Wolf Richter wolfstreet.com, www.amazon.com/author/wolfrichter

“Don’t rely on Social Security”: because inflation adjustments are punitively low, and benefits become more inadequate as you age.

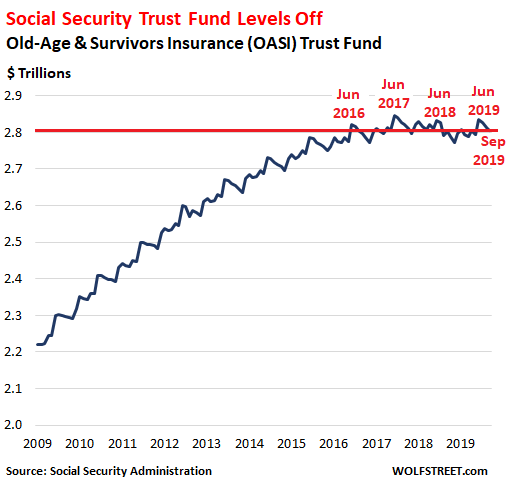

The Old-Age and Survivors Insurance (OASI) Trust Fund – does not include the Disability Insurance (DI) Trust Fund – which closed the fiscal year 2019 at the end of September with a balance of $2.80 trillion, according to figuresreleased by the Social Security Administration. This balance was up by $3 billion from September last year, but was down $16 billion from September 2017.

The balance tends to hit annual peaks in June. The all-time peak was in June 2017, at $2.846 trillion. In June 2018, the balance was down by $13 billion. In June 2019, the balance, at $2.834 trillion, was up $1 billion from a year earlier, but was still down $12 billion from the peak in June 2017. You get the drift: 2017 was a record year, 2018 was an alarming down-year, and 2019 has reversed the down-trend, but not by much:

The Social Security Trust Fund is benefiting from the increase of workers – particularly millennials, the largest generation ever – and from rising wages that trigger higher Social Security deductions. And the date when the trust fund is depleted keeps getting moved out further, currently estimated to occur in 2034.

Depletion of the Trust Fund doesn’t mean that Social Security will collapse or whatever. It means either that workers will have to pay in a little more, or benefits will get cut, or a little of both. Social Security has been fixed before. Raising the maximum amount of earning subject to Social Security tax would be one way of doing it.

Over 63 million retirees are drawing Social Security benefits (in addition, 8 million people are drawing SSI disability benefits).

Back when I was a senior in high school, the dad of my sweetheart told me that Social Security was a “scam” and that it wouldn’t be around for him to use when he’d retire. He was a CPA and had his own business, an accounting and tax firm. He ended up retiring and collecting Social Security, which was still around. And a few years ago, he passed away, and his wife began collecting survivor benefits. Social security, which has been around for 84 years, has outlived him, and it’s going to outlive me too.

But he gave me a piece of wise and correct advice – for the wrong reason: “Don’t rely on Social Security.” It’s tough to live off Social Security benefits, and it gets much tougher as you get older, as we’ll see in a moment.

Of the SS Trust Fund’s assets, almost all, $2.79 trillion, were invested in in long-term US Treasury bonds at the end of September, with a weighted average maturity of 7.8 years. The remaining $12 billion (less than half of 1% of the total) were invested in short-term “certificates of indebtedness,” similar to Treasury bills.

US Treasury securities are considered among the most conservative assets. The fund’s investment in Treasuries is very similar to a bond fund’s or a regular pension fund’s investment in Treasuries. The funds receive interest payments and are paid face value by the Treasury Department when the security matures.

But there is one difference: Bond funds, pension funds, and other investors buy “marketable” Treasury securities that can be traded in the bond market. The SS Trust Fund buys nonmarketable Treasuries that cannot be traded, which has an advantage: Since they cannot be traded, their value doesn’t change on a daily basis. The Trust Fund accounts for them at face value, and face value is what the Trust Fund gets paid when the securities mature.

Fed’s interest rate repression crushed interest income.

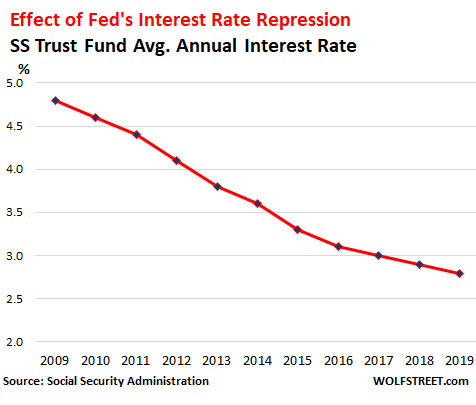

In September, the weighted average interest rate of the securities in the Trust Fund fell to 2.73%, the lowest in my lifetime. The average annual interest rate for each year has been declining relentlessly since 2009, dropping from 4.8% in 2009 to 2.8% in the fiscal year 2019:

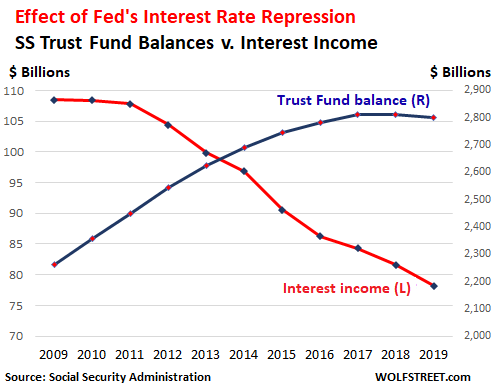

This means that despite rising balances in the SS Trust Fund, interest income has plunged. Trust Fund balances rose 24% from 2009 through 2019. But interest income fell 28% over the same period, from about $108 billion in 2009 to $78 billion in 2019. The chart below shows average weighted annual interest income (declining red line, left scale) versus Trust Fund balances (right column):

This decline of interest income speeds up the deterioration of the Trust Fund. At current Trust Fund levels, each decline of 1 percentage point of the average annual interest rate slashes the Fund’s interest income by $28 billion a year.

And interest income will fall further as securities that were acquired years ago at higher interest rates are replaced with securities bearing much lower interest rates.

Punitively low Cost of Living (COLA) adjustments.

Benefits in 2020 will increase by just 1.6% for the year, starting in January 2020, the Social Security Administration announced on Thursday.

Social Security benefits are adjusted for inflation based on the Bureau of Labor Statistics’ inflation measure for “urban wage earners and clerical workers” (CPI-W). The fundamental problem is that CPI does not measure changes in the costs of living. It measures changes in prices of the same thing or service at the same quality over time. And when quality of goods (such as electronics or car) or service (such as housing) improves, the BLS removes the cost of these improvements form the index.

In other words, CPI only measures the loss of purchasing power of the dollar, and purposefully does not measure the costs of quality improvements.

This produces a situation where over the past 20 years, the CPI for new vehicles has been flat, even as actual retail prices have soared, as the cars have gotten a lot better, such as going from two air bags to 10 air bags, and from a 4-speed automatic transmission to an 8-speed automatic transmission, etc. Here is my detailed discussion on these “hedonic quality adjustments” for new vehicles and how they relate to CPI.

But it is impossible today to buy these products or services without the quality improvements, and therefore retirees have to pay more even if they don’t want those quality improvements.

The 1.6% increase in benefits doesn’t include the increases in prices due to quality improvements. It just compensates for the loss of purchasing power of the dollar (price changes of the same thing at the same quality). That’s one massive issue with the COLA adjustments.

Another massive issue with the COLA adjustments is that the basket of goods and services used by an elderly person is different from the goods and services used by the average urban worker. For example, the average elderly person has much greater healthcare needs than the average worker. And healthcare expenses have far outrun the Consumer Price Index.

The inadequate COLAs are transpiring every year, year-after-year, and for retirees who’re dependent on Social Security, which is already tough to live on at the beginning, face a gradual and pernicious reduction of the standard of living they’re able to pay for.

This is why my high school sweetheart’s dad was right, but for the wrong reason, and yes, dear millennials, that’s for you: Don’t rely on Social Security, not because it won’t be there for you (it will be), but because the COLAs are purposefully insufficient once you draw benefits, and the benefits will become more and more inadequate as you age.