Over the last two days, I’ve been explaining how inflation has triggered a recession in the U.S.

By quick way of review:

- The Fed lied about inflation throughout 2021, claiming it was non-existent or “transitory” meaning it would go away by itself.

- Once inflation, as measured by the Consumer Price Index (CPI), breaks above 5% a recession has followed every time in the last 50 years.

- CPI broke above 5% in September 2021.

- Inflation triggers a recession because it means consumers have to cut back spending (75% of GDP is consumer spending).

All of this is really bad news for stocks.

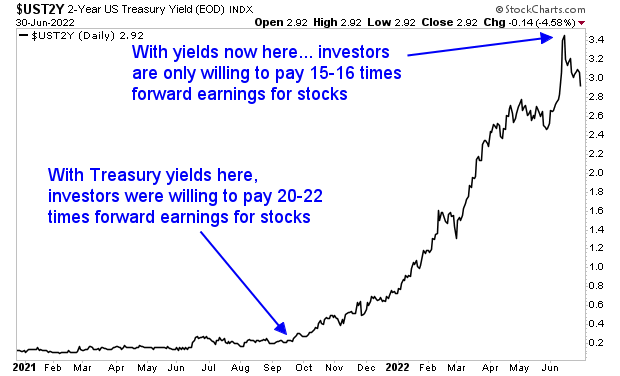

As I’ve written many times before, U.S. bonds, called Treasuries, are the bedrock of our current financial system. The yields on these bonds represent the “risk free” rate of return against which all risk assets are valued.

With that in mind, the ENTIRE drop in stocks thus far has been due to the “Price” in Price to Earnings, being adjusted to Treasury yields rising. With Treasury yields at 0.25%, investors were willing to pay 20 to 22 times forward earnings for stocks. But now that Treasury yields have risen to 3%, investors are only willing to pay 15-16 times forward earnings.

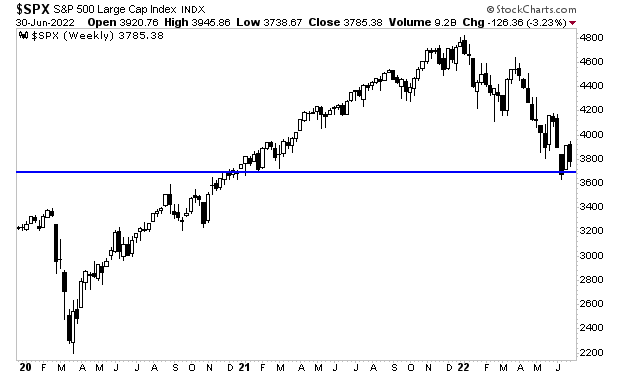

Put simply, the bear market in stocks thus far was ENTIRELY based on inflation… NOT on a recession. As I write this, the consensus Wall Street Earnings Per Share (EPS) in 2022 is around $230. A stock market valuation of 16 times earnings give us a fair value of 3,680 for the S&P 500.

And that’s roughly where stocks have fallen to thus far in this bear market.

Unfortunately for Wall Street and its delusional forecasts…The average recession results in EPS falling 25%. This would mean 2022 EPS is actually $172, NOT $230.

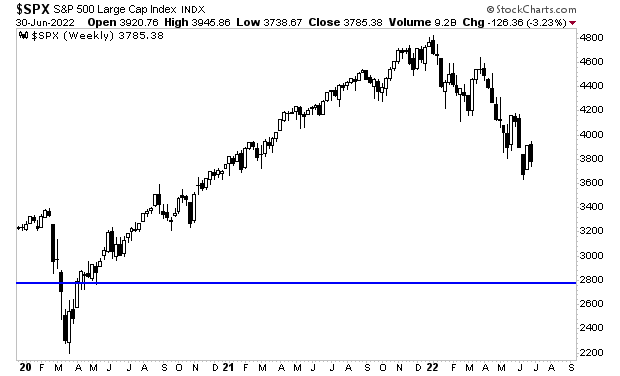

A stock market valuation of 16 times this new much lower EPS means the S&P 500’s fair value drops to 2,760.

That’s the blue line in the chart below.

The Fed lied about inflation… and it wiped out 30% of the stock market. The Fed is now lying about a recession… and it’s going to send stocks to levels most investors can’t imagine.