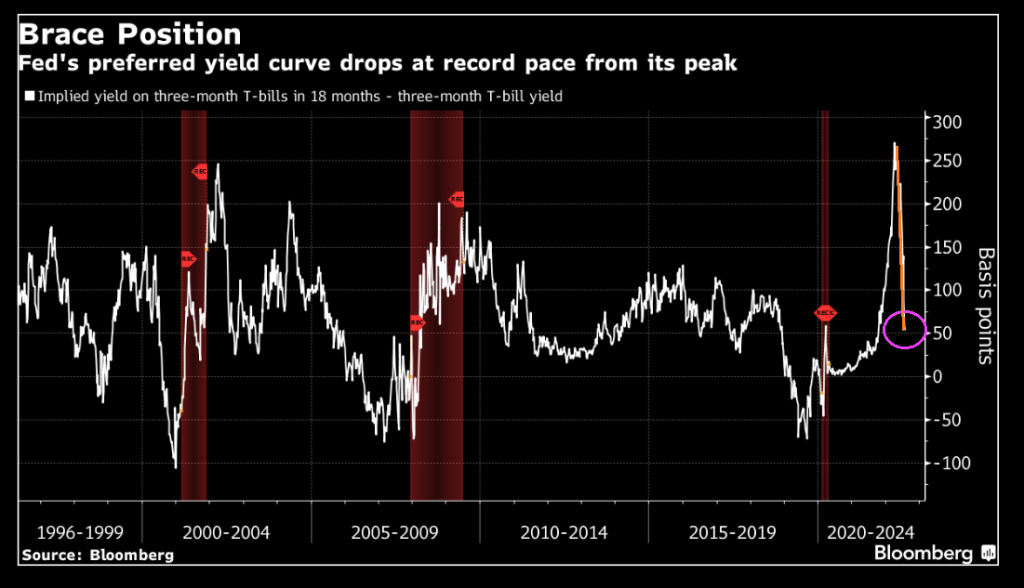

But in Yellen’s defense, The Fed’s preferred yield curve (implied yield on 3-month T-Bills in 18 month – 3 month T-Bill yield) is still positive, though crashing like a paralyzed falcon.

So, the Biden administration is sticking to the strong labor market story. But what the Biden Administration (and Yellen) fail to acknowledge is 1) unemployment is a lagged indicator of a recession (unemployment was low prior to the 2008 GREAT recession, then exploded and 2) there is still a tremendous amount of monetary stimulus outstanding that The Fed has taken away … yet.

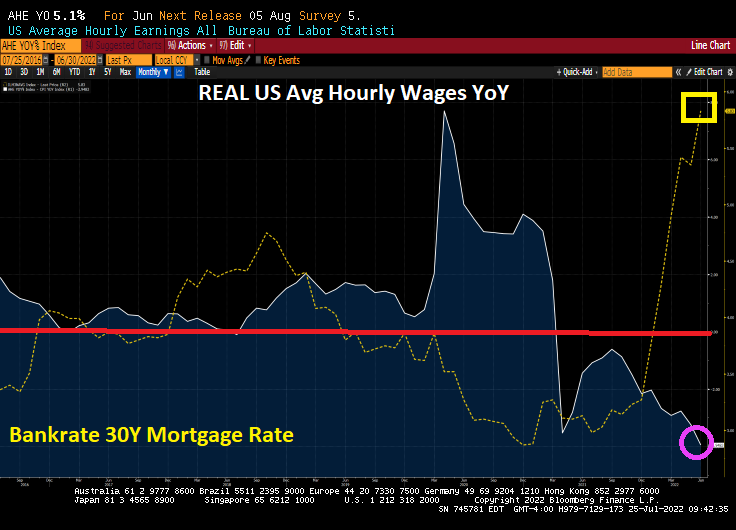

Essentially, the Biden Administration is panicking over the coming mid-year election and will say anything at this point to stay in power. So, I would probably ignore anything said by Biden, Yellen and their talking heads before the midterms elections. But when Biden’s economic advisor says that the US economy is strong, I want to ask him how having NEGATIVE wage growth is a good thing,

Let’s see if Yellen is correct and The Fed’s Fireball will tame inflation. Frankly, I think the global slowdown is the only thing that will tame inflation.