The markets are at a crossroads.

We’ve had one major rally this week (Monday).

We’ve had one major drop this week (Tuesday).

The issue is which one was the real deal. Monday could easily have been the result of short-covering and “start of the month” buying by financial institutions.

Similarly, Tuesday could have been the markets dropping simply because China issued a warning that it believes U.S. stocks are “in a bubble.”

Honestly, it’s impossible to tell. The market is a bit of a mess. So, the best thing to do is wait and watch today as the markets will finally provide some clarity. One of the greatest trader’s adages is “when in doubt, stay out.” And that certainly rings true for the market this week.

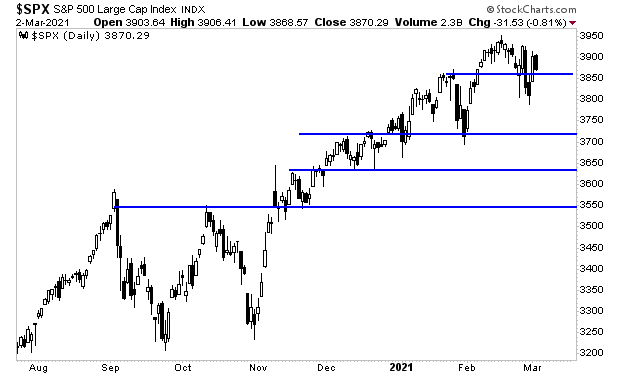

For the S&P 500, the support is at 3,860, 3720, 3,640, and 3,550. If stocks take out this first line (3,850) on a closing basis, it opens a “trapdoor” to a nasty drop to the low 3,700s. This is a BIG reason not to be adding to longs this week.

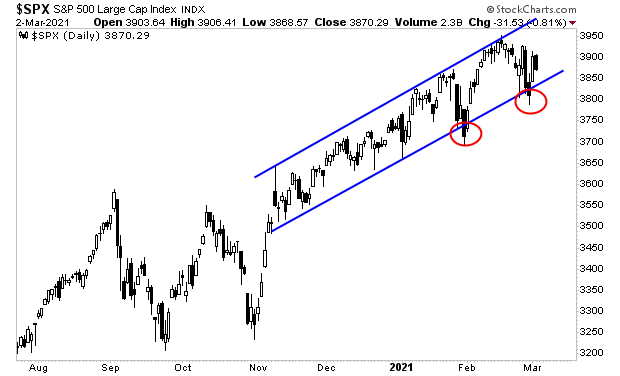

Similarly, if you are a stock market bear, you don’t want to ignore the strong uptrend stocks have established over the four months. We’ve had two “bear traps” during that time in which stocks broke down, violating the trendlines only to reverse and rally hard. I’ve identified those occasions with red circles in the chart below.

If you’re a bear, these are why you don’t want to bet on a big collapse right now: stocks could breakdown only to reverse and take you to the cleaners.

So again, the best strategy this week is to “watch and wait.” Let the market show you what is coming and then take action.

Bear in mind, we’re talking strictly about TODAY, as in right now. In the intermediate term, I remain extremely bearish.

Why?

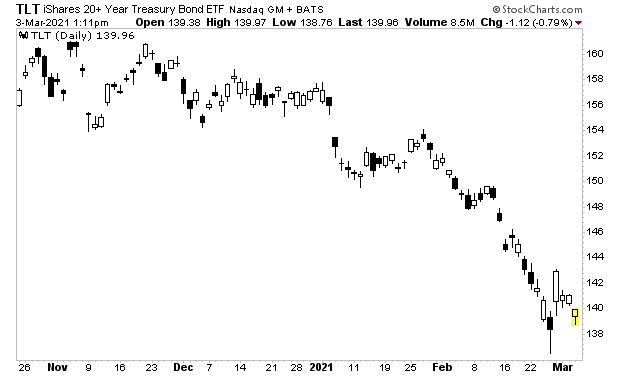

Because inflation is blowing up the bond market. Bonds bounced a few days ago, but are once again rolling over and falling.

Put another way, the issue that blew up the stock market late last week has not been resolved. If anything, it’s about to get worse.

Which means stocks could very easily be a bloodbath in the coming weeks.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the public.

To pick up your copy of this report, FREE, swing by:

phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research