Authored by Sven Henrich via NorthmanTrader.com,

As long time readers know I’m a big fan of $VIX technical structures and compression patterns. Often dismissed as non-chartable I think we’ve successfully to put that argument to bed a long time ago.

Recently in “Key Charts” I again outlined the $VIX as one of the key charts to watch and it’s been interesting to say the least here during this OPEX week and hence I wanted to outline an update as a pattern is forming that suggests a major $VIX uprising may be in the cards this fall.

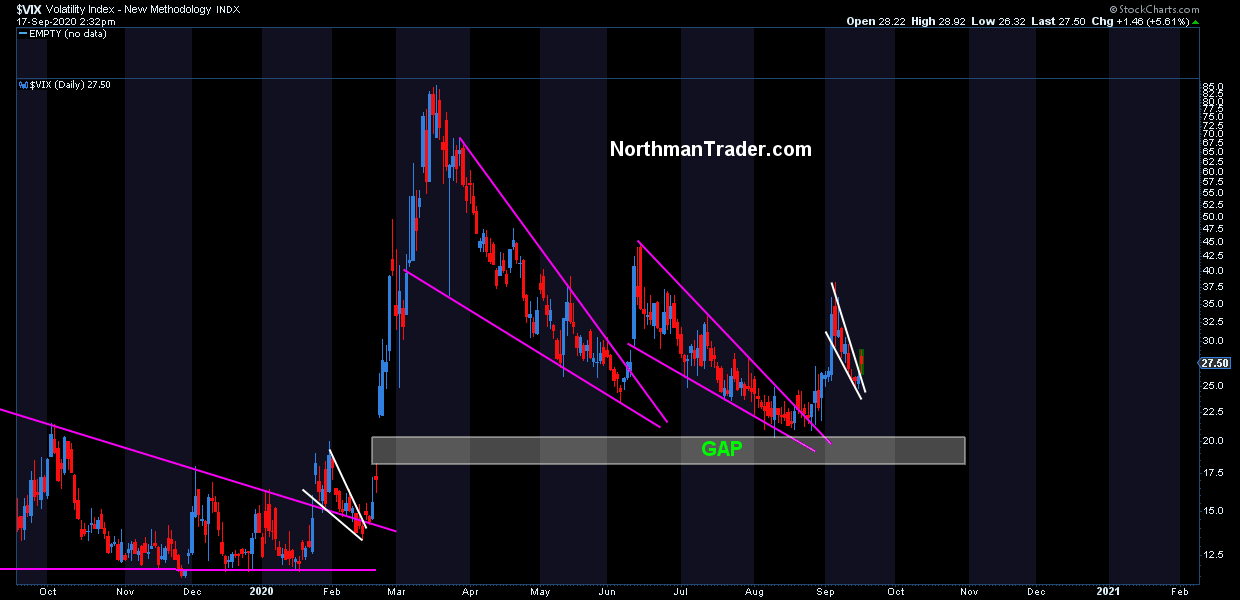

Yes, $VIX again came under pressure into monthly $VIX futures monthly contract roll-over, but interestingly it didn’t manage to fill the August gap which would have been standard fare if you will:

The good news for bulls may be as now 3 open gaps have formed on the futures contract. As ultimately all $VIX gaps fill there is something to look forward to eventually for bulls. But for now the $VIX keeps telling a larger story that’s a lot more ominous.

In a way I regard the $VIX an expression of central bank control and their self declared mission to “calm” markets. During the most successful times of central bank interventions in recent years the $VIX was very much compressed and contained. Yet, despite trillions of interventions and the deceiving highs on indices such as $SPX and $NDX volatility has remained stubbornly high, all a reflection that perhaps central bank control is not as strong as it appears. The $VIX is anything but calm.

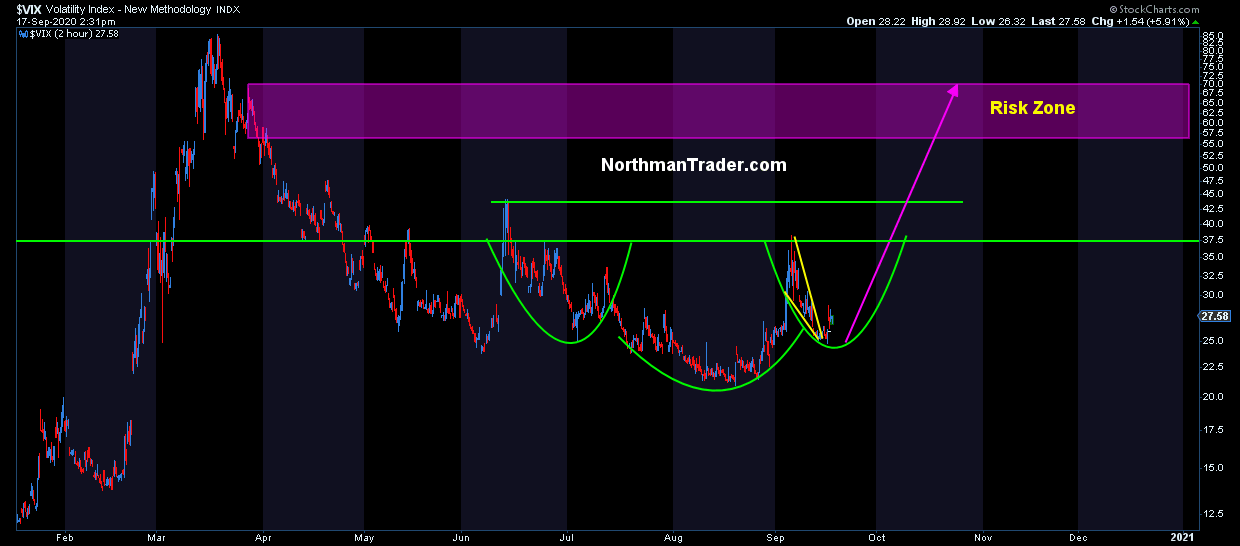

And so we can observe that following the latest breakout of the $VIX (and leading up to the compression phase of this OPEX week) $VIX again broke out of a smaller compression pattern:

In recent months $VIX has gotten crushed during every Friday like clockwork and perhaps it will again this Friday.

That’s not the issue.

The issue is that all of these repetitive structures are forming what could be a much more ominous pattern that could even exceed my previous 46 target.

The structure? A potential larger inverse pattern:

First point to make: This pattern at this stage is unconfirmed and it’s likely going to take some time to build fully. But this week’s low in the $VIX matches up nicely with the July left shoulder and this summer’s low volume rally and summer lows in the $VIX have formed a very clean head structure and the recent surge to 38 and subsequent drop this week have begun the process of forming a right shoulder.

How can this play out? What would confirm it? There are many possibilities of course. Since we’re just at the beginning of the right shoulder formation we may, for example, have a quick spike toward the neckline, and then another rally in markets from there compressing the $VIX again. All of this would ironically firm the structure and make it potentially very potent into the October and November time frame, i.e. into the US election.

The potential fire power of the pattern will have to be monitored as the pattern develops, but currently it suggests a $VIX spike into the 55-70 range if the pattern confirms which would come with a break above the neckline.