While most interpreted the FOMC minutes as dovish, we don’t necessarily share that view ahead of a week when US ISM, geopolitics and European inflation take centre stage. Will the US momentum continue to hold up against the rest of the world?

Read our financial forecast here.

TARIFF RISKS AND THE ROCKET MAN ARE BACK IN TOWN

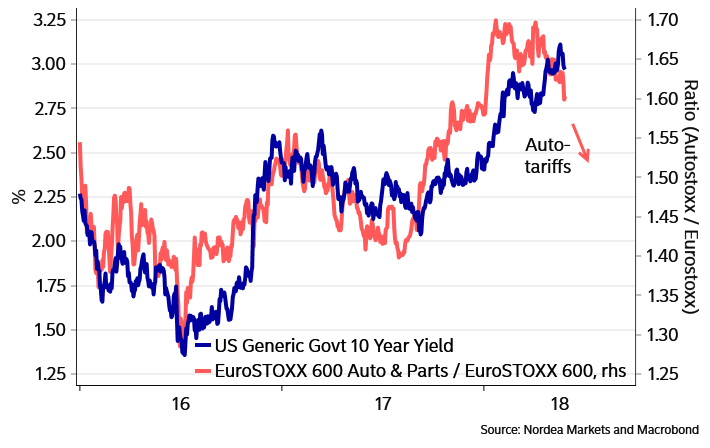

It has been another week of bumpy risk appetite, as both tariff risks and North Korea have entered the frame again. We warned a few months back that Auto tariffs would be the obvious next target for Donald Trump (FX weekly: “Taxation mirror on the wall, who is the fairest of them all?”) given the discrepancies in the import-taxation of Autos between the US and Europe (and the US and China for that matter). The concept of mirror-taxation that Trump launched at his press meeting on the steel and aluminium tariffs thus stills seems to be at the top of the US president’s agenda.

While the market overestimated the Trump risks a few months back, we now tend to think that risks are more balanced or even tilted towards Trump re-rocking the market boat. The market repercussions of a renewed focus on tariffs and the breakdown of North Korea talks are relatively clear. If North Korean tensions increase again and if Trump decides to launch auto tariffs, it will take its toll on risk appetite in general and likely also be a game-changer for the current USD positive market environment (at least initially).

CHART 1: WEAKER AUTOSTOXX USUALLY COINCIDE WITH LESS UPSIDE PRESSURE ON LONG BOND YIELDS

DOVISH FOMC MINUTES? FAKE NEWS

While you can read the Fed’s tolerance towards overshooting on inflation as dovish news, the primary reason behind the dovish shift in the fed funds pricing in the aftermath of the minutes was the comment on a potential 20 bp hike in the IOER rate instead of a 25 bp hike.

The Fed wrote “Since the target range was established in December2008, the IOER rate has been set at the top of the target range to help keep the effective federal funds rate within the range. Lately the spread of the IOER rate over the effective federal funds rate had narrowed to only 5 basis points. A technical adjustment of the IOER rate to level 5 basis points below the top of the target range could keep the effective federal funds rate well within the target range.”

So the re-pricing of the front of the Fed Funds curve was much more about technicalities than actual dovish policy signals. Something that was misinterpreted by many commentators – and likely also the reason why the USD did not react negatively to the minutes.

The FOMC mentioned the word “symmetrical” eleven times in the minutes (Fed comment: On track), indicating that they are willing to tolerate overshooting inflation short term. However, we don’t consider this a particularly dovish policy signal, but rather see it as prudent risk management from the Fed. As the Fed is obviously not in control of short-term fluctuations in inflation, the FOMC has simply adjusted the language to minimise the negative market impact of the almost certain overshooting inflation.

CHART 2: ONLY FED FUNDS PRICING REACTED DOVISHLY TO THE FOMC MINUTES, NOT THE USD

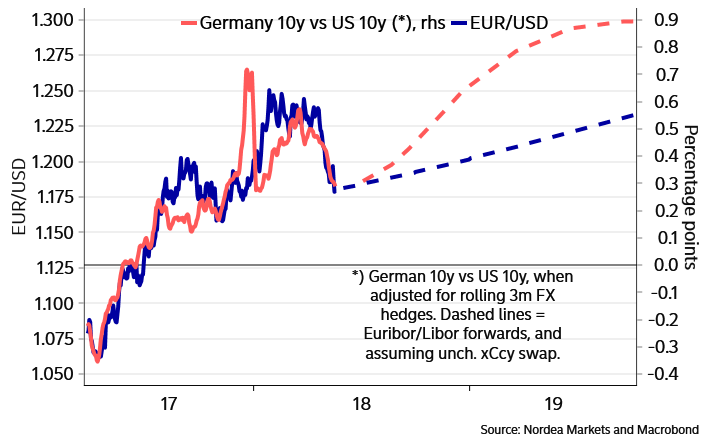

And while this symmetrical inflation focus from the FOMC may sound USD negative at first glance, it is not necessarily bad news for the USD. Since 2016, periods of relative steepening of the USD curve versus the EUR curve have coincided with a stronger USD, as a steeper USD curve invites partially FX hedged international bond flows into US.

Our bottom line is that tolerance towards inflation could prove temporarily USD positive via a relative steepening of the USD curve. Recently, the core inflation spread widening between the US and Japan, the UK and the Euro area has been a key driver of the USD gaining versus most peers. Our newly updated G10 forecasts also include a short-term expectation of a stronger USD.

CHART 3: OVERSHOOTING INFLATION LEADS TO A STEEPER USD CURVE AND A STRONGER USD

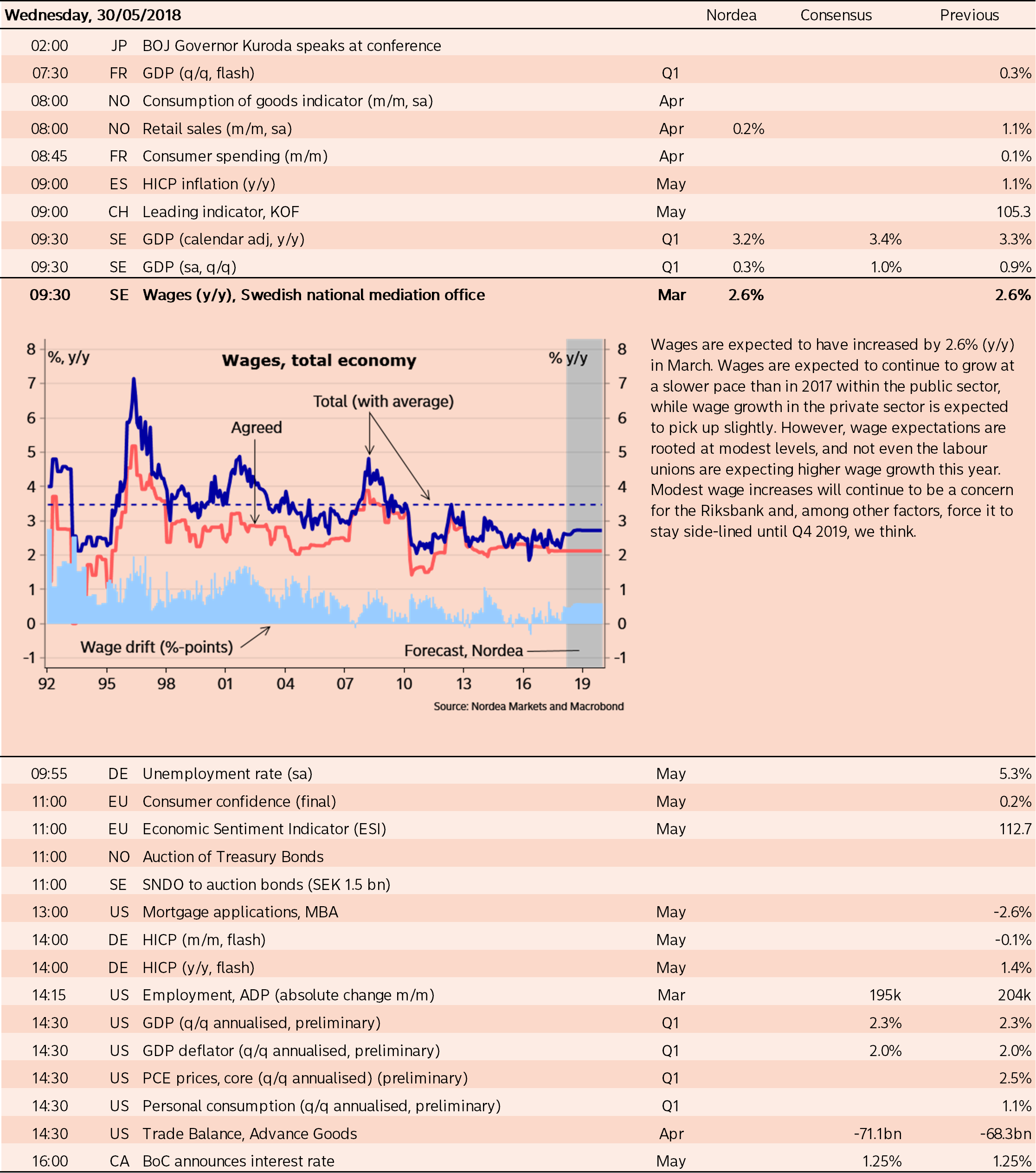

ECB TO FACE HIGHER HEADLINE INFLATION, BUT WEAK CORE INFLATION AND GROWTH MOMENTUM

On the EUR side of the equation, the ECB meeting in a few weeks’ time looks increasingly interesting. While our base case is that ECB will refrain from taking any policy actions in June (our base case is July), the updated staff projections could prove unusually interesting.

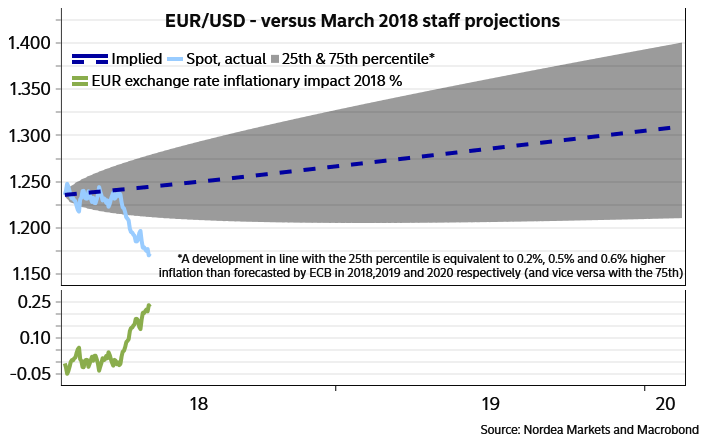

While the rising energy prices will start to surface in EUR headline inflation as early as next week, also the FX developments since the latest projection update in March argue for a higher HICP inflation path in the staff projections (currently as much as 0.25% for 2018 according to the ECB’s own methodology). This leaves a potential difficult communication task ahead for the ECB, as they likely want to sound dovish despite a higher inflation forecast.

CHART 4: THE EUR WEAKNESS SINCE THE LAST STAFF PROJECTIONS ARGUE FOR 0.2% HIGHER HICP INFLATION IN 2018

We see elevated risks that markets will put too much emphasis on rising headline inflation in the Euro area over the next months and as the market pricing of the ECB has almost collapsed recently, there is a risk that the market will reprice the ECB hawkishly from the current levels. If a hawkish re-pricing were to arise into the summer, we would prefer to fade such a move.

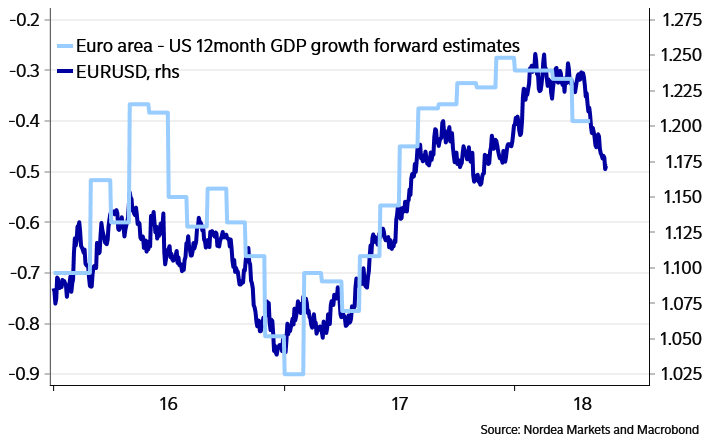

Both core inflation and growth momentum are worrying the ECB and this is maybe also what the EUR/USD currently prices in.

CHART 5: EUR/USD IS PRICING IN RENEWED GROWTH DIVERGENCE BETWEEN US AND EUROPE

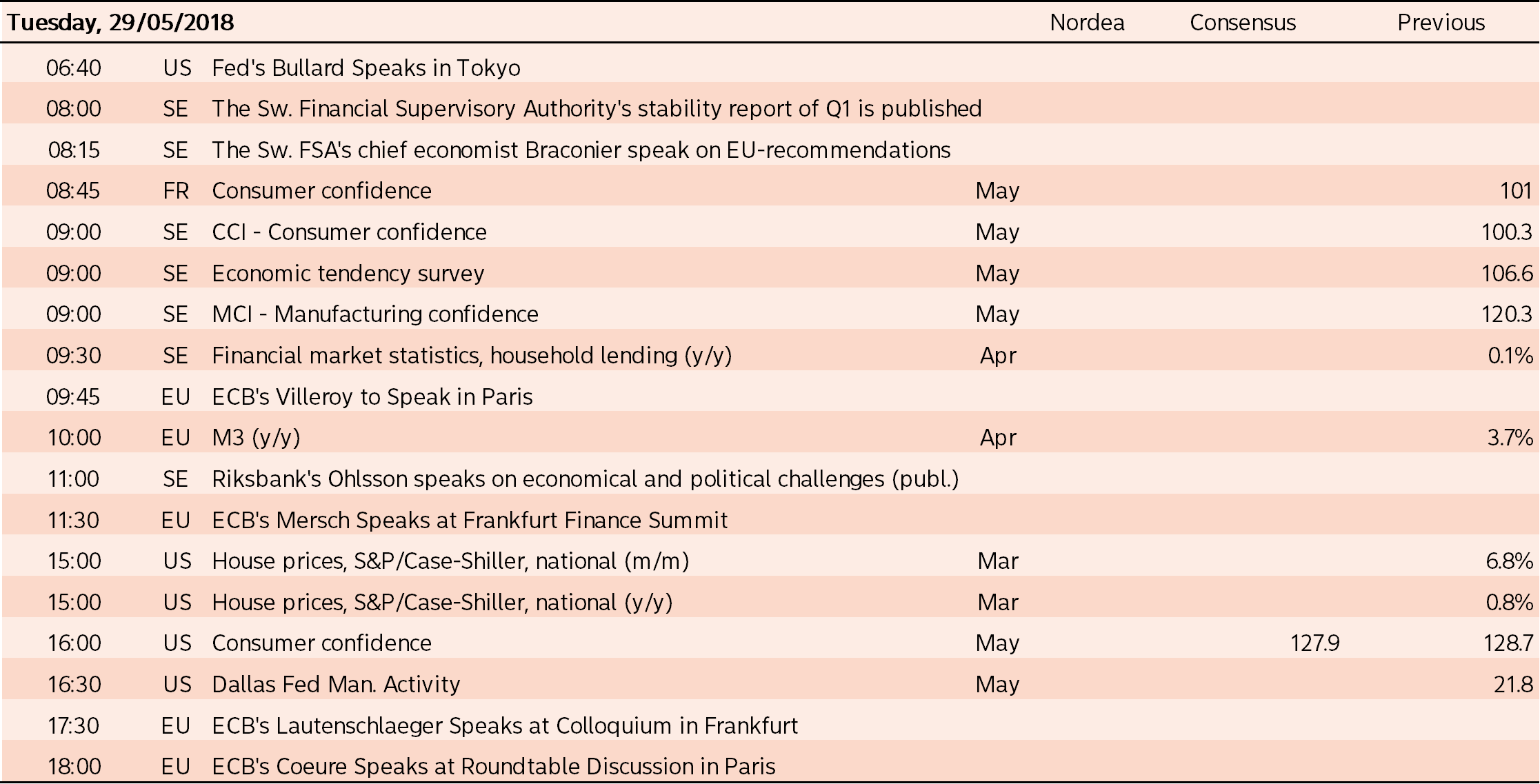

FLY, PLEASE FLY, OH SWEDISH CANARY

In terms of the European growth momentum, Mario Draghi and co. should cross their fingers ahead of the Swedish PMIs next week. Sweden is a small open export-dependent country that picks up changes in global demand faster than the Euro area. That is why the Swedish PMI tells us where Euro-area PMI will head a couple of months later.

So if the Swedish canary doesn’t fly next Friday, it is a sign that the ECB could turn even more dovish than anticipated two to four months from now.

CHART 6: IF YOU MONITOR SWEDEN, THEN YOU WILL NOW WHAT HAPPENS IN THE EURO AREA TWO MONTHS LATER

Otherwise it has been a relatively quiet week on the data front from Scandinavia. The most newsworthy story from Sweden is that the Swedish Debt Office will take a position for a stronger krona. While the flow effects are marginal from this decision (7bn SEK), the signal value could prove to be strong. The trade-weighted krona is still 1% weaker than the Riksbank anticipated for Q2 and 3.5% weaker than anticipated for Q3. The Riksbank’s KIX forecasts are consistent with EUR/SEK at 10.15 in Q2 and 9.90 in Q3.

In Norway, the AKU unemployment rate came out in line with consensus of 3.9%. But even with the economic surprise index at depressed levels in Norway, we think that the recent patch of data still argues for an unchanged rate path in June. Low inflation and high spreads in the money market argue for a lower rate path. However, higher oil prices pull significantly in the other direction. A September rate hike is still on the table.

WHAT IS MOST IMPORTANT IN THE WEEK AHEAD?

In addition to the continued developments surrounding the North Korean summit and auto tariffs, next week is relatively data-heavy in both the US and the Euro area.

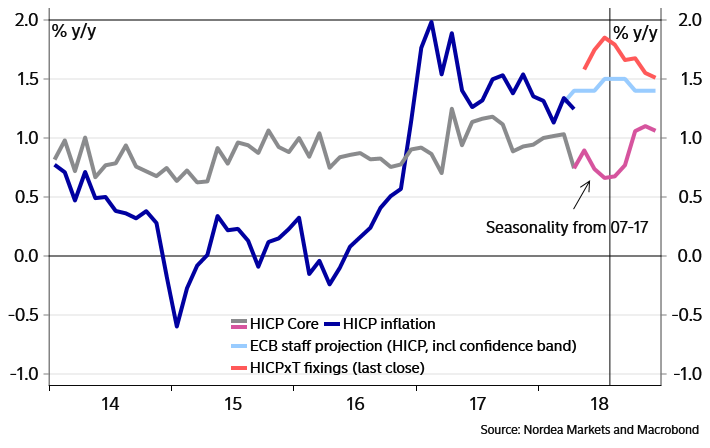

The European inflation print (Thursday) will be extra closely scrutinised by markets, as the very weak April print caused a dovish shift in market expectations for the ECB. We expect Euro-area core inflation to rebound to 1%, while headline inflation could print at 1.6%.

Given the seasonal pattern in Euro-area core inflation for the past ten years, core inflation better rebound in May, otherwise a very weak summer for core inflation could be on the cards. A rebound to 1% alongside headline inflation at 1.6% should limit the need for a further dovish repricing of the ECB short term. We get the first inflationary hints out of Germany already on Wednesday.

CHART 7: EA CORE INFLATION BETTER REBOUND IN MAY, OTHERWISE IT WILL BE A WEAK SUMMER FOR CORE INFLATION

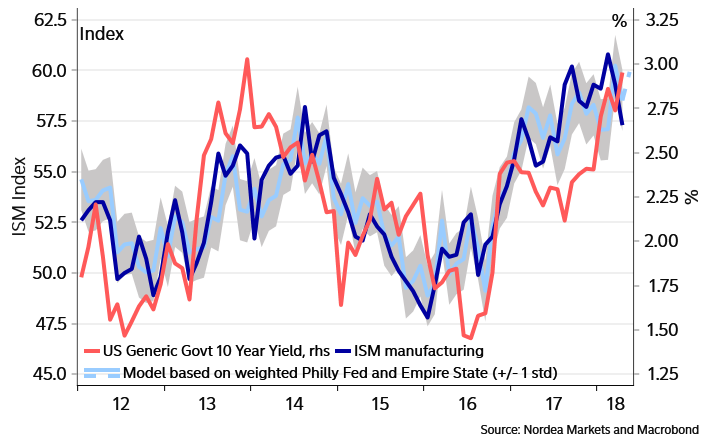

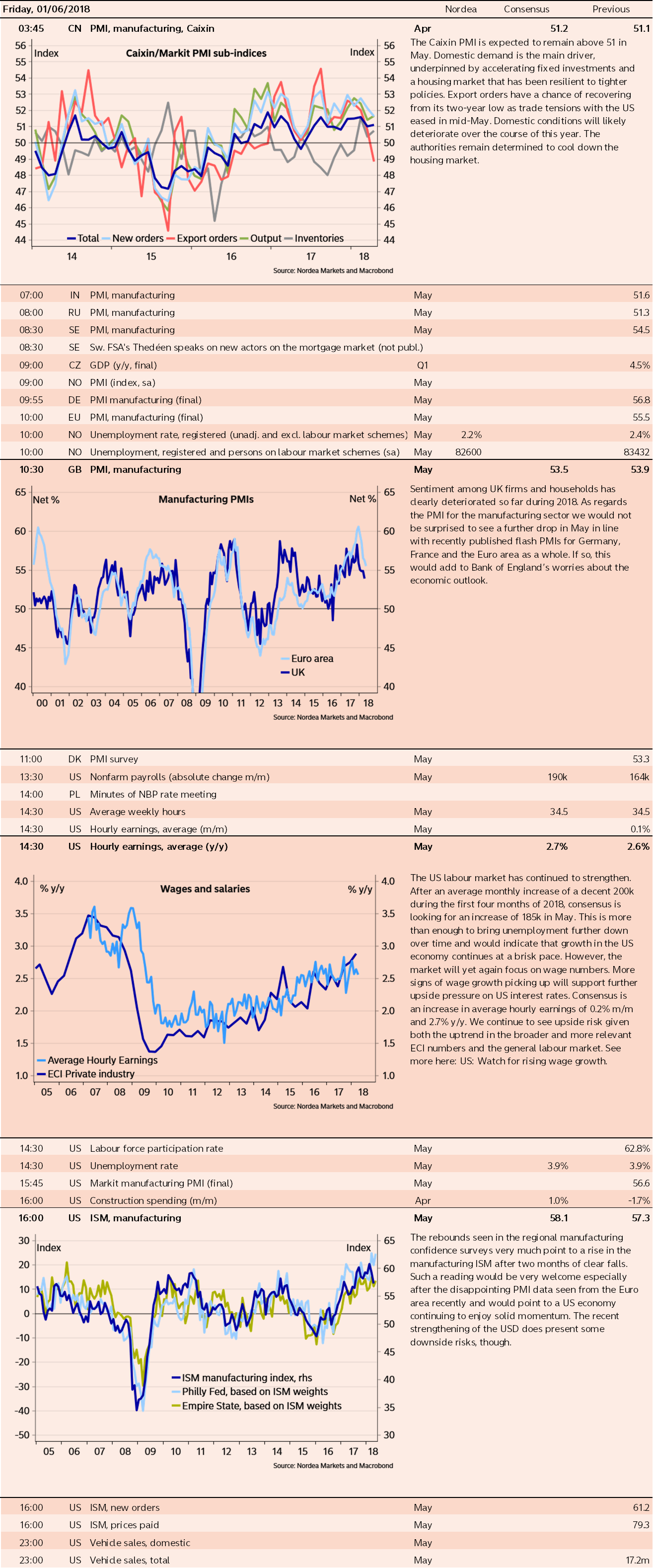

We will get new clues on whether the US will continue to outpace the rest of the world in terms of economic momentum when the ISM index is published (Friday). The regional surveys point to a rebound in the ISM. While most of this anticipated rebound in the ISM is already priced in (consensus expects a rebound from 57.3 to 58.1), it should still work to emphasise that the US is in the driving seat at the moment. But we still don’t judge that there is good risk/reward in betting on a high ISM print. Also the job report will be in focus in the US on Friday afternoon.

CHART 8: IS THE LIKELY REBOUND IN THE ISM INDEX ALREADY PRICED IN?

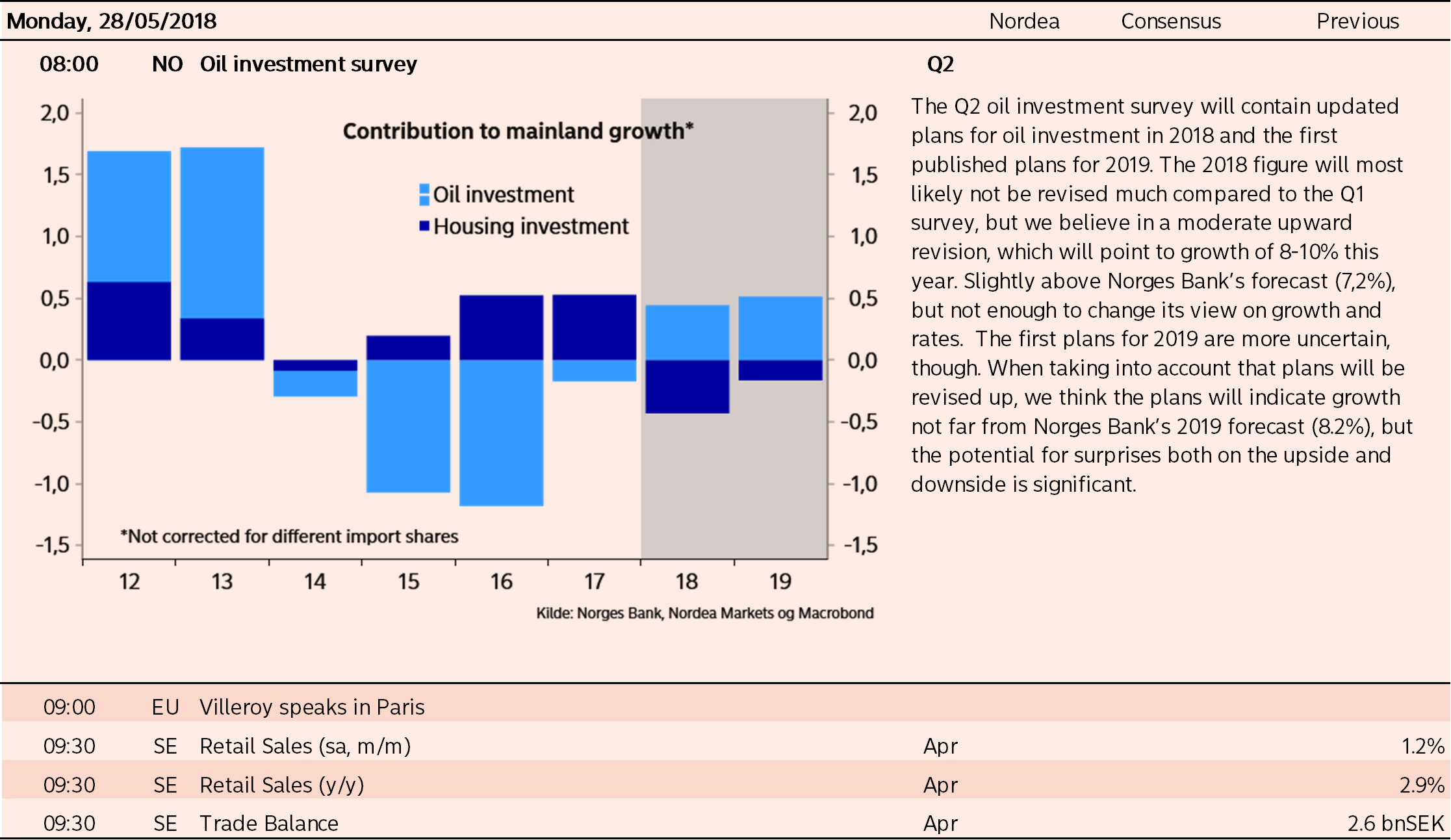

In Scandinavia, the week will kick off with the Oil Investment Survey from Norway on Monday. Strong growth in oil investment both in 2018 and 2019 is an important reason for ours and Norges Bank’s upbeat view on the economy. The rise in oil investment more than counteracts the effect of lower housing activity which follows last year’s slowdown in housing prices. We believe in a moderate upward revision of the oil investments this year, which will point to growth at 8-10%. Also Norwegian registered unemployment will be important for Norges Bank (Friday).

From Sweden, the first quarter GDP report is due out on Wednesday. We believe that GDP growth moderated in the early months of the year – and more than the Riksbank anticipates. Household consumption grew at a healthy pace, while exports flattened. On Friday the Swedish PMI is due.

Editorial by Andreas Steno Larsen, Senior Strategist

KEY RESEARCH PIECES OVER THE PAST WEEK:

Major forecasts: A temporary return of king USD

Swedish Q1 GDP preview: Downside risks to Riksbank forecast

Norway preview: Strong growth in oil investment and tighter labour market

TRY: Where do we go from here?

Should Russia fear US recession?

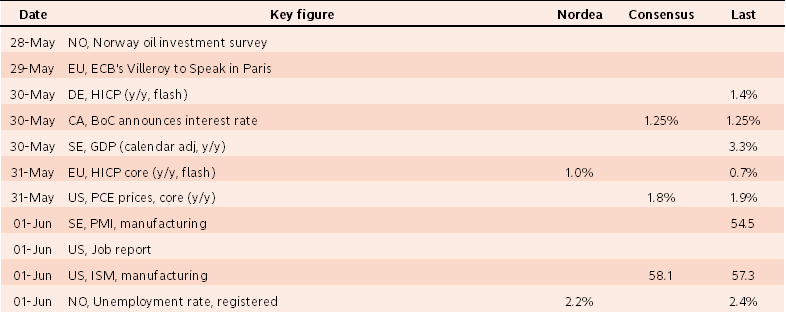

TABLE 1: MAIN RELEASES TO WATCH

MONDAY

The US and UK markets are closed today due to Memorial Day and UK spring bank holiday, respectively. In Sweden, retail sales from April are released and from Norway the Oil Investment survey is due out, but otherwise the day is very quiet on the data front. The ECB’s Villeroy (neutral) will speak during the day.

TUESDAY

Swedish and US consumer confidence are the only key releases today. A bunch of central bankers will give speeches, including the Fed’s Bullard (dove, non-voter) and ECB members Villeroy (neutral), Mersch (neutral), Lautenschläger (hawk) and Couere (dove).

WEDNESDAY

Today’s HICP figures from Germany and Spain will indicate whether the risk concerning Thursday’s Euro-area inflation numbers is to the upside or downside. In the Nordics, Norwegian retail sales are due along with Swedish Q1 GDP data. Across the Atlantic, revised Q1 GDP data are released and the ADP job report will give some indications of the outcome of Friday’s official job report. The Bank of Canada will also announce its interest rate decision.

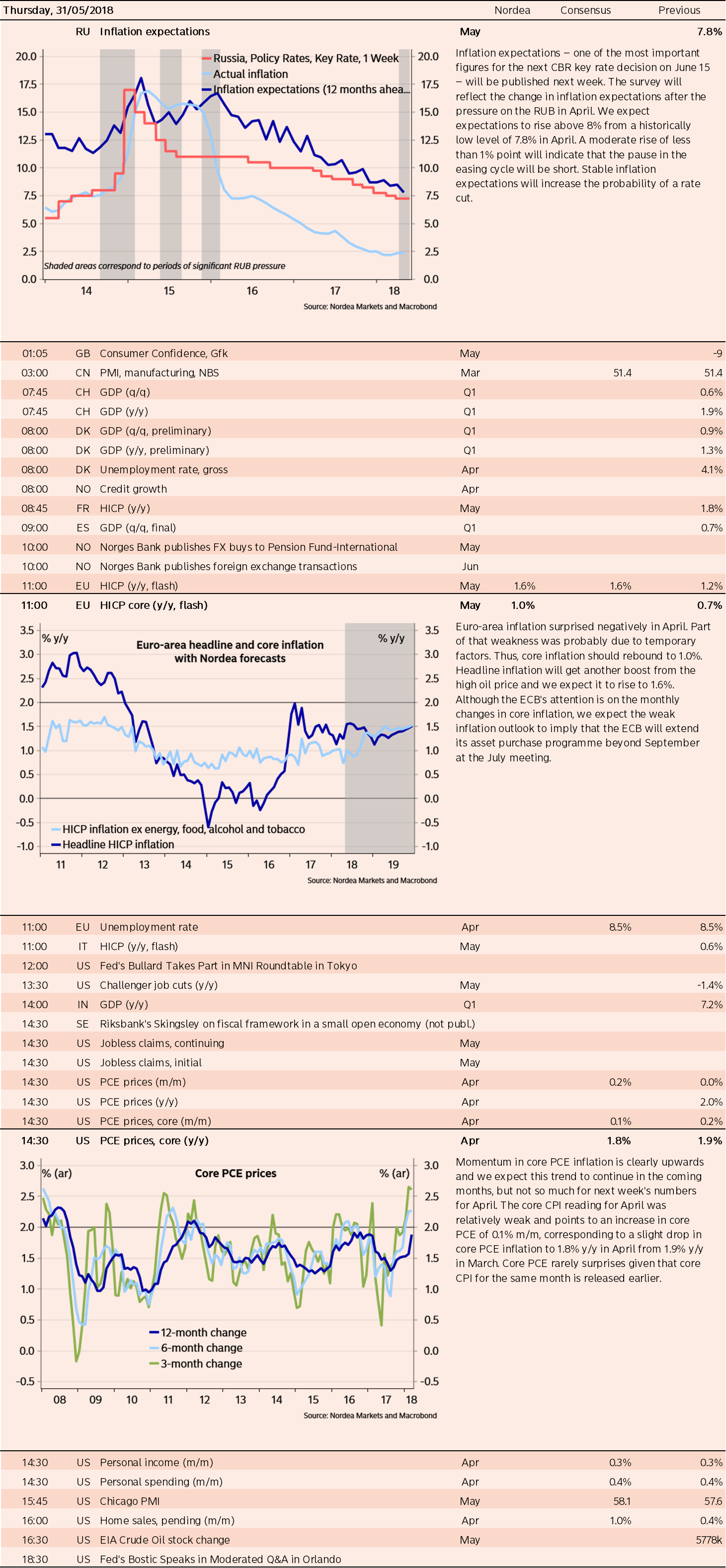

THURSDAY

Today is the big inflation day as we get both flash Euro-area HICP numbers and the Fed’s preferred inflation measure, the core PCE price index. Otherwise, the day will bring official PMIs from China and a couple of speeches from FOMC members Bostic (neutral/dove, voter) and Bullard (dove, non-voter).

FRIDAY

Today’s main release is the US job report where focus once again will be on the wage component. The day, however, also brings a lot of important growth and activity indicators, including the ISM index from the US and flash PMIs from China (Caixin), Sweden, Norway, Russia and the UK. Final PMIs from the Euro-area are also due.