What I can say with full confidence, though, is that prices will rise – for producers and consumers alike – which is good for gold but a headwind for continued economic growth.

From Frank Holmes at Frank Talk:

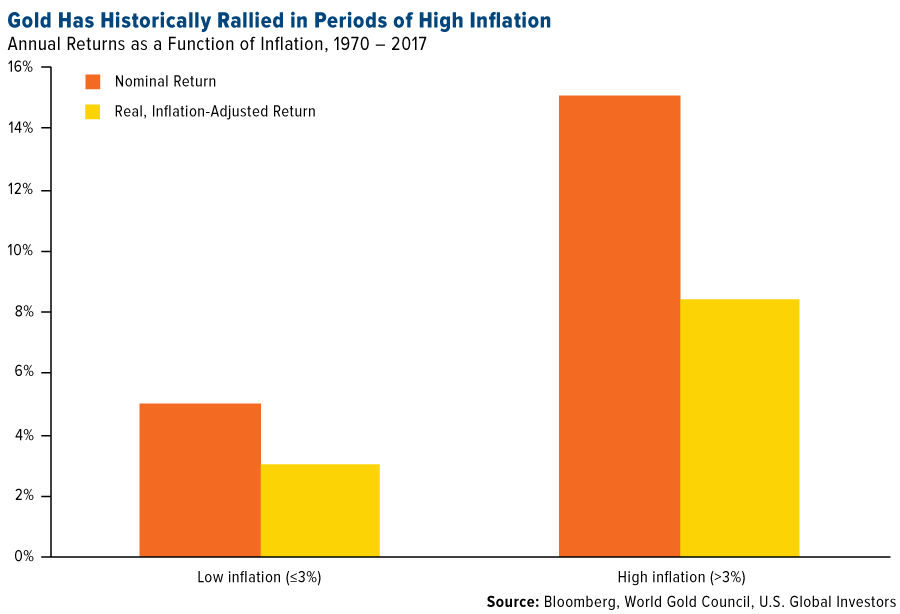

Higher Inflation Has Historically Meant Higher Gold Prices

The good news in all this is that higher inflation has historically been supportive of the price of gold. In the years when inflation was 3% or higher, annual gold returns were 15% on average, according to the World Gold Council (WGC).

When gold hit its all-time high of $1,900 an ounce in August 2011, consumer prices were up nearly 4% from the same time the previous year. The two-year Treasury yield, meanwhile, averaged only 0.21%, meaning the T-note was delivering a negative real yield and investors were paying the U.S. government to hang on to their money. This created a favorable climate for gold, as investors sought a safe haven asset that would at least beat inflation.